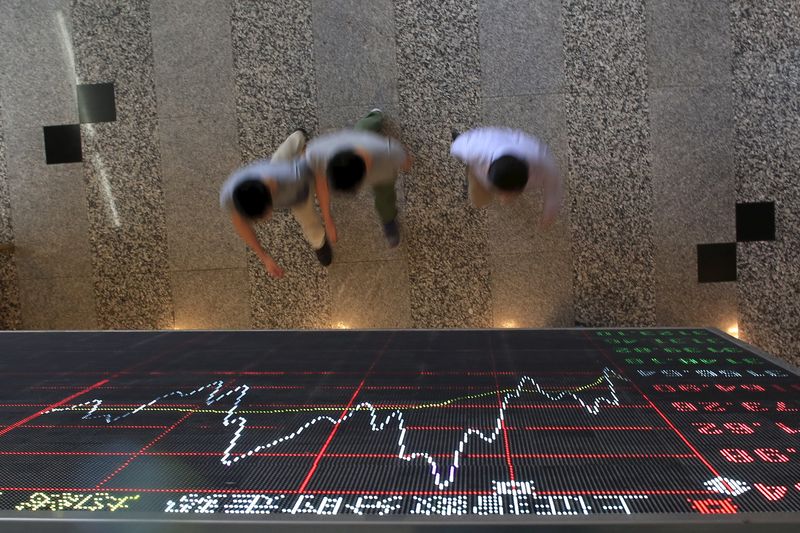

Asian stocks slammed by China woes, higher U.S. inflation

2023.08.14 00:44

© Reuters.

Investing.com– Most Asian stocks sank on Monday, with Chinese indexes leading losses on persistent concerns over slowing economic growth, while stronger U.S. inflation readings also pushed up fears of a more hawkish Federal Reserve.

U.S. inflation read higher than expected on Friday, indicating that inflation was seeing a potential resurgence after retreating in the first half of the year. The reading, which came after data also showed an increase in inflation, pushed up concerns that the Fed will have more impetus to keep raising interest rates.

Wall Street indexes sank on Friday, providing a weak lead-in to regional markets.

Chinese stocks lead losses on property woes, stimulus uncertainty

China’s and indexes fell 1.3% and 0.9%, respectively, on Monday. Hong Kong’s index slid 2.5%, hit by a mix of tech weakness and property sector losses.

Heavyweight Chinese property stocks were hit with a fresh wave of selling after Country Garden (HK:), one of the country’s biggest developers, warned of a massive, $7.6 billion loss in the first half of 2023.

The stock slid 13% to a new record low on Monday, as reports suggested the firm was also facing difficulty in meeting its debt obligations and at risk of a default. Such an event could mark another high-profile default for China’s property market, and heralds more headwinds for the country’s key economic engines.

Data on Friday also showed that Chinese slumped in July, capping off a slew of weak economic readings for the month. Focus is now on and data due on Tuesday.

While weak economic readings from China buoyed expectations of more stimulus measures in the country, government officials have so far offered scant details on how more economic support will be rolled out.

Australia’s sank nearly 1% as concerns over China hit major mining stocks.

Tech stocks hit by hawkish Fed fears

Technology-heavy Asian indexes saw steep losses on Monday, on concerns that U.S. interest rates could rise further. Higher rates weigh on the future earnings of tech stocks, which are usually valued based on their potential earnings power.

South Korea’s shed 0.9%, while Japan’s index fell 0.9% after a long weekend. Losses in major chipmaking stocks saw the index lose 1.4%.

Indian stocks set for weak open ahead of inflation data

Futures for India’s index fell 0.3% on Monday, pointing to a weak open for local markets as investors awaited potentially stronger-than-expected inflation readings for July.

Both and inflation readings are due later in the day, coming just a few days after the warned of a near-term spike in inflation.

Consumer inflation in particular is expected to have shot up in the past month due to higher food prices.