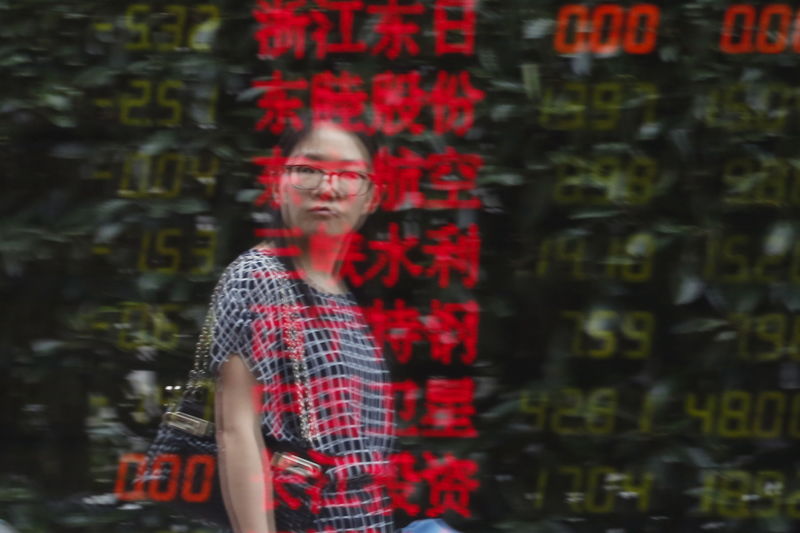

Asian Stock Market lost optimism

2022.12.12 01:06

[ad_1]

Asian Stock Market lost optimism

Budrigannews.com – On Monday, investors moved away from risky assets ahead of more signals on U.S. monetary policy this week. Additionally, rising COVID-19 cases in China dampened optimism about China’s economic reopening.

The day’s biggest decliners were Chinese and Hong Kong stocks because markets were worried that China’s loosening of COVID regulations would lead to much higher infection rates. China is already struggling with a daily infection rate that is at an all-time high.

With the removal of COVID curbs, optimism regarding the nation’s economic recovery was largely offset by this.

The and indexes were down 0.8 percent and 0.6 percent, respectively, while Hong Kong’s index was down nearly 2 percent. As China relaxes its COVID protections, analysts anticipate significant market volatility.

0.7% was lost by the index, which is also heavily influenced by China.

After data showed that in Japan, prices remained near 40-year highs in November, the index dropped 0.2%. According to the reading, price pressures are likely to persist and put pressure on the Japanese economy in the near future.

India’s and indexes were flat on Monday ahead of a key report later in the day, which is expected to indicate that price pressures in the country have decreased further.

This week, key U.S. (CPI) inflation data are expected on Tuesday. Although it is anticipated that the data will demonstrate that inflation eased further in November, stronger-than-expected inflation for the month may signal a similar trend in consumer prices.

More Budrigantrade-com-Stock markets will rise amid Fed rate cuts

The information is supposed to factor into the Federal Reserve’s position on money related approach to a great extent. A two-day meeting of the central bank is scheduled to conclude on Wednesday.

However, the central bank may issue more hawkish signals if inflation is higher than anticipated. U.S. interest rates will peak much higher than anticipated due to stubborn inflation, according to several Fed officials.

Nevertheless, Treasury Secretary Janet Yellen stated that inflation is anticipated to fall significantly in 2023, pointing to some positive market trends.

This year, as investors moved into debt markets with higher yields and tighter liquidity, rising U.S. interest rates had a significant impact on Asian stock markets.