AUD/USD Flirts With 2024 High After CPI – Breakout in the Cards?

2024.08.29 03:02

- Australian inflation fell to 3.5% y/y but remains a tick above the cyclical low of 3.4% set earlier this year.

- Core inflation, however, did hit a cyclical low at 3.8%, leaving the market split 50/50 on whether the RBA will cut interest rates this year.

- AUD/USD is not yet in overbought territory, suggesting the pair could run further toward horizontal resistance at 0.6850 or 0.6900 if we do see a confirmed breakout.

In a quieter week for economic data, yesterday’s Australian report carried more weight than it usually would. While Down Under did fall to 3.5% y/y from 3.8% last month, this was actually a tick higher than the 3.4% reading traders and economists had anticipated.

Notably, headline inflation remains above the cyclical low seen earlier this year (3.4% y/y), though the core inflation rate did drop to a cyclical low at 3.8% y/y.

In any event, traders are pricing in 50/50 odds of an RBA rate cut this year, and the Aussie is, along with the US dollar itself, the strongest major currency so far on the day.

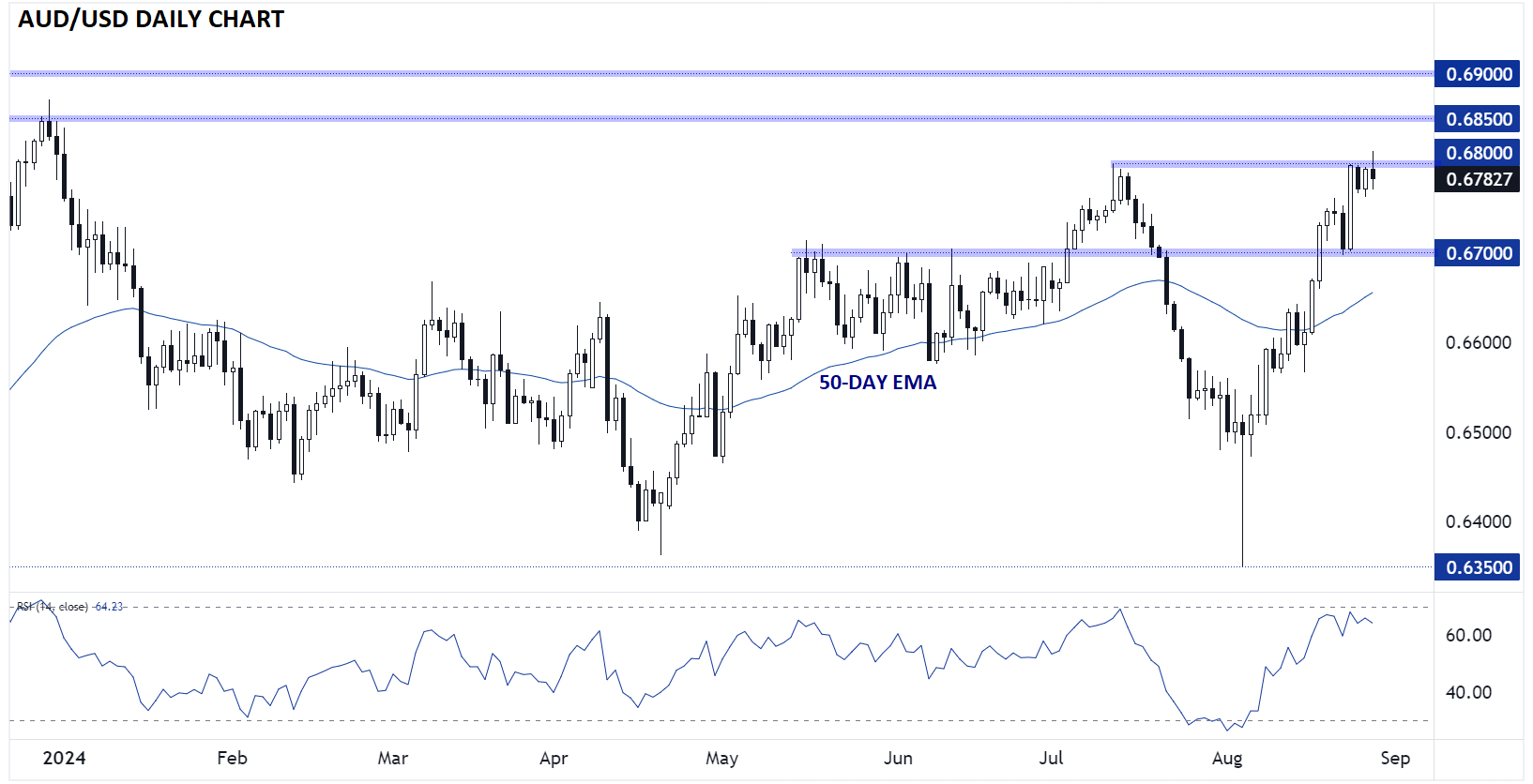

Australian Dollar Analysis – AUD/USD Daily Chart

Source: TradingView, StoneX

From a technical perspective, has tacked on 650 pips from its lows set earlier this month, and the pair is now testing its highest level since the start of the year near 0.6800. Notably, bears appear to be making a stand here so far this week, with the Aussie turning lower on Monday and (so far) yesterday after testing the key 0.6800 level.

According to the 14-day RSI, AUD/USD is not yet in overbought territory, suggesting the pair could run further toward horizontal resistance at 0.6850 or 0.6900 if we do see a confirmed breakout. Meanwhile, a deeper retracement here, perhaps on the back of a softer US initial jobless claims report today or cool Core PCE on Friday.

Original Post