AUD/USD – Buoyed by Australian Jobs Data as Markets Consider One More RBA Hike

2023.09.14 08:09

- Australian employment increased by 64,900 in August (2,800 full-time, 62,100 part-time)

- Participation hits 67%, a new high

- Is a double bottom forming in AUD/USD?

The Australian jobs data on Thursday was surprisingly good, with the number of new jobs created vastly exceeding expectations, although the bulk were in part-time roles.

Participation also unexpectedly improved, hitting 67% for the first time which will be very welcomed by the central bank as it, and every other one around the world, seeks to defeat inflation while achieving a soft landing. That job will be much easier if the tightness in the labour market is eased through more people joining it, rather than people losing their jobs at higher interest rates bite.

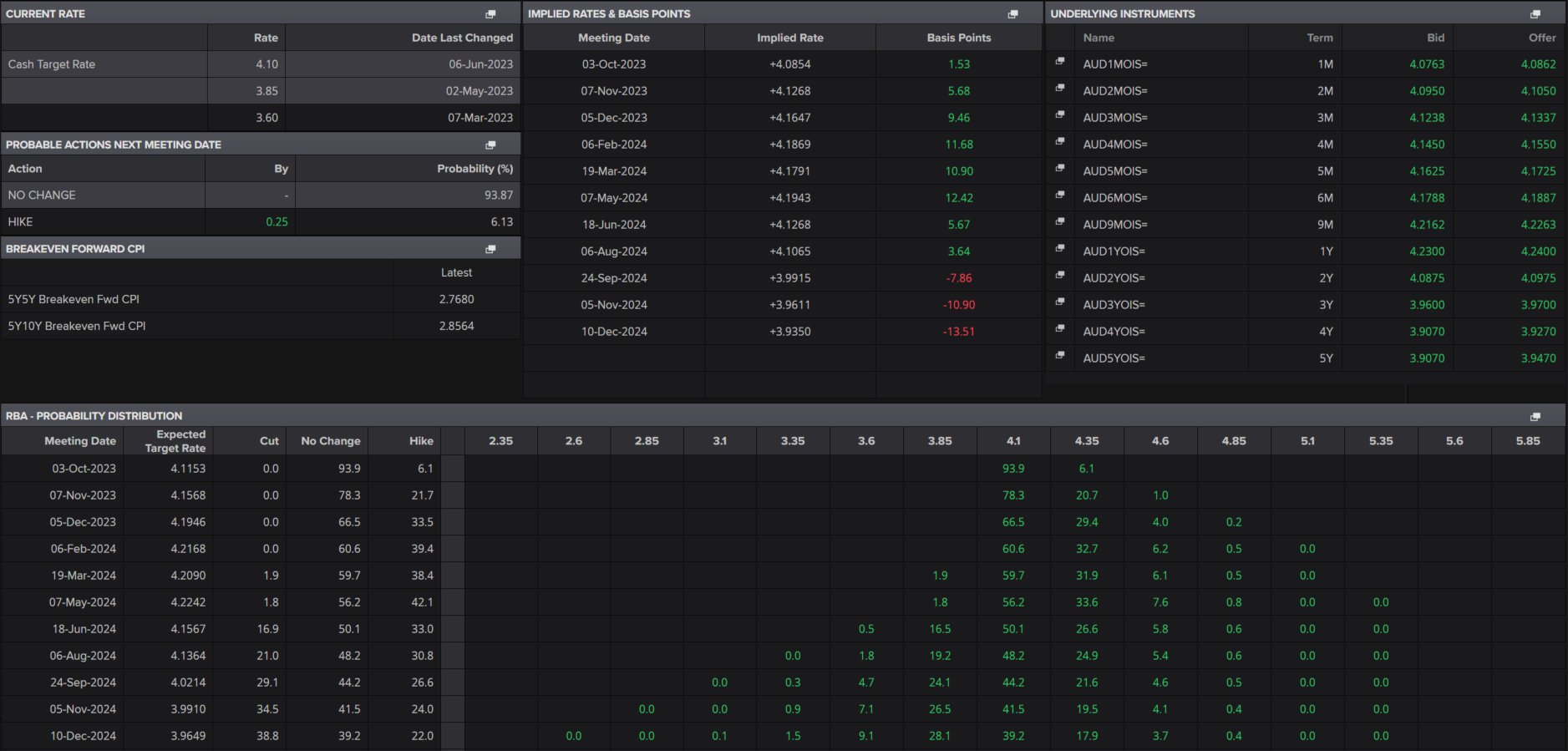

Despite these promising figures, markets are still positioning for another possible rate hike from the RBA over the coming meetings under the new leadership of Governor Michele Bullock. One more hike between now and the middle of next year is around 40% priced which is arguably quite high under the circumstances.

RBA Interest Rate Probability RBA Interest Rate Probability

RBA Interest Rate Probability

Source – Refinitiv Eikon

Aussie Buoyed by Jobs Figures

The technical picture in is really quite interesting. On the face of it, it’s been range-bound for the last month and therefore doesn’t look particularly exciting.

But two things stand out. One is the double top that formed between early June and August. The sell-off that followed was quite swift, falling around 230 pips over the following couple of weeks before the consolidation started. But with the double top itself being around 300 pips from the peak to the neckline, is there theoretically more to come? I’m skeptical considering how long it’s been trending sideways but it’s possible.

Source – OANDA on Trading View

The second is the potential double bottom that’s now formed during that consolidation period. With the neckline around 0.6520, a break above here could be quite a bullish move and, in theory, offer a possible price projection based on the size of the pattern. Obviously, there are no guarantees but a break of the neckline would make things interesting.

Original Post