AUD/USD, USD/CNH: Watch for Reversal as Yuan Pressure Builds on Aussie

2024.11.12 12:58

- AUD/USD closely tracking USD/CNH as the yuan weakens, suggesting a potential retest of key reversal zone.

- Strong correlation between USD/CNH and US interest rate expectations continues to drive price action.

- USD/CNH is now influencing AUD/USD movements.

Overview

The () and Australian dollar () have been moving almost in lockstep, showing a tight correlation against the . Since the Aussie is often viewed as a proxy for China, it’s essentially following the yuan’s lead, making yuan movements critical when analyzing AUD/USD setups.

AUD, CNH: The Same Picture

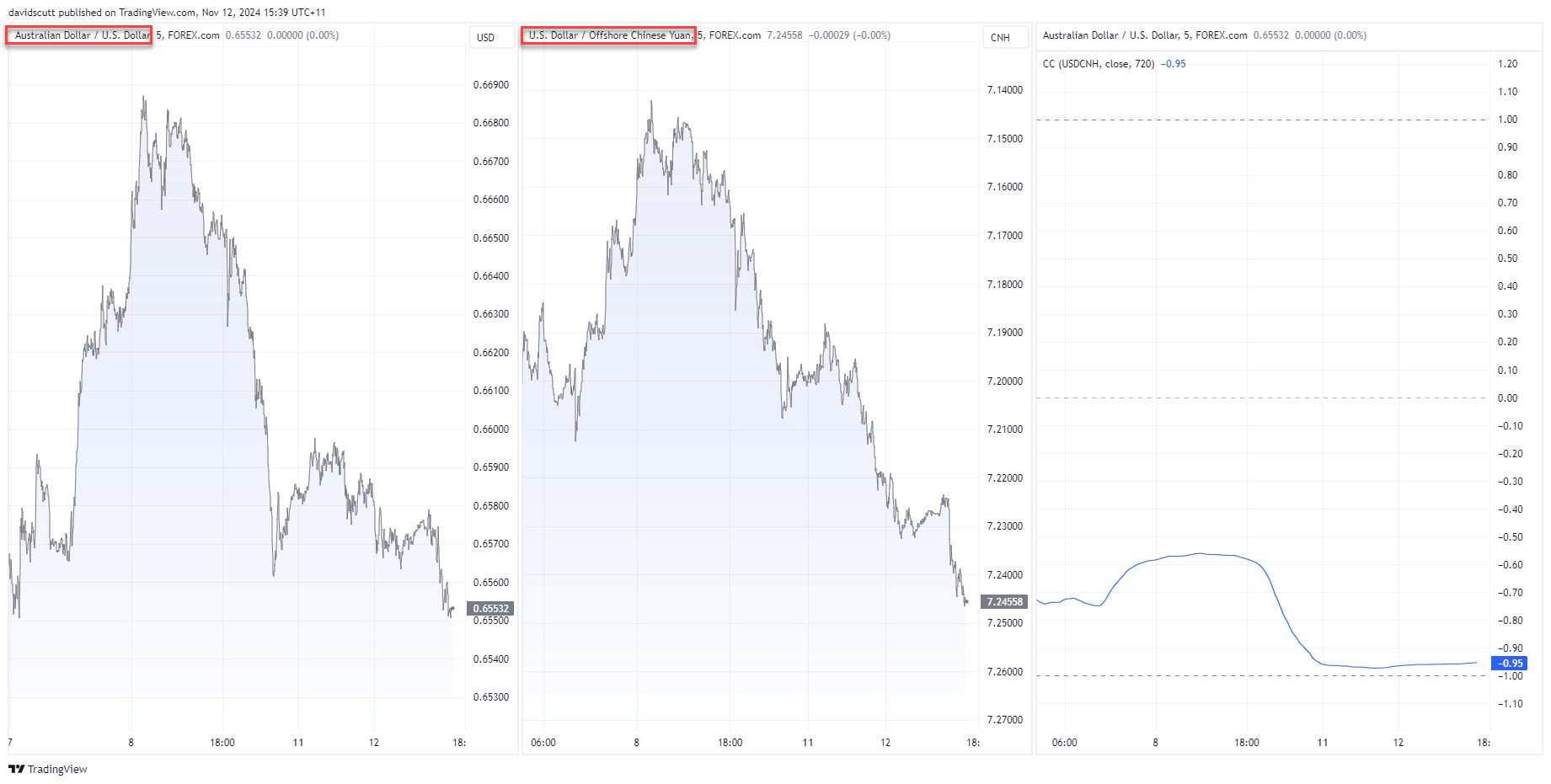

This chart shows AUD/USD alongside USD/CNH (inverted scale) and their rolling six-hour correlation on a five-minute basis. Not only do they look nearly identical, but with a correlation of -0.95, they’re practically moving in sync.

