AUDUSD set for third bearish monthly close

2023.04.27 09:50

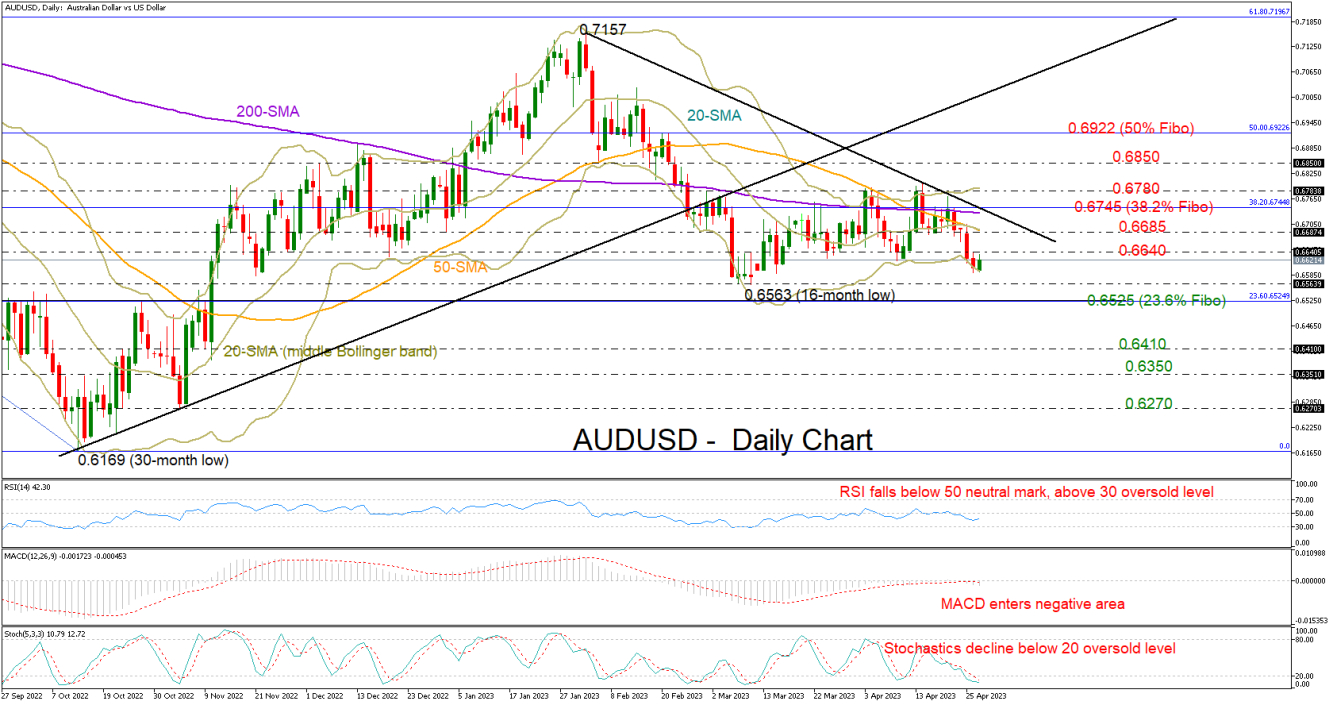

is set for its third negative monthly close after failing to pierce through the 0.6800 level. The focus is currently on the March low of 0.6563 as the short-term outlook is looking blurry.

The pair could not successfully climb above its 200-day simple moving average (SMA), with the 38.2% Fibonacci retracement level of the April-October 2022 downtrend triggering this week’s downfall to 0.6590. Notably, the 50-day SMA crossed back below the 200-day SMA, diminishing hopes for an uptrend resumption.

In momentum indicators, the MACD is decelerating in the negative region and below its red signal line, flagging more losses ahead. Likewise, the RSI has dived into the bearish region, adding to the discouraging signals. Yet, some consolidation cannot be excluded as the stochastic oscillator is already within the oversold region, while the price itself is trading around the lower Bollinger band.

In the bearish scenario, where the sell-off expands below the March low of 0.6563, the 23.6% Fibonacci of 0.6525 could immediately come to the rescue, preventing a sharp decline towards the 0.6410 handle. Should the latter give way, some congestion could emerge around 0.6350 before the door opens for the key 0.6270 support zone.

If buying interest rises above Wednesday’s bar of 0.6640, the next obstacle could be the 50-day SMA at 0.6685. Not far above, the 200-day SMA and the tentative descending trendline from February’s peak could be a bigger challenge. In the case that the bulls claim that territory, driving above the 0.6780 resistance too, then the recovery might flourish towards the 0.6850 mark.

Summing up, AUDUSD seems to be exposed to more downside according to the technical picture. Nevertheless, traders may wait for a break below 0.6563-0.6525 or above 0.6800 to direct the market accordingly.