AUD/USD Dips on Soft Retail Sales

2023.05.09 08:14

- ends 6-day rally

- Australian retail sales decline

- Fed warns that banks are tightening credit

The Australian dollar is in negative territory, ending a rally of close to 200 points. In the European session, AUD/USD is trading at 0.6760, down 0.29% on the day.

Australian retail sales decline

Australian posted a decline of 0.6% in the first quarter, following a downwardly revised reading of -0.3% in Q4 2022. The reading matched the consensus, but investors were not pleased with a second straight decline and the Aussie has lost ground today. The National Australia Bank (OTC:) responded to the release by warning that a “consumer recession” had arrived.

Australians are holding tight onto their wallets due to the uncertainty in economic conditions. The cost-of-living crisis, driven by high inflation and rising interest rates, has driven down household spending. The new budget may help matters a little, but inflation will have to continue moving lower before consumers increase spending.

Australia will release consumer confidence for May on Wednesday, with the markets braced for a decline of -1.7% after a sharp gain of 9.4% in April.

The Federal Reserve has warned that the turbulence in the banking industry had led to tighter credit conditions which could slow down growth in the US economy. These concerns were highlighted in the Fed’s bi-annual financial stability report. The Fed’s quarterly Senior Loan Officer Opinion Survey noted that banks expected to continue tightening lending requirements and that bank officials expressed concerns about recession and deposit withdrawals.

The Fed isn’t about to pivot on its rate policy due to the stress in the banking sector. The financial stability report said that “a large majority of banks” were able handle the strain from higher rates and noted that banks were “well capitalised”. Still, the Fed will have to keep in mind the danger of contagion and give thought to cutting rates later in the year in order to minimize the chances of a recession.

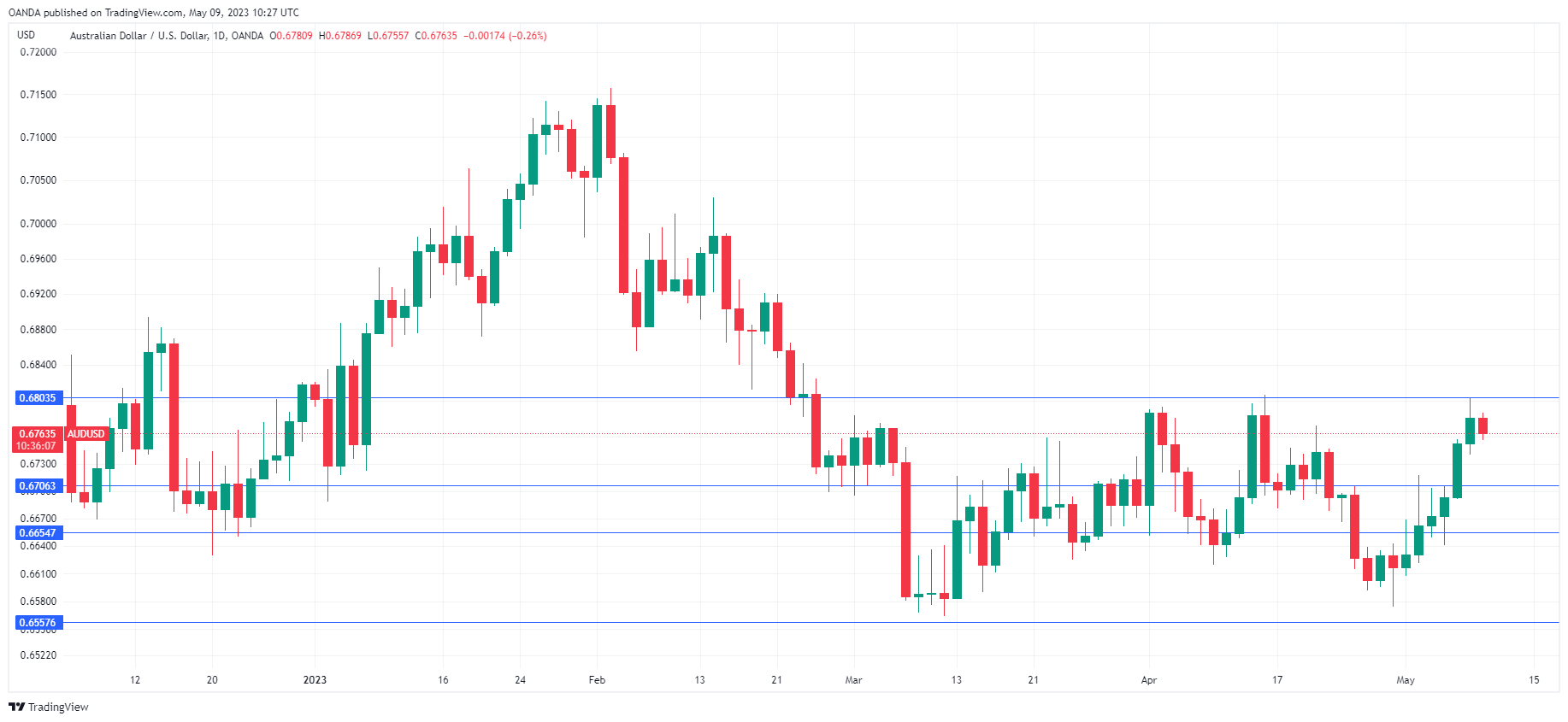

AUD/USD Technical

- AUD/USD faces resistance at 0.6706 and 0.6803

- 0.6654 and 0.6557 are providing support

Original Post