AUD/USD Drops, Confidence Data Next

2022.12.12 10:37

[ad_1]

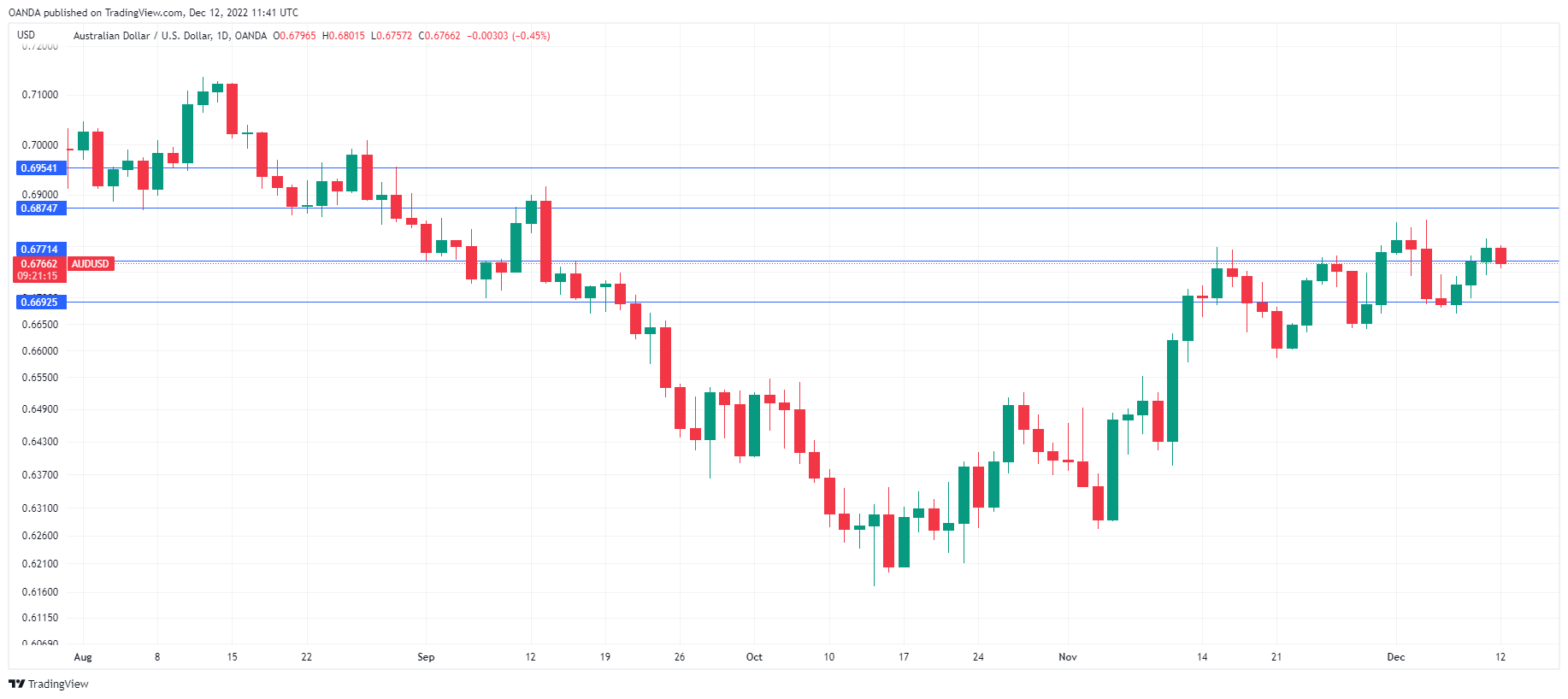

The Australian dollar has started the week in negative territory. In European trade, trades at 0.6766, down 0.44%.

Australian dollar eyes confidence releases

Australian confidence indicators headed south in the most recent releases – will we see an improvement on Tuesday? slipped to zero in October, down from 5 a month earlier. The consensus for November stands at 5 points. declined by 6.9% in November, down from -0.9% in October. The index has only managed one gain in the past 12 months, pointing to prolonged weakness in consumer confidence.

With still not under control, the RBA continues to raise rates, although it has now delivered three straight hikes of 25 basis points. Last week’s meeting was the final one for 2023, with the next meeting not until February. There is great economic uncertainty, including which direction inflation is headed. This has resulted in differing views on the terminal rate, with forecasts ranging from 3.3% all the way to 3.8%. With the cash rate currently at 3.10%, there is little doubt that the RBA will renew its tightening in February, likely with a 25-bp increase.

The Federal Reserve will also be in the spotlight this week, with the on Wednesday expected to produce a 50-bp hike. Even with a record pace of rate hikes in 2022 and the Fed saying that the terminal rate could hit 5% or higher, the markets haven’t bought into the Fed’s hawkish message.

We have seen how softer-than-expected inflation reports have renewed risk appetite and hopes of a dovish Fed pivot. The US will release the November inflation report on Tuesday, a day before the Fed meeting. If is weaker than the 7.3% forecast, we could see investors again speculate about the Fed turning dovish. Fed policymakers don’t want to see financial conditions loosening yet, since that would complicate the Fed’s battle against inflation.

AUD/USD Technical View

- AUD/USD tested support at 0.6676 earlier. Next, there is support at 0.6558

- There is resistance at 0.6760 and 0.6878

[ad_2]