Aussie Shrugs After RBA Minutes, U.S. Retail Sales Next

2023.07.18 07:45

- RBA minutes point to a close call at July decision

- US retail sales for June expected to climb

The edged lower on Tuesday, trading at 0.6807, down 0.14%. We could see some further movement in the North American session when the US releases retail sales.

RBA minutes point to uncertainty about the economy

The RBA minutes didn’t provide much in the way of insights and the Australian dollar barely showed a muted response. Perhaps the most interesting aspect of the minutes was the spelling out of both sides of the argument about whether to raise rates or take a pause. In support of a hike, the minutes noted that wage growth is rising, inflation is falling and the labor market remains tight. The case for a pause relied on inflation remaining high and weaker growth. In the end, policymakers voted to pause since the arguments in favor of holding rates were more compelling.

The minutes stated that monetary policy was “clearly restrictive” at the current rate level but that would not preclude the RBA from further tightening, which would depend on the economy and inflation. The money markets have priced a pause at the August 1st meeting at 75%, according to the ASX RBA rate tracker. At the July meeting, the decision to pause was a close call and that could repeat itself at the August meeting, so I am not as confident in a pause as the money markets.

US retail sales expected to climb

The US releases the June retail sales report, with expectations that consumers remain in a spending mood. The consensus estimate for headline retail sales is 0.5% m/m, up from 0.3%, and the core rate is expected to rise 0.3%, up from 0.1%.

The Federal Reserve is widely expected to raise rates at the July 27th meeting. If retail sales improve as expected, we could see the pricing for a September rate hike – currently, there is only a 14% chance of a rate hike, according to the CME Tool Watch.

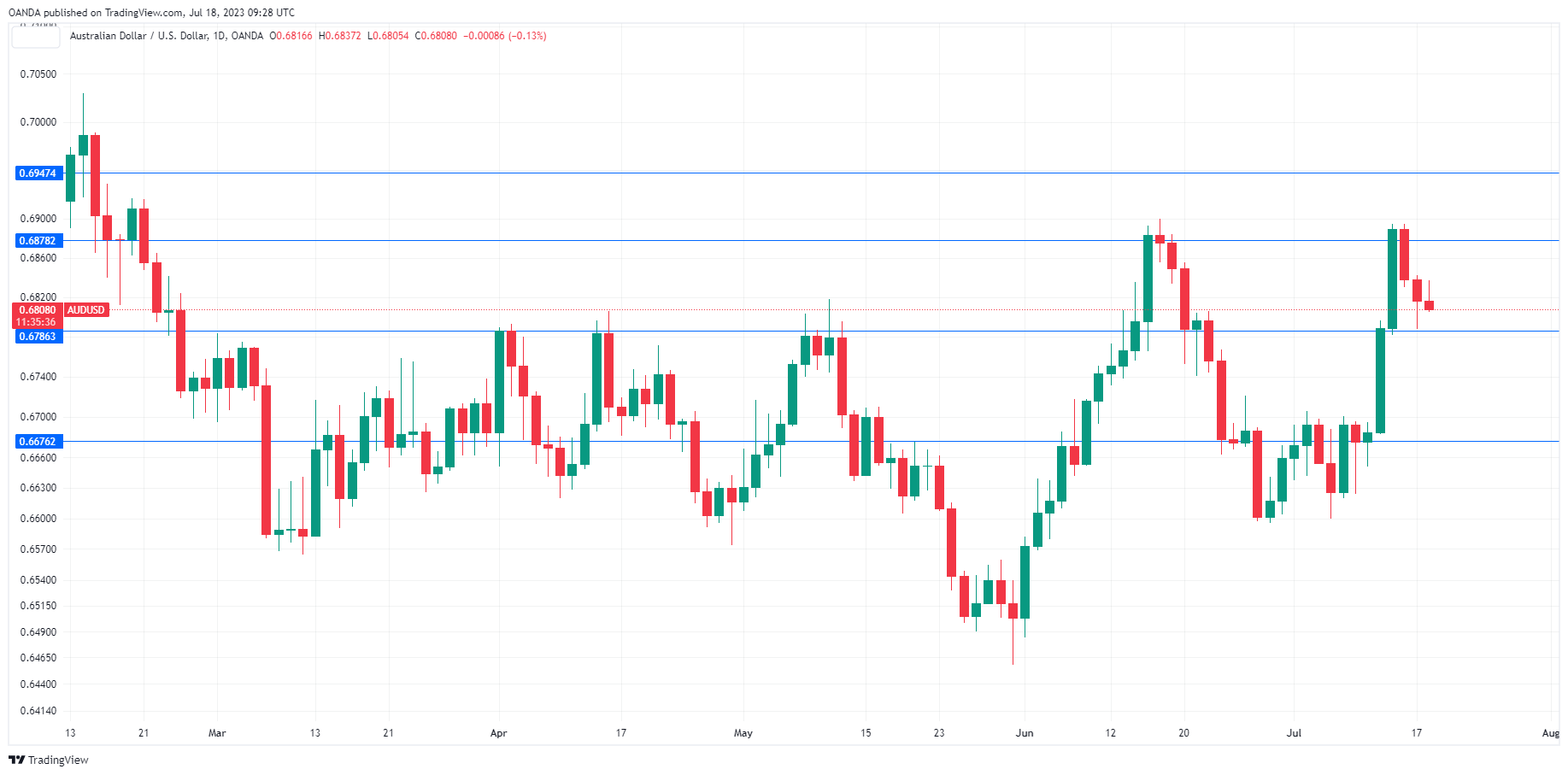

AUD/USD Technical

- There is resistance at 0.6878 and 0.6947

- 0.6786 and 0.6676 are providing support

Original Post