AUD/USD: RBA Kept Rate Unchanged, Dovish Tone Fails to Boost Sentiment

2024.12.10 11:07

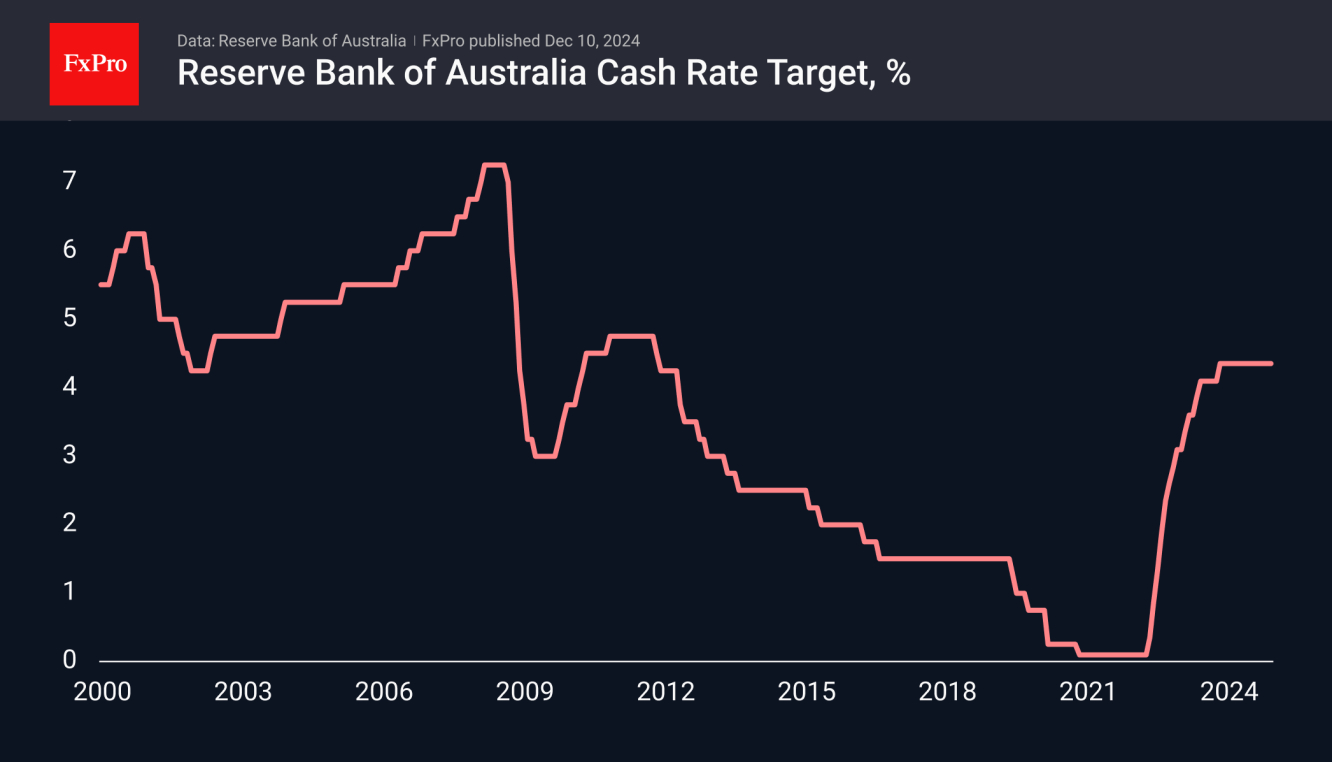

The Reserve Bank of Australia kept its unchanged at 4.35%, maintaining it at a 13-year high for the past 13 months.

