Asian stocks sink on debt ceiling jitters

2023.05.24 23:22

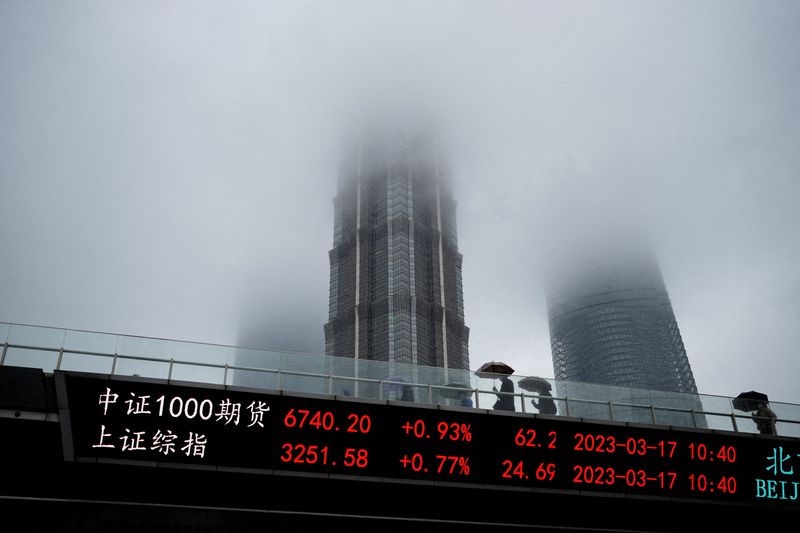

© Reuters. FILE PHOTO: An electronic board shows stock indices at the Lujiazui financial district in Shanghai, China, March 17, 2023. REUTERS/Aly Song

By Ankur Banerjee

SINGAPORE (Reuters) – Asian shares fell to a two-month low on Thursday, and the U.S. dollar rose as the impasse in negotiations to raise the U.S. debt ceiling kept investors wary of risky assets due to the hit the global economy will take if the U.S. government defaults.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.56% to a two-month low of 505.35, with Australia’s was down 0.78%. remained an outlier for the region, gaining 0.32%.

China shares eased 0.01% while Hong Kong’s fell 1% in early trading.

Negotiators for Democratic President Joe Biden and top congressional Republican Kevin McCarthy held what both sides called productive talks on Wednesday as they race to reach a deal to raise the debt ceiling.

But with no resolution in sight traders remained wary of a possible and catastrophic default with U.S. Treasury Secretary Janet Yellen maintaining early June as a debt ceiling default deadline.

Credit ratings agency Fitch put the United States on watch for a possible downgrade late on Wednesday, further dampening sentiment.

“This development raises the spectre of a possible downgrade from the top-tier credit rating, fuelled by the persistent deadlock over the U.S. debt ceiling and the looming threat of a U.S. default,” said Anderson Alves, a trader with ActivTrades.

“These concerns have stoked market volatility and instilled caution among rating agencies and investors.”

Wall Street’s main indexes ended lower overnight on debt-ceiling concerns.[.N]

E-mini futures for the rose 0.38%, while Nasdaq futures spiked 1.4% higher in early Asian hours after Nvidia (NASDAQ:) Corp forecast second-quarter revenue more than 50% above Wall Street estimates.

The semiconductor company said it was boosting supply to meet surging demand for its artificial-intelligence chips, which are used to power ChatGPT and many similar services.

Meanwhile, Federal Reserve officials “generally agreed” last month that the need for further interest rate increases “had become less certain,” according to minutes of the May 2-3 meeting when the policy rate was raised a quarter-percentage-point hike to 5.00%-5.25%. Several officials said that hike might be the last.

Ray Attrill, head of FX strategy at National Australia Bank (OTC:), said the minutes reflect the somewhat divided nature of much of the post-May meeting commentary from an array of Fed officials.

“Those advocating for the Fed to not be done at the current 5.0-5.25% do seem open to at least a pause in June,” Attrill said.

Markets though are now pricing in 33.6% chance of a 25 basis point hike in June, compared with 28% last week, according to CME FedWatch tool.

The yield on was up 2.9 basis points to 3.748%, while the yield on the 30-year Treasury bond was up 2.6 basis points to 3.992%.

The two-year U.S. Treasury yield, which typically moves in step with interest rate expectations, was up 5.3 basis points at 4.396%.

Investors shunned debt at risk of not being repaid if the U.S. Treasury Department runs out of cash. The yields on bills due on June 1 rose as high as 7.3710% overnight.

In the currency market, the , which measures the U.S. currency against six peers, rose 0.154%, touching a fresh two-month peak of 104.01.

The yen weakened 0.11% to 139.62 per dollar, while sterling was last trading at $1.2347, down 0.14% on the day.

fell 0.35% to $74.08 per barrel and was at $78.19, down 0.22% on the day.