Aussie Heads Lower Following RBA’s Rate Hike

2023.11.07 09:52

The has lost over 1% since the start of the day on Tuesday as traders appeared unimpressed with the monetary authorities’ actions.

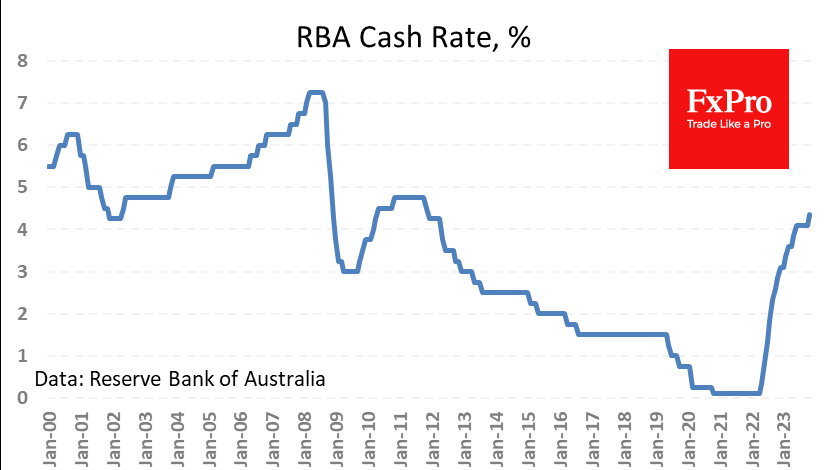

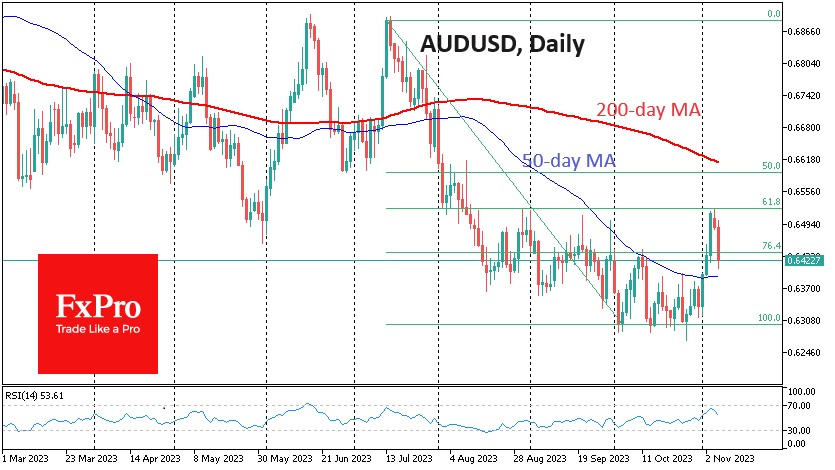

The selling momentum hit AUD/USD following the decision to raise the key rate by 25 basis points to 4.35%, a 12-year high. The decision aligned with expectations, so touching the 0.6500 level kicked off a significant sell-off, forcing the pair to retreat below 0.64 briefly.

The RBA noted that the policy tightening was necessary for confidence that inflation would return to target within a reasonable timeframe. The decision commentary concludes by noting that it is not clear whether further increases will be required. This passage was probably the reason for the sharp decline in the Australian currency.

Since the beginning of November, AUD/USD has added 2.8% or about 180 pips after forming a bottom for most of October. Today’s dip looks more worrisome than a correction from the rise. It is worth paying attention to the pair’s dynamics near 0.6390, where the 50-day moving average is.

Returning under it will make last week’s rally considered false and will open a quick way to the area of lows near 0.6300. Moreover, it potentially opens the way to levels below 0.60, as touching 0.65 coincides with the 61.8% Fibonacci retracement level of the decline from the August peak to the October bottom.

The FxPro Analyst Team