AUD/USD Shorts Pay Off as Upside Breakout Fails, Downside Target in Sight

2023.03.22 04:57

shorts at 6700/20 DID work again, as the upside breakout fails, with a high for the day at 6726.

On the downside, we can target 6670 (hit yesterday) perhaps as far as 6640/35 and 6620.

We can try shorts again at 6700/20 with stops above 6730. A break higher see 6710/00 act as support to target very strong resistance at 6770/90. Shorts need stops above 6810.

longs at the 15-year trend line, and 100 week plus 500-day moving average support at 8790/80 could start to work as we hold above the December low at 8700. A break below here is a sell signal.

Targets for longs are 8850 (a high for the day here again yesterday) and 8930, which were both hit on Friday. Further gains can target 8960/70.

Further gains this week can target 8960/90. A break higher is a buy signal targeting 9080 and resistance at 9130/40.

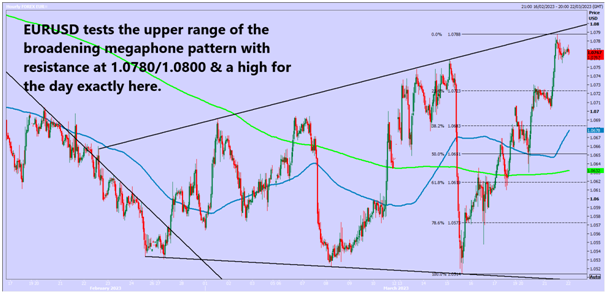

tests the upper range of the broadening megaphone pattern with resistance at 1.0780/1.0800 and a high for the day exactly here.

With ECB talking tough on inflation and the Fed expected to raise only 25 bps or even pause, plus market expectations for cuts as soon as June, you have to wonder if EUR/USD will continue higher into the end of the month.

So shorts need stop above 1.0815. A break higher is a buy signal targeting 1.0870/80.

Shorts at 1.0780/1.0800 are working so far and can target first support at 1.0730/20. Obviously, the direction of the dollar will be determined by the FOMC today, but further losses can target strong support at 1.0690/70.

EUR/USD Chart

Gold Chart

WTI Crude Oil Chart

Video Analysis: