AUD/USD: Aussie Jumps, RBA Rate Cut Bets Pared on Another Monster Jobs Report

2024.10.17 05:30

- Australia produces another stunningly strong jobs report for September

- Unemployment steady, underemployment hits multi-year lows

- RBA rate cut probabilities slashed given implications for inflation pressures

- AUD/USD rips higher but report impact likely to be limited

Overview

Australia recorded another monster increase in employment for September, putting another nail in the coffin for Reserve Bank of Australia (RBA) rate cut expectations this year. However, like the on Wednesday, its impact on is likely to be short-lived with the US interest rate outlook likely to remain the dominant influence in the near-term.

The Details: Wow!

You’ll struggle to find a jobs report as strong as Australia produced for September. It was near-faultless.

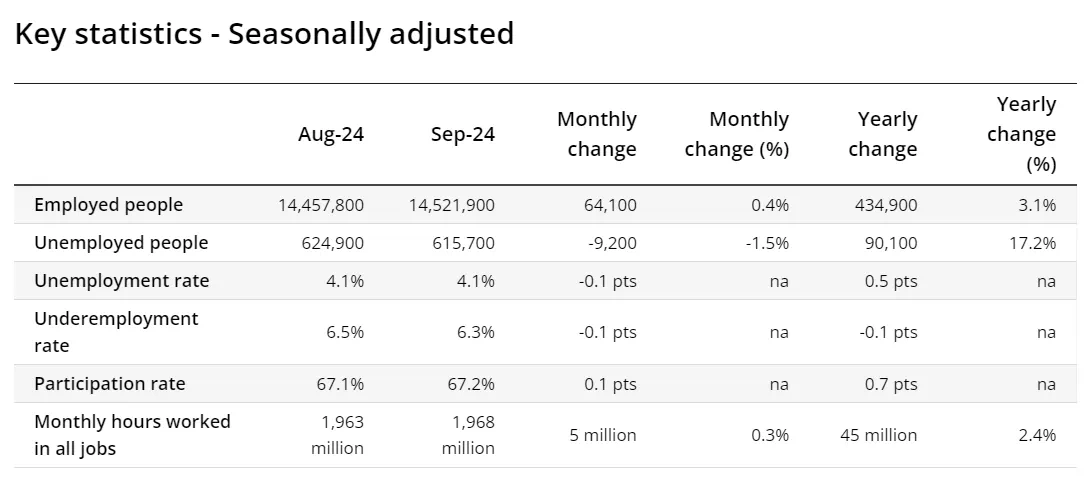

Source: ABS

Employment surged by 64,100 with 51,600 of those full-time. Hours worked inched higher by 0.2%. Unemployment held steady at a downwardly revised 4.1%, an impressive result considering the participation rate climbed to 67.2%, a record high. The employment-to-population ratio also hit fresh highs.

Underemployment, which measures the proportion of the workforce who are employed but would like more hours, tumbled 0.2% percentage points to 6.3%, the equal-lowest level since April 2023. Combined with unemployed workers, the underutilization ratio eased to a six-month low of 10.4%.

The decline in these measures of labor slack suggests the jobs market may be tightening again, potentially placing renewed upward pressure on wages.

With Australian underlying inflation pressures remaining well above the 2.5% midpoint of the RBA’s target range, the strength of the September update will generate unease among policymakers about cutting interest rates prematurely, adding to risks that inflationary pressures may reaccelerate given the likely boost to demand.