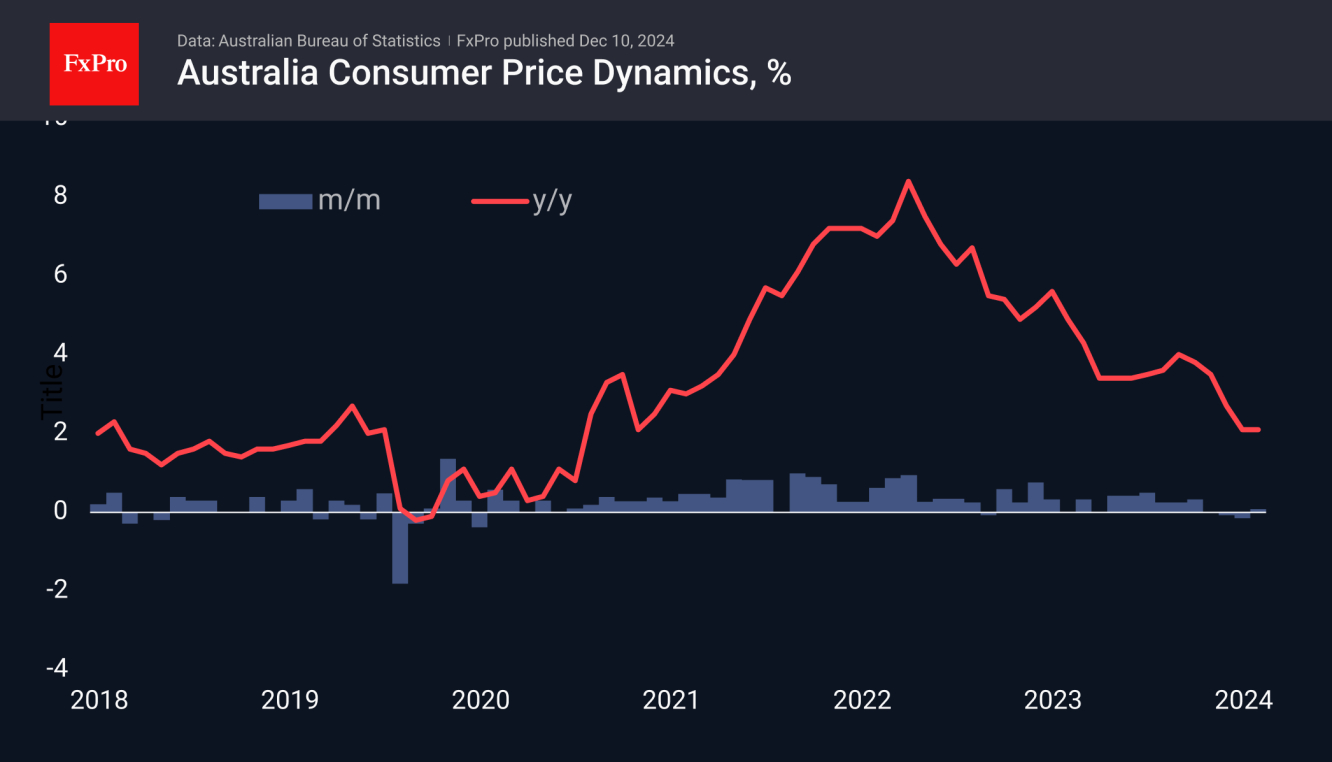

Most of the RBA’s peers have moved to ease monetary policy at various points this year, including aggressive cuts by neighbouring RBNZ, suggesting that inflation is on a downward trajectory. Australian consumer inflation was 2.1% in September and October (latest data available). However, this is not enough for the RBA, which noted that the core inflation rate of 3.5% is still above the 2.5% target.

However, the RBA has indicated growing confidence that inflation will return to target, seemingly opening the door to an easing of policy soon. Weak economic growth is also a case for easing. growth slowed to just 0.8% last year. Barring a double dip, this is the slowest pace since 1991, the last time the economy was in a natural recession.

On the news of the rate, the AUD temporarily lost its footing and returned to the local lows of the last three trading sessions below 0.6400. Conventional logic would suggest that tighter monetary policy should cause the Aussie to strengthen against rivals that are cutting rates. But in Australia’s case, traders are more likely to be swayed by the outlook for the economy and monetary tightening promises to further suppress economic growth.

The , at 0.6400, is trading at the lower end of its range of the past two years, having lost around 8% over the past 10 weeks. Technically, this was a reversal to the downside from the 200-week moving average. Now, it is important to watch how the pair performs in the coming weeks. A break of the long-term support will open the way for a decline to 0.55. The ability to hold above will trigger a scenario of a return to the 0.70 area.

The FxPro Analyst Team