Asian stocks solid and kiwi jumps on RBNZ rate hike

2022.08.17 06:05

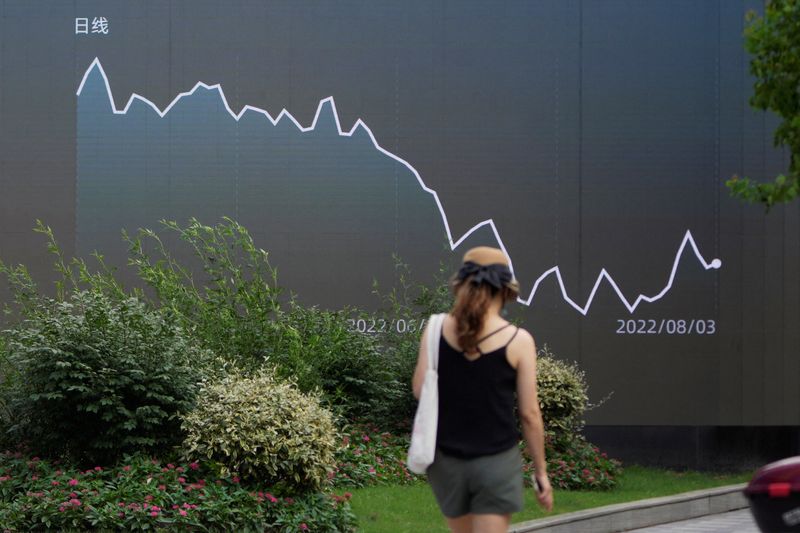

FILE PHOTO: A pedestrian walks past a giant display showing a stock graph, in Shanghai, China August 3, 2022. REUTERS/Aly Song

By Sam Byford

(Reuters) – Asian shares tracked solid Wall Street performance on Wednesday as strong overnight earnings for U.S. retail giants pointed to further scope for the Federal Reserve to tackle inflation with rate hikes.

Japan’s Nikkei rose 0.81% to 29,101.33, breaking through the 29,000 barrier for the first time since Jan. 6.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.02%.

Stocks in New Zealand fell 0.285% and the kiwi dollar gained 0.35% after the country’s central bank announced a fourth consecutive 50 bps rate hike to 3.00%.

Despite the hike being in line with expectations, the announcement was described as “definitely more hawkish than expected” by Imre Speizer, head of NZ market strategy at Westpac, who pointed to the tone of the RBNZ’s statement and a 15 bps raise in the official cash rate (OCR) track to 4.10%.

“Clearly they’re a bit more worried about wage inflation and a very tight labour market, that’s been a big recent development,” Speizer said.

Australia’s AXJO index fell 0.14% and the Aussie dollar reached a new one-week low after Q2 wages data showed growth slightly below expectations.

Hong Kong’s Hang Seng index rose 0.2%, while Chinese blue chips were down 0.3%.

Overnight, the Dow Jones Industrial Average gained 0.71% and the S&P 500 gained 0.19% as Home Depot (NYSE:HD) posted higher than expected sales and Walmart (NYSE:WMT) increased its profit forecast.

S&P emini futures were flat in early Asian trading hours.

Investors now see a 41% chance of a third successive 75 bps rate hike at the Fed’s next meeting in September, up from 39% the previous day. Minutes from the previous meeting will be released later today.

U.S. retail trade data for July will also come out later in the day, with investors watching for further signs of a recession.

“Retail sales should have been more resilient given the lower prices at pump improved the spending power of the average American household, and Amazon (NASDAQ:AMZN) Prime Day in the month possibly attracted bargain hunters as well,” wrote Saxo Bank analysts in a note, while pointing to “modest” consensus expectations of 0.1%.

Ten-year Treasury yields rose slightly and were trading at 2.8202%, having earlier wiped out an overnight rise to 2.8730%.

In commodities, Brent crude futures rose 0.1% to $92.43 a barrel while U.S. West Texas Intermediate (WTI) crude gained 0.22% to $86.72 per barrel.

Oil prices had fallen overnight to their lowest since before Russia’s invasion of Ukraine, with markets speculating on Iran’s response to a proposal to revive the 2015 nuclear deal, which could increase Iranian oil exports.

Spot gold fell 0.07% to $1,774.40 an ounce, while bitcoin rose 0.11% to $23,990.23. The leading cryptocurrency spiked to a two-month high over the weekend but has traded flat since losing almost 5% on Monday.