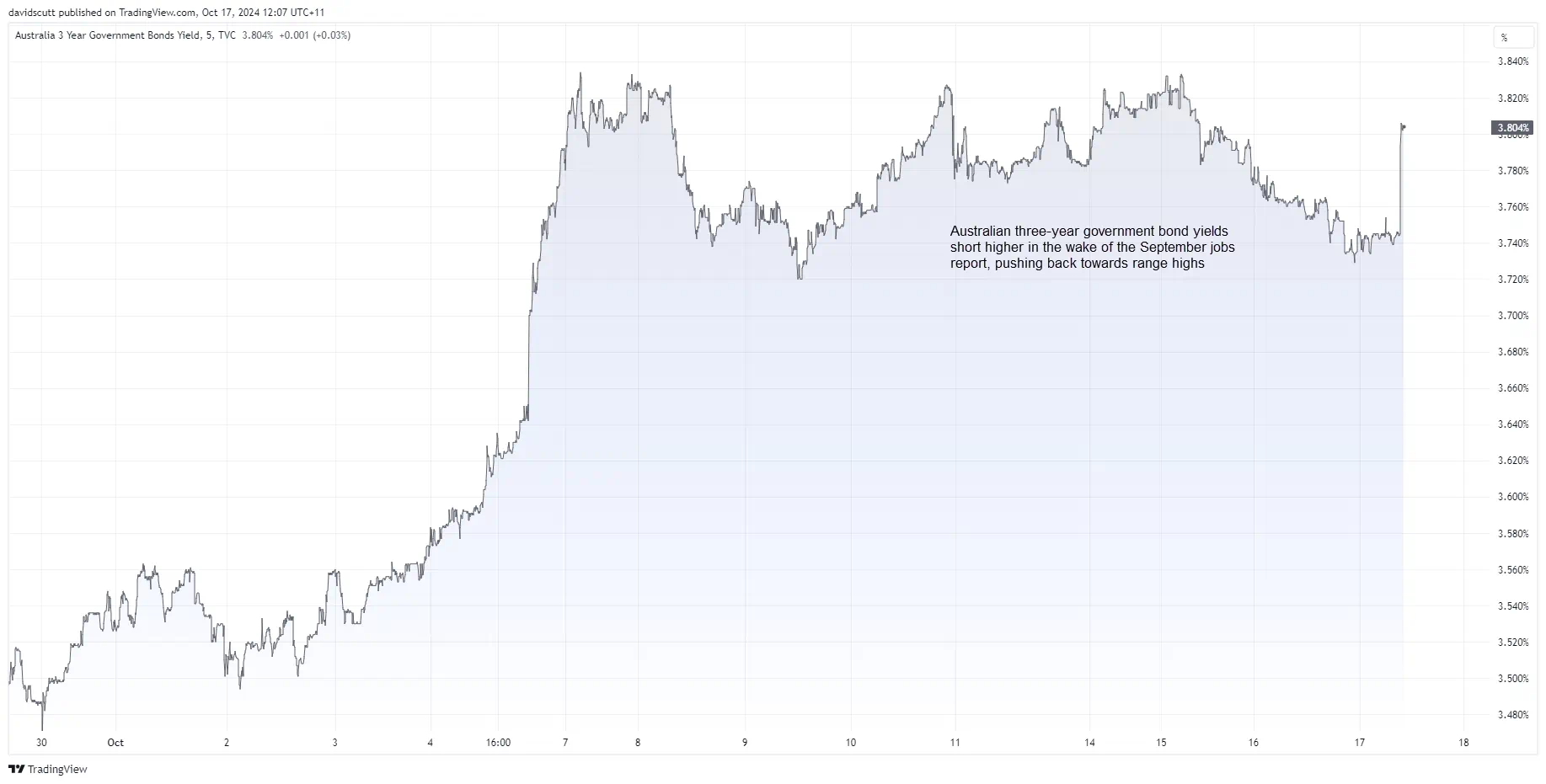

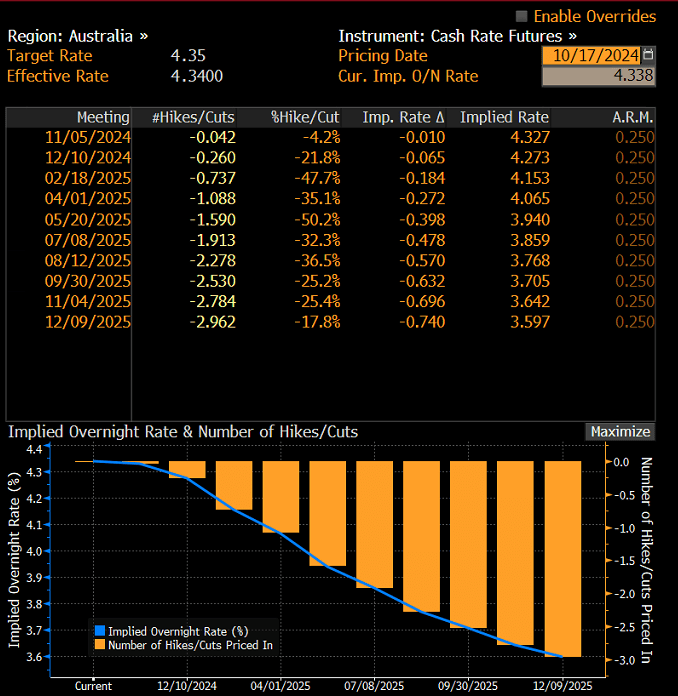

RBA Rate Cut Pricing Slashed

Rates traders have slashed expectations about the speed and magnitude of RBA rate cuts for the upcoming easing cycle with swaps markets putting the probability of a cut by December at just 26%. A full cut isn’t priced until April 2025 with only three reductions expected by the end of next year.

Source: Bloomberg

The way things are going, unless we see a meaningful deceleration in underlying inflationary pressures in the months ahead, or some form of major global risk event, the RBA simply has no need to provide more stimulus to the economy.

The strength of the labour market likely means the RBA will need more than one quarterly CPI report to feel confident inflation will return to target by early 2026, meaning a cut is unlikely until after the Q4 2024 report is received in late January.