Source: TradingView

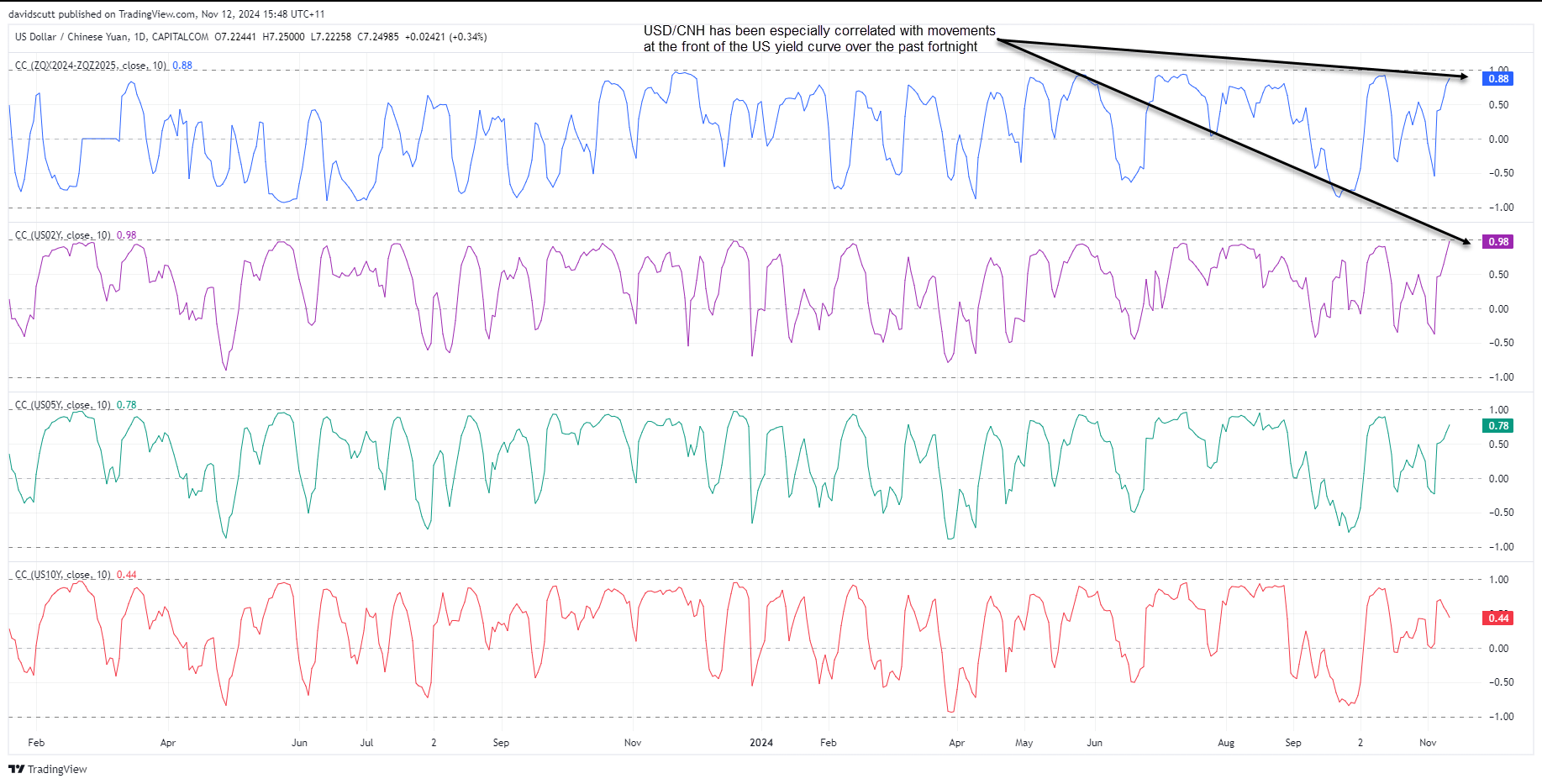

USD/CNH Heavily Influenced by Fed Rates Outlook

Zooming out, it’s clear USD/CNH is driven by expectations around US interest rates, particularly the short end of the curve most influenced by monetary policy. The daily rolling correlations with pricing through the end of 2025 and yields sit at 0.88 and 0.98 over the last two weeks, well above what’s seen for longer-term US yields. While Trump’s trade policies with China are often pointed to as the cause of yuan weakness, this suggests it’s more about US economic strength and the likelihood of looser US fiscal policy ahead.

