AUD/USD Slides on Hawkish Fedspeak

2023.04.21 06:49

- has fallen sharply

- Fed members continue to urge more rate hikes

Fed members say inflation still too high

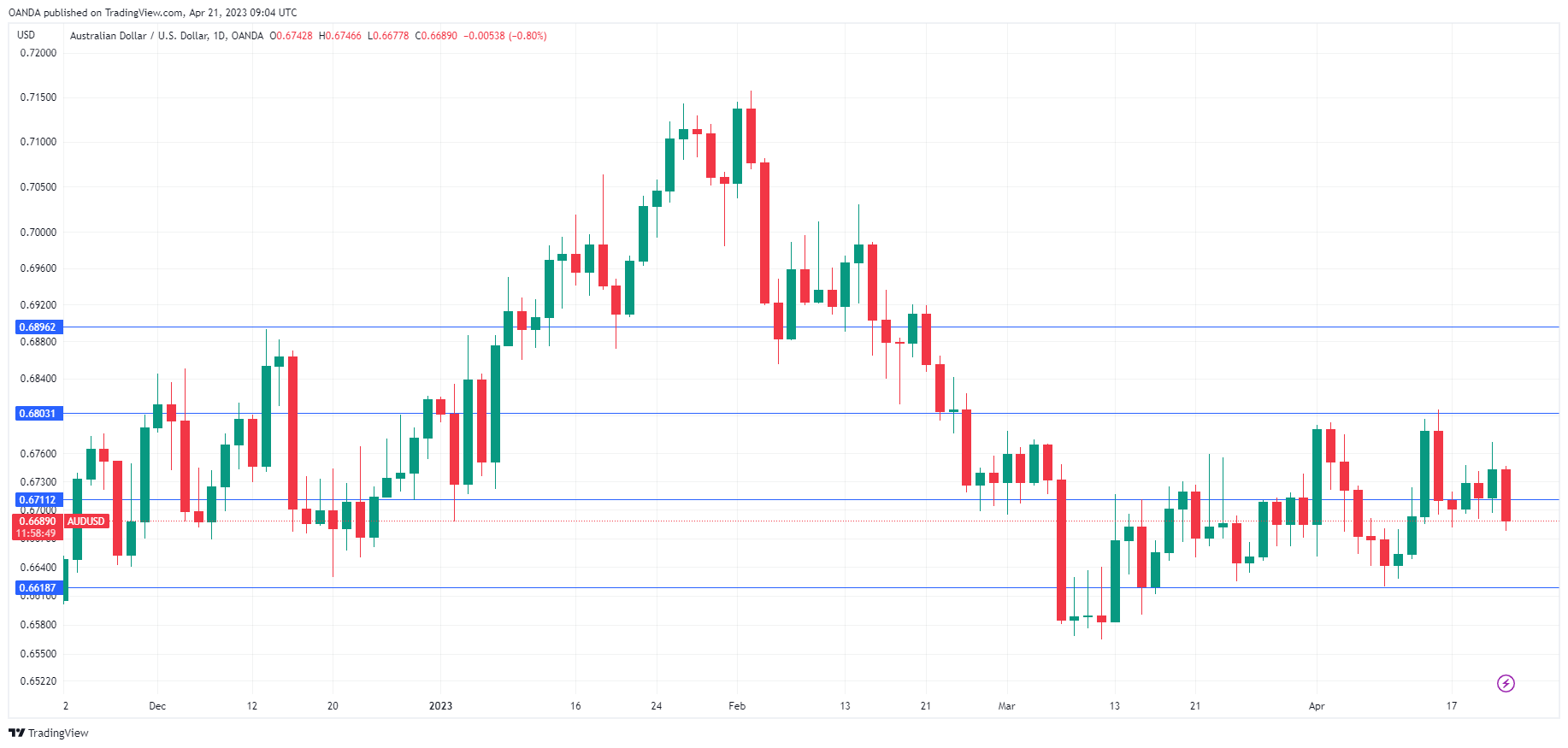

The Australian dollar has been relatively quiet during the week but is getting pummelled on Friday. AUD/USD is trading at 0.6685, down 0.84% on the day. The sharp drop can be attributed to technical factors and hawkish comments from Fed members on Thursday.

The Federal Reserve is not yet ready to wrap up its current rate-tightening cycle and has sent out the troops to blitz the airwaves and reiterate the Fed’s hawkish stance. On Thursday, Fed member Bostic said he favors one more rate hike and then an extended pause, saying the tightening will take time to work its way through the economy. Bostic noted that the banking crisis had led to tighter financial conditions, which has made the Fed’s work easier.

Fed member Mester also came out in support of more rate hikes but suggested that the economy would have a soft landing. A day earlier, Fed member Williams said “inflation is still too high” and the Fed would use monetary policy to “restore price stability”. Williams added that he expected inflation to drop to 3.25% this year and hit the 2% target by 2025.

The markets are hearing this message loud and clear, and have priced in a 25-basis point hike in May at 81%, according to the CME Group (NASDAQ:). Where the markets and the Fed differ is on rate cuts – the markets are anticipating cuts before the end of the year, while Fed members have said that it does not see the economy stalling to such an extent as to justify rate cuts.

AUD/USD Technical

- There is resistance at 0.6803 and 0.6896

- AUD/USD is testing support at 0.6711. Next, there is support at 0.6618

Original Post