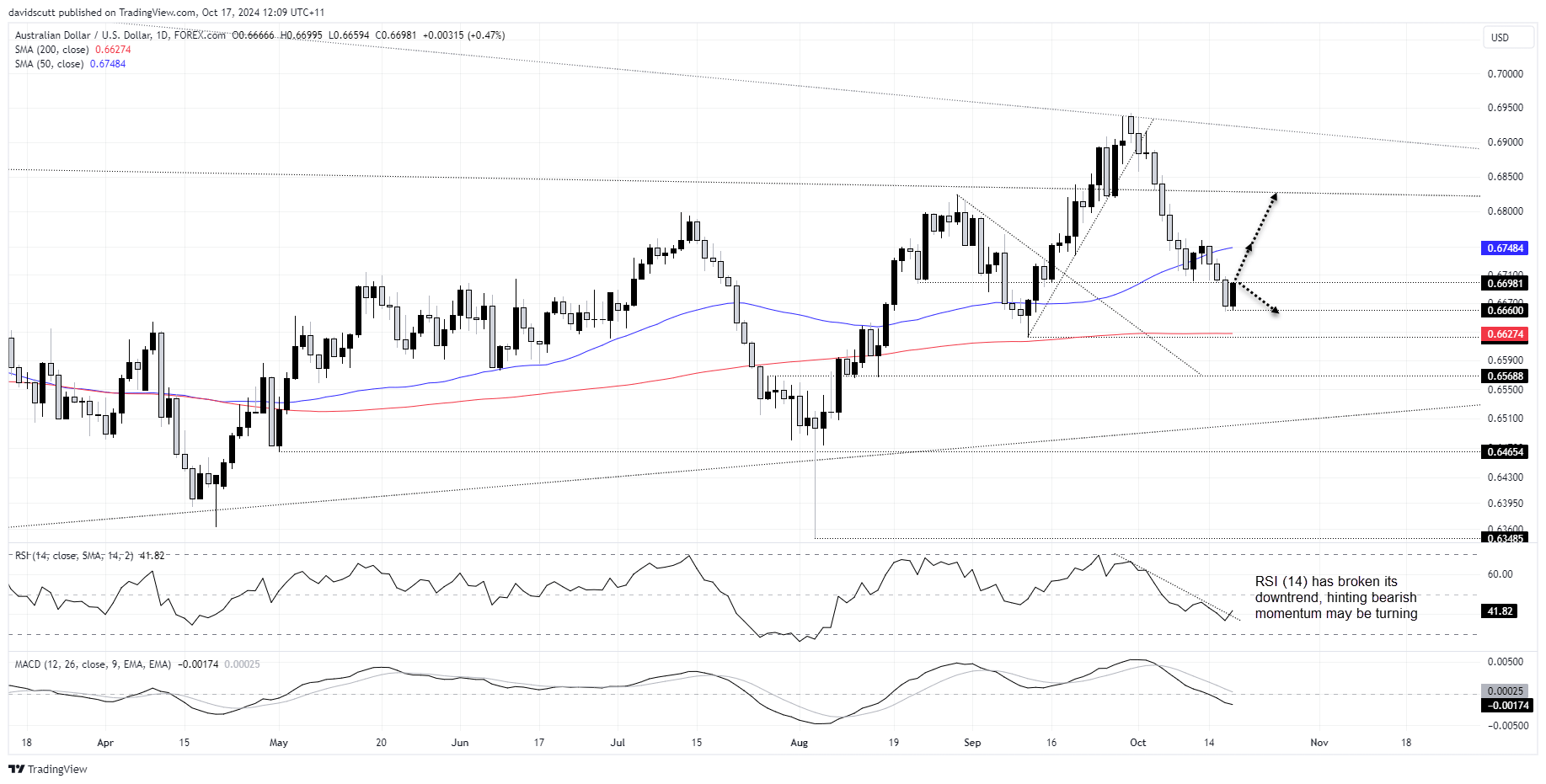

AUD/USD Bumping Up Against Former Support

AUD/USD jumped following the employment report, testing former horizontal support at .6700. With RSI (14) breaking its downtrend, there’s tentative evidence to suggest bearish momentum may be turning, although the signal has yet to be confirmed by MACD.

If the price manages to break and hold above .6700, traders could buy with a stop beneath the level for protection targeting a move to the 50-day moving average or .6760 where rallies stalled over the past fortnight. There are no major levels beyond until the downtrend is located around .6830.

Alternatively, if the price can’t break .6700, the trade can be flipped with shorts initiated beneath the level with a stop above for protection. .6660 would be the obvious initial target.

I expect the influence of the report will tail quickly over the remainder of Thursday’s session, replaced by the reaction in the USD to US jobless claims and retail sales data and ECB interest rate decision.

Original Post