Source: TradingView

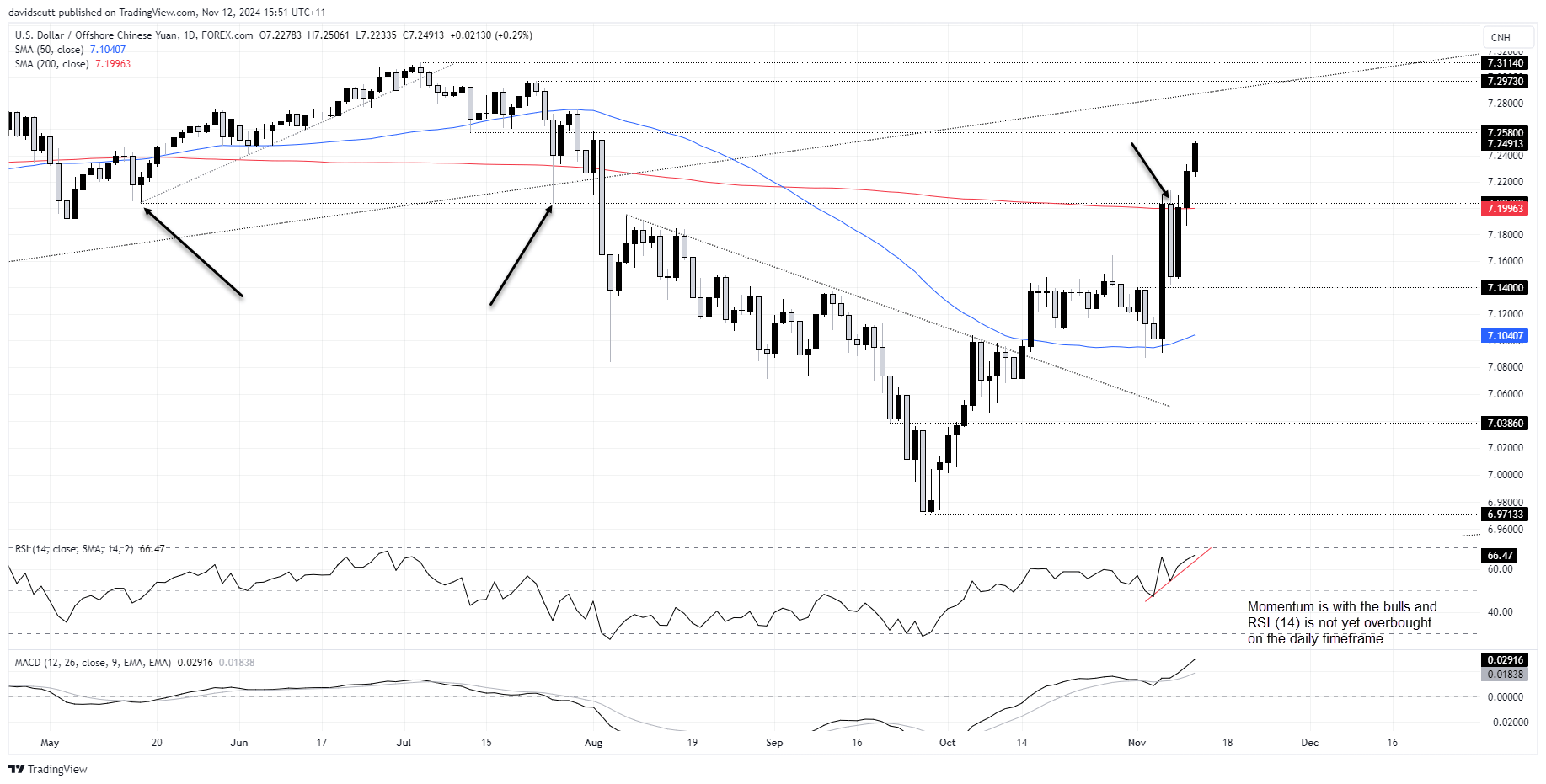

USD/CNH Breaks Out, Momentum Favors Upside

Source: TradingView

As USD/CNH is influencing AUD/USD movements, that’s what we’ll look at first from a technical perspective.

After three consecutive failures above 7.2040 last week, the price broke cleanly above both it at the 200-day moving average on Monday, going on with the move in Asian trade on Tuesday.

With MACD and RSI (14) providing bullish signals on momentum, and the latter not yet overbought on the daily, the bias is to buy dips and topside breaks near-term, putting 7.2580, 7.2973 and 7.3114 on the radar for bulls.

On the downside, 7.2040 and 200-day moving average may now as support, making that the initial level of note.

Unless you’re a scalper, the inclination is to wait for the price to track towards one of these levels before considering trades, allowing for stops to be placed beneath them for protection.

