AUD/USD Continues Downward Spiral Amid Economic Concerns

2024.10.30 09:14

The Australian dollar remains under significant pressure, with extending its downtrend mid-week to reach 0.6539, the lowest since August. The decline, which began on 1 October, has been relentless, with the pair experiencing little to no respite from its downward trajectory.

Recent data indicating that Australia’s annual inflation cooled to 2.8% in Q3 from 3.8% in Q2, falling just below the expected 2.9%, has contributed to the accelerated sell-off. Although this brings inflation within the Reserve Bank of Australia’s (RBA) target range of 2-3%, the core inflation gauge closely monitored by the RBA remains elevated at 3.5% year-on-year in Q3. Given the persistent core inflation, the RBA has no immediate impetus to lower interest rates.

The central bank maintains that inflation needs to stabilise before considering monetary easing. With the RBA’s next meeting scheduled for next week, market consensus does not anticipate a change in the current interest rate of 4.35% per annum. Rate cuts are not expected until at least May 2025.

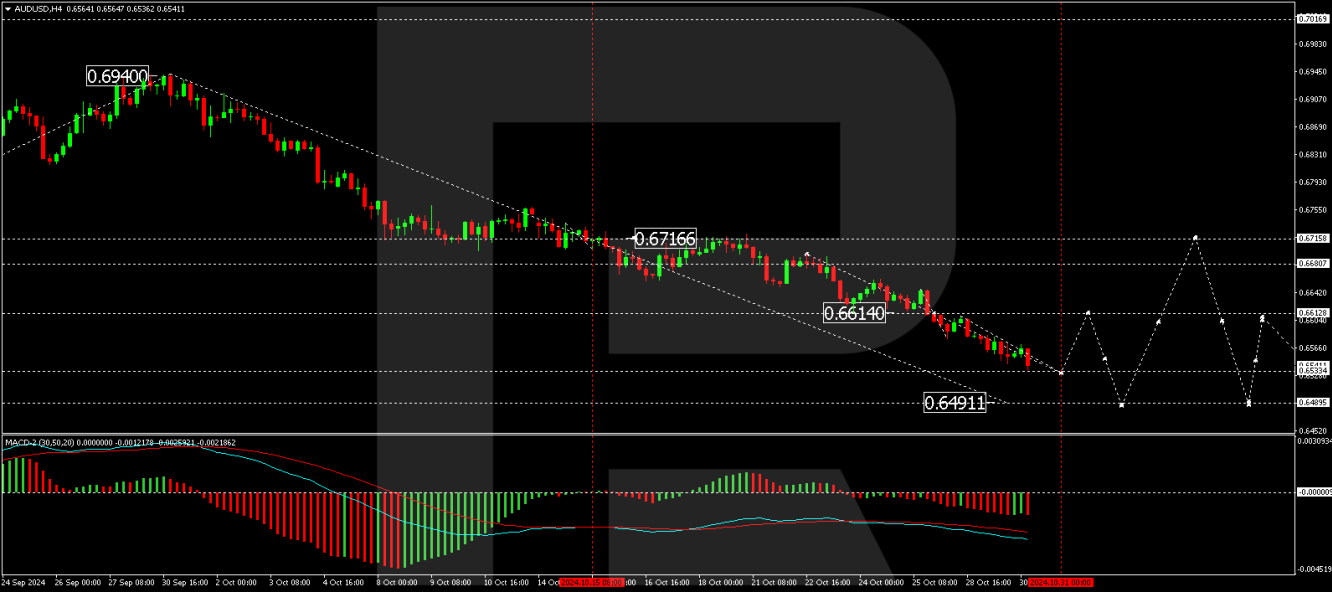

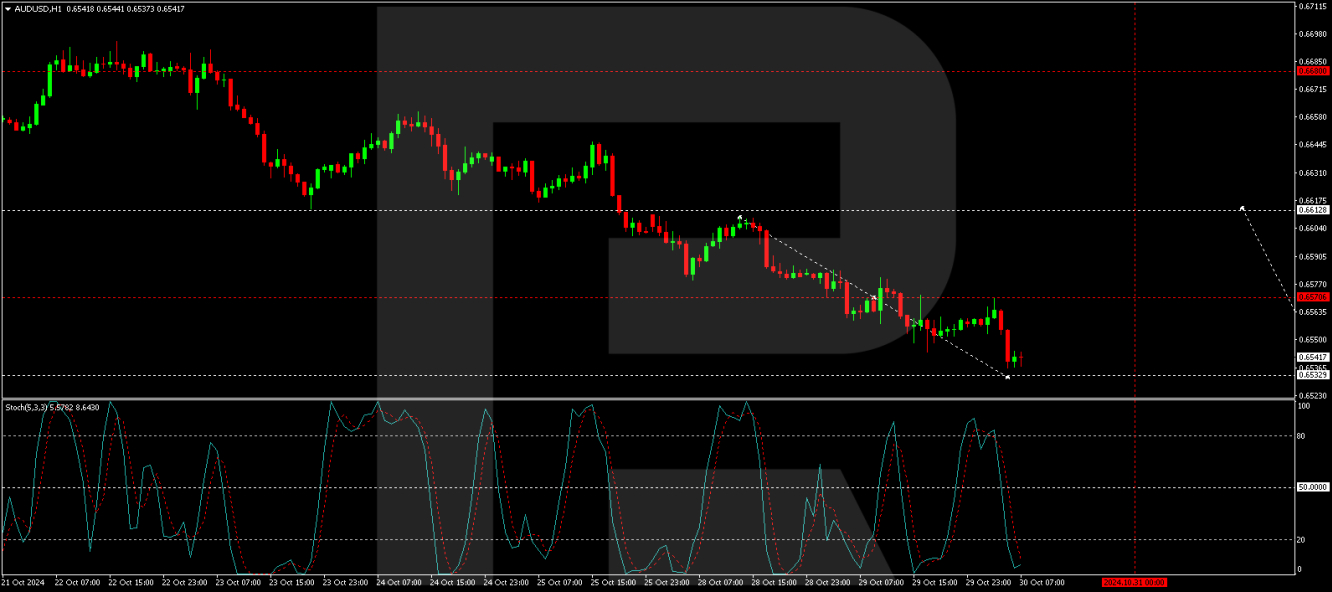

Technical analysis of AUD/USD

The AUD/USD is persisting in its downward wave, targeting 0.6533. If this level is reached, a corrective phase towards 0.6613 may follow, and the downward trend is expected to resume towards 0.6491. The MACD indicator supports this bearish outlook, as its signal line is well below zero, indicating a continuation of the downward momentum.

On the hourly chart, AUD/USD has established a consolidation range around 0.6570, breaking downwards to continue towards 0.6533. Once this level is achieved, a corrective move to 0.6613 may begin, with an intermediate target at 0.6570. This potential upward correction is confirmed by the Stochastic oscillator, whose signal line is below 20 but poised to rise towards 80, suggesting a brief respite from the selling pressure.

By RoboForex Analytical Department

Disclaimer: Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.