Asian stock Market falls due to COVID outbreaks in China

2022.12.28 01:03

Asian stock Market falls due to COVID outbreaks in China

Budrigannews.com – After China took further steps toward reopening its COVID-battered economy, investors sought direction as Asian equities swung between losses and gains in choppy trading on Wednesday. Concerns about an economic slowdown were also weighing on sentiment.

After falling as much as 0.5 percent, MSCI’s broadest index of Asia-Pacific shares outside of Japan was up 0.2 percent. Subsequent to having the best month to month execution in almost 30 years in November, the file is level for December with two days of exchanging left.

The Eurostoxx 50 futures were down 0.13 percent, German futures were down 0.05 percent, and futures in the United Kingdom were up 0.24 percent.

China stocks were minimal changed, while the Hong Kong securities exchange rose 2%, supported by China’s declaration on Monday it would quit requiring inbound explorers to go into isolation beginning from Jan. 8.

A quicker than expected pinnacle of contamination has stirred up assumptions that a speedy financial recuperation is on the cards however flooding cases that are stressing assets and putting medical clinics under tension has placed a cover on financial backer energy.

U.S. Treasury yields pushed down growth shares that are sensitive to interest rates, causing Wall Street to end the night lower.

Investors have been trying to figure out how much the Federal Reserve will need to raise interest rates as it tightens policy to fight inflation and avoid sending the economy into a recession at the same time.

The yield on fell 1.1 basis points to 3.847%, remaining close to the previous session’s five-week high of 3.862%.

The yield on the 30-year Depository security was down 2.9 premise focuses to 3.914%, while the two-year U.S. Depository yield, which normally moves in sync with loan cost assumptions, was down 1.7 premise focuses at 4.351%.

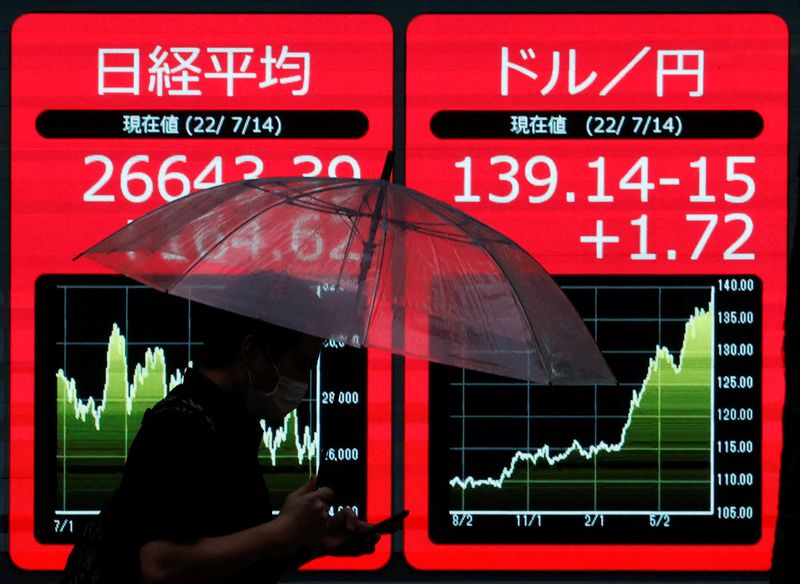

In the mean time, Bank of Japan (BOJ) policymakers examined developing possibilities that higher wages could at long last destroy the gamble of a re-visitation of flattening, a rundown of sentiments at their December meeting displayed on Wednesday.

The BOJ maintained its ultra-easy policy at the meeting on December 19 and 20, but it stunned the market by adjusting its bond yield control policy, allowing longer-term interest rates to rise further.

Investors will likely concentrate on who will lead the Bank of Japan when Governor Haruhiko Kuroda resigns in April, despite growing market expectations that the central bank will likely alter its policy.

According to ING economist Min Joo Kang, “we think the policy review will follow in the second quarter of 2023 once the new governor is appointed.” She stated that ING anticipated a rate increase in late 2023 or early 2024 and that another modification to the yield curve control policy was possible in the first half of 2023.

“The spring salary negotiation the year after next is the most important one to watch for further significant policy changes for the Bank of Japan.”

While Australia’s declined by 0.6%, it lost 0.45%.

More Kraken Stop Crypto Activity in Japan

The euro gained 0.01 percent to $1.0639, while the Japanese yen lost 0.39 percent against the US dollar at 134.00.

The increased by 0.038%, which compares the safe-haven greenback to six major currencies.

Was $84.42, up 0.11 percent on the day, at $79.61 per barrel.