AUD/USD Stays in One Piece After Flash Crash

2024.08.06 07:17

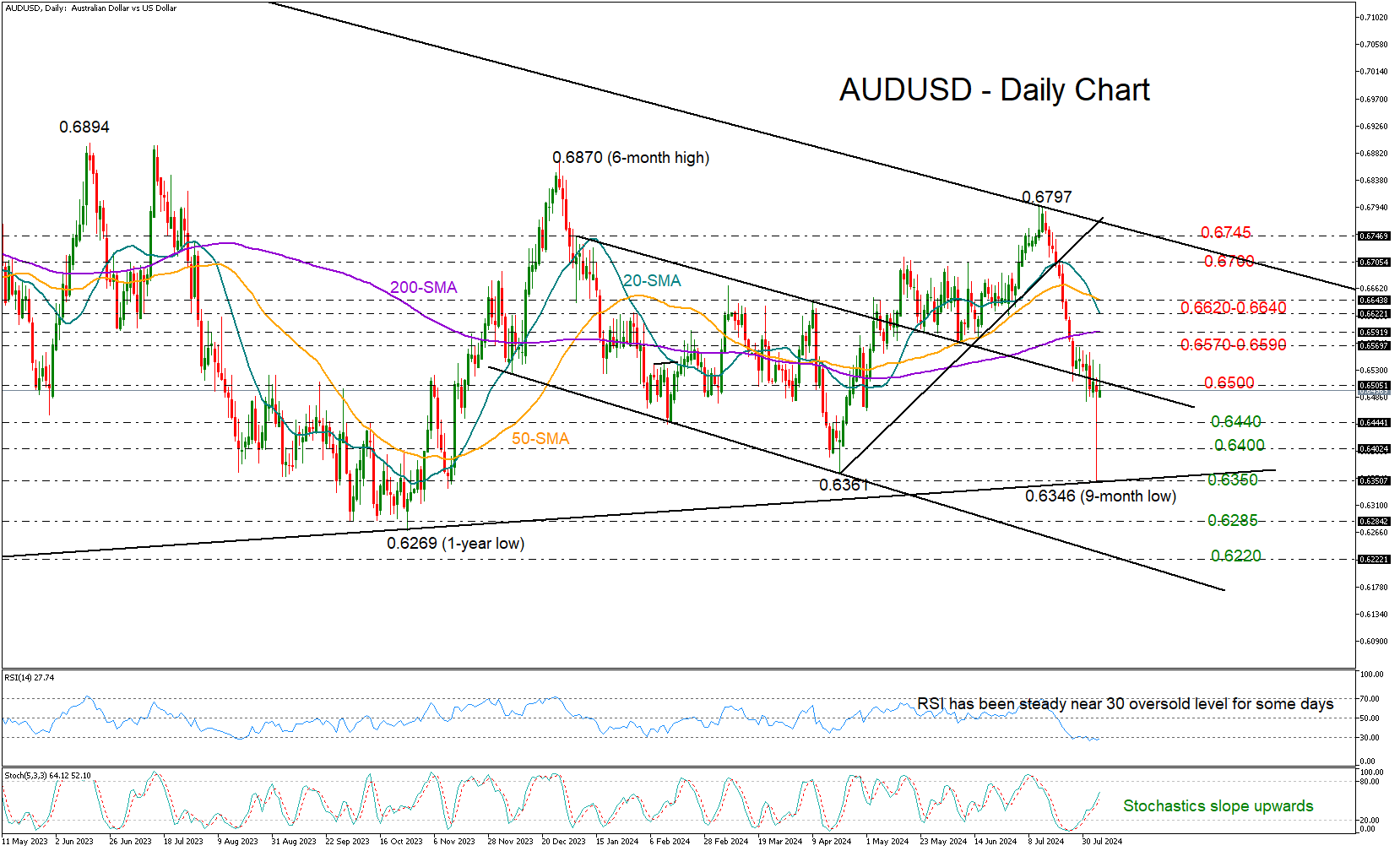

- AUD/USD bounces back from its lowest point in nine months

- Short-term risk skewed to the upside; close above 0.6500 needed

- RBA maintains steady policy; pushes back rate cut timing

encountered a significant drop to a nine-month low of 0.6346 on Monday, marking its worst daily performance since the pandemic, but it quickly found fresh buying near the trendline, which connects the 2022 and 2023 lows, and managed to recover most of its losses by the end of the day.

The Reserve Bank of Australia (RBA) provided a helping hand to the pair on Tuesday after it played down any hopes for a rate cut soon, boosting the price as high as 0.6539.

However, the pair could not sustain its gains, returning below the 0.6500 number again and beneath the falling constraining line from January which has been limiting upside movements over the past three trading days.

With the RSI remaining flat near the oversold level of 30 for a few days and the stochastic oscillator showing an upward trend, it seems like the bulls may have some luck in their favor in the upcoming sessions.

A clear close above 0.6500 could last until the 0.6570-0.6590 zone, where the 200-day SMA is positioned. If the 20- and 50-day SMAs at 0.6620 and 0.6640 give way as well, the bullish wave could pick up pace towards the 0.6700 number and the broken ascending trendline seen near 0.6745.

In the opposite scenario, if the price holds below 0.6500, there could be stronger selling interest towards the range of 0.6400-0.6440.

If the bears breach that base too, the 0.6285 floor from October 2023 could be the next destination.

To summarize, AUD/USD has laid the foundation for its next recovery phase, but buyers might not step in if the price fails to break above 0.6500.