AUD/USD bounces back after hitting 9-month low

2023.08.31 06:38

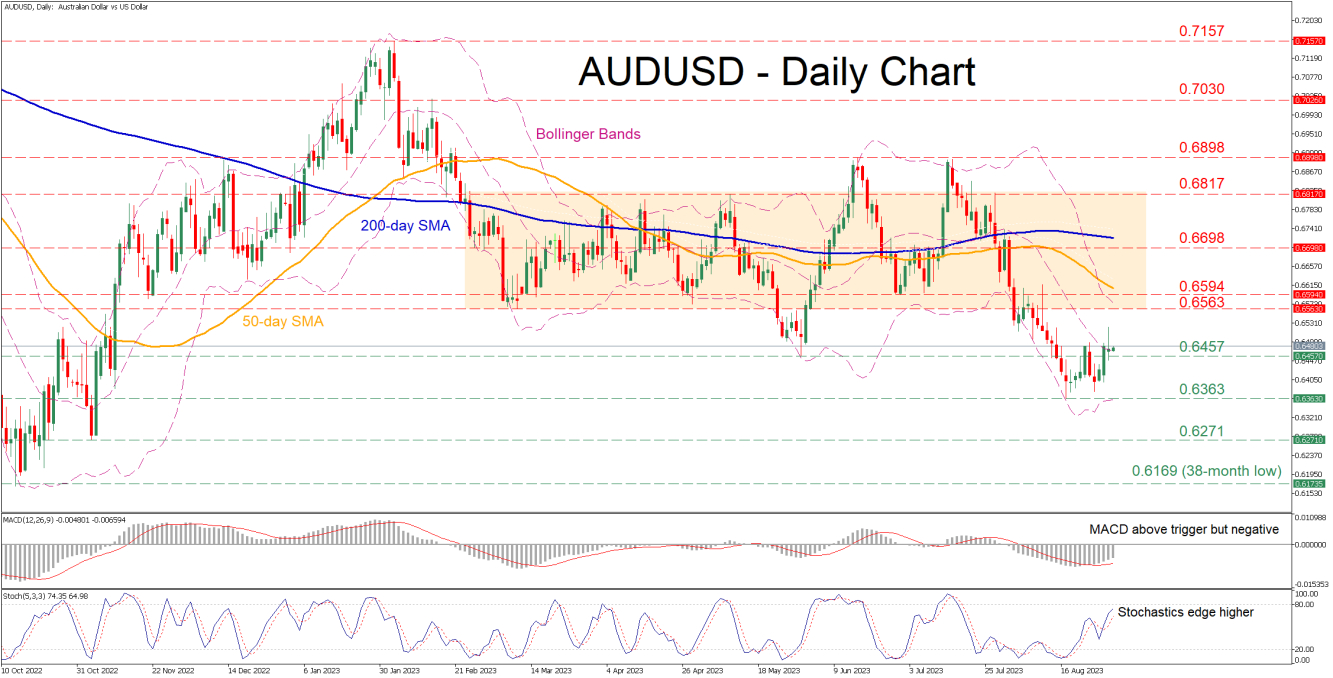

AUDUSD had been in an aggressive decline after its bullish breakout from the rectangle encountered resistance at 0.6898, validating a double top pattern. However, the pair appears to be attempting a recovery since it managed to halt its retreat at the nine-month bottom of 0.6363 in mid August.

The momentum indicators currently suggest that the bearish forces are waning but have not surrendered yet. Specifically, the MACD is strengthening above its red signal line in the negative zone, while the stochastics are ascending sharply.

Should the negative pressures wane, the price could ascend to face a couple of previous support regions such as 0.6563 and 0.6594, which could now serve as resistance zones. Conquering the latter, the bulls may attack the 0.6698 hurdle. Even higher, the May peak of 0.6817 could curb further upside attempts.

Alternatively, bearish actions could send the price to test the May low of 0.6457. A break below that zone could trigger a decline towards the nine-month low of 0.6363. Failing to halt there, the pair might retreat to fresh multi-month lows, where the November 2022 bottom of 0.6271 could provide downside protection.

In brief, AUDUSD appears to have managed to find its footing, but the road to recovery is long. For the bulls to regain confidence, the pair must at least reclaim the 50-day simple moving average (SMA).