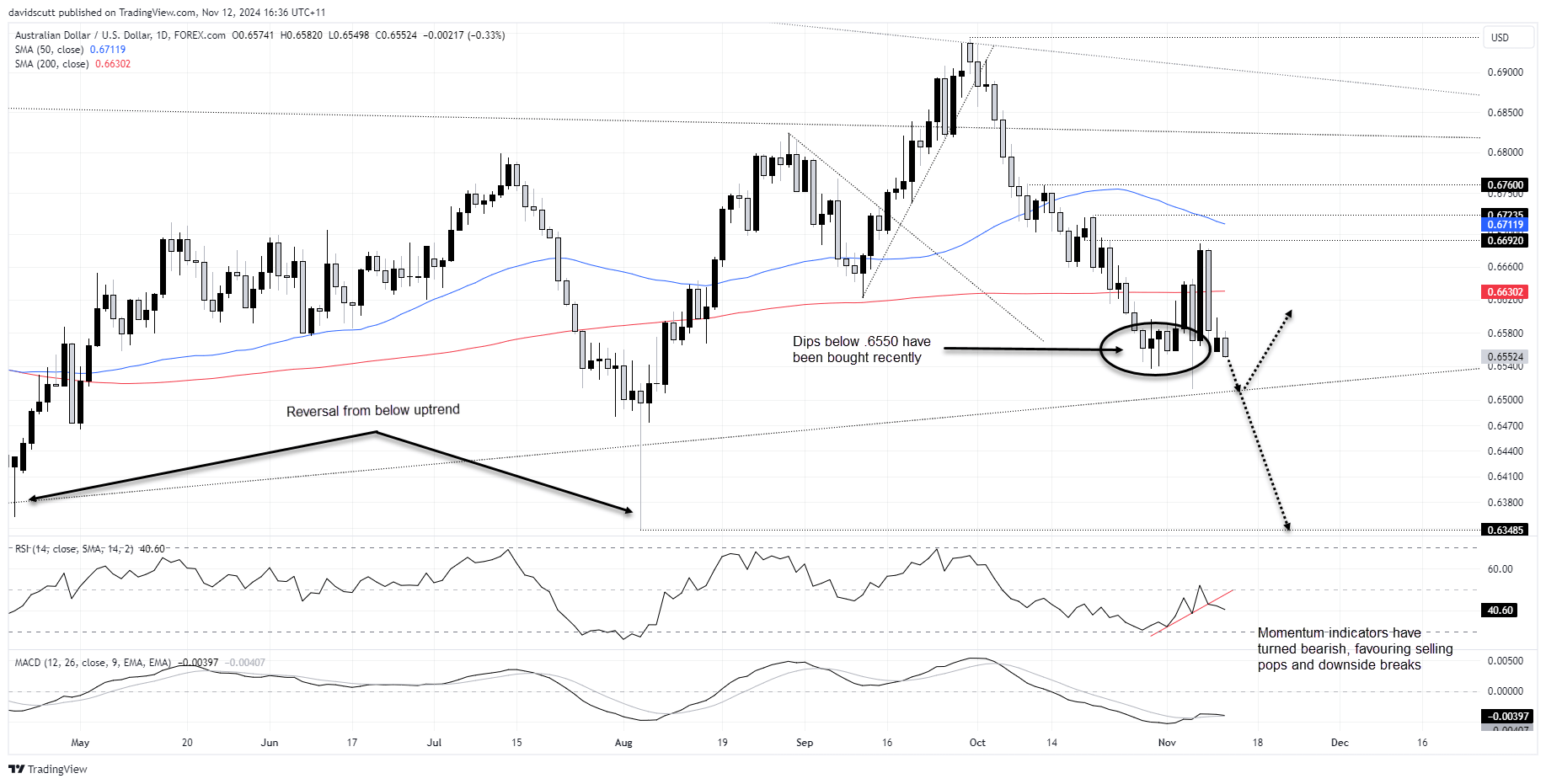

AUD/USD Nears Known Reversal Zone

Source: TradingView

Should the upside in USD/CNH materialize and a strong correlation with the Aussie dollar be maintained, it means AUD/USD could be on track for another tango with long-running uptrend support dating back to the pandemic lows of March 2020.

The last three times the price has neared or interacted with this level it has delivered large bullish reversals, suggesting it’s a key near-term level. It may also explain why the price has bounced from .6550 on the past five occasions it’s been there.

If we see the price test the uptrend again, let the price action tell you what to do. If it breaks and closes beneath it, you could sell with a stop above for protection targeting .6348, the low set in early August. Alternatively, if the price can’t break the uptrend, you could flip the trade around, buying above with a stop below for protection.

MACD has crossed over from above while RSI (14) has confirmed the bearish signal, favoring selling pops and downside breaks near-term.

Original Post