AUD/USD Eyes Chinese PMIs

2023.12.28 08:37

- China releases PMIs on Saturday

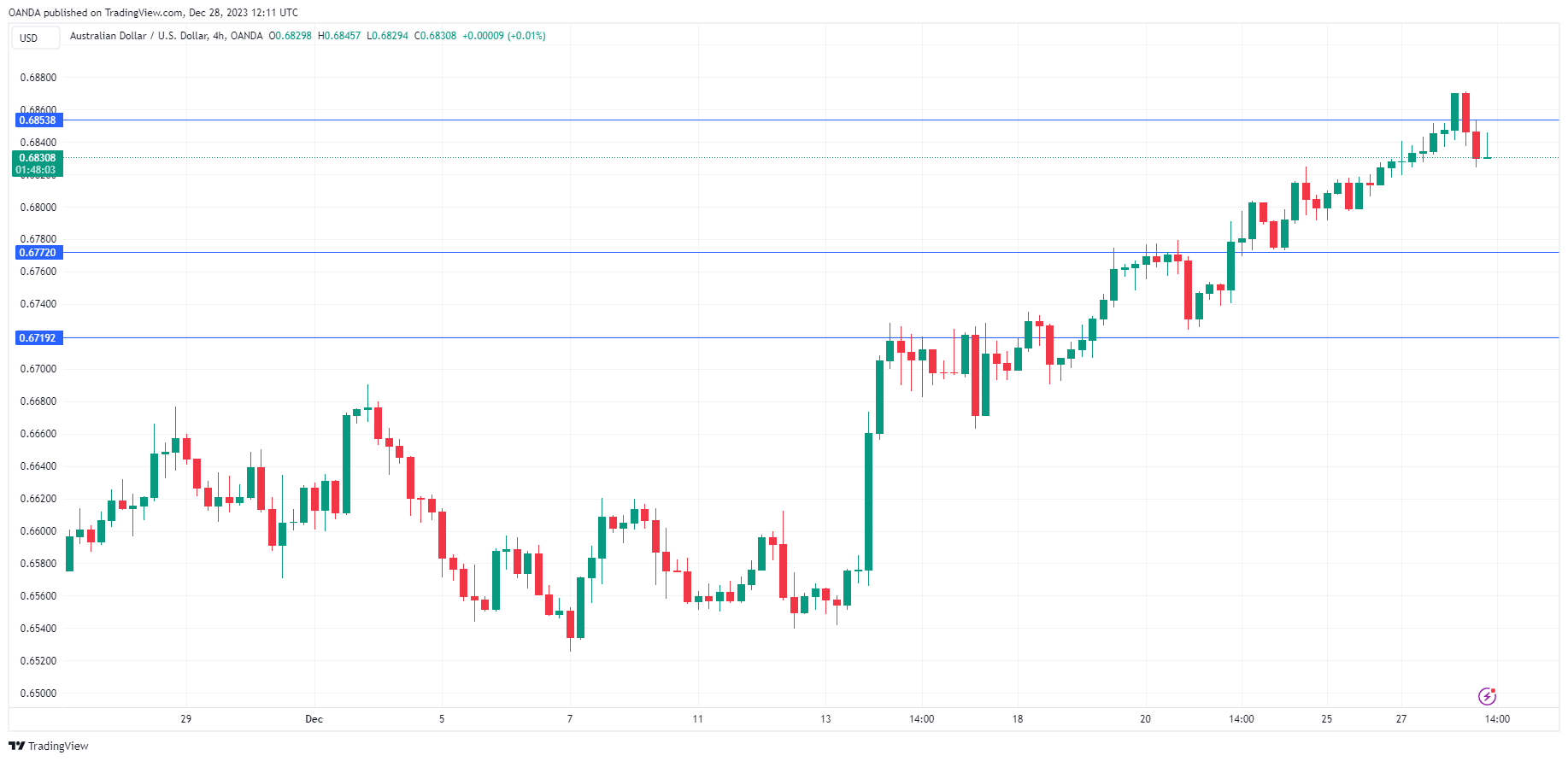

The Australian dollar has edged lower on Thursday. In the European session, is trading at 0.6833, down 0.21%. Earlier today, the Aussie climbed as high as 0.6871, its highest level since July.

Risk Appetite Rise Boosts Aussie

The has hit rough times and the Australian dollar has taken full advantage, surging 7.8% since November 1st. The US dollar has fallen sharply against the other major currencies over the past two months, as the markets expect the Federal Reserve to cut interest rates up to six times next year. Fed members have cautioned that the market is getting ahead of itself but don’t expect markets to dampen expectations after Fed Chair Powell pencilled in three rate cuts in 2024 at the December meeting.

There are no Australian events this week but the risk-on mood in the financial markets has boosted the Australian dollar, which is headed for a third straight winning week. Investors will be keeping an eye on Chinese PMIs which will be released on Saturday. China’s recovery has been patchy and the slowdown has resulted in deflation in the world’s number two economy. The manufacturing sector has been mired in contraction for most of this year and non-manufacturing expansion has been steadily falling and has stagnated over the past two months.

The PMI releases could have a strong impact on the direction of the Australian dollar early next week, as China is Australia’s largest export market. If the PMIs are stronger than expected, the Aussie could get a lift. Conversely, a weak PMI report would likely weigh on the Australian dollar.

The US labour market has remained strong despite the Federal Reserve’s steep rate-tightening cycle. Unemployment claims will be released later today, with a market consensus of 205,000, compared to last week’s reading of 210,000. The Fed is under pressure to lower interest rates early in 2024 but the robust labour market is complicating such a move, as jobs remain plentiful and workers are spending which is helping keep inflation high.

AUD/USD Technical

- AUD/USD tested resistance at 0.6853 earlier. Next, there is resistance at 0.6906

- 0.6772 and 0.6719 are providing support

Original Post