Asia stocks surge as cooling inflation feeds hopes Fed will ease up

2022.11.10 21:50

[ad_1]

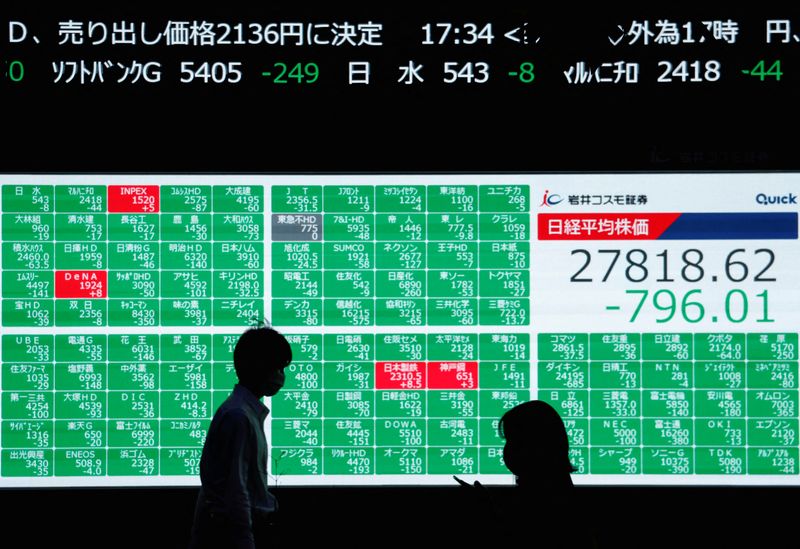

© Reuters. FILE PHOTO: People walk past an electric board showing Japan’s Nikkei share average in Tokyo, Japan September 14, 2022. REUTERS/Issei Kato

By Ankur Banerjee

SINGAPORE (Reuters) – Asian shares spiked higher on Friday, while the dollar nursed steep losses after a smaller-than-expected increase in U.S. consumer prices fuelled hopes that the Federal Reserve could tone down its aggressive pace of interest rate hikes.

MSCI’s broadest index of Asia-Pacific shares outside Japan jumped 3.72%. Australia’s climbed 2.43% and rose 3%.

The U.S. consumer price index climbed 7.7% year on year – the first time since February that the annual increase was below 8%, and the smallest gain since January.

“It’s something the market had been waiting for a long time,” said Shane Oliver, head of investment strategy and chief economist at AMP (OTC:) Capital. “There was a lot of money sitting on the sidelines.”

Overnight, the and Nasdaq notched up their biggest daily percentage gains in over 2-1/2 years on the data.

After four consecutive 75 basis-point interest rate hikes to tame decades-high inflation, the case is now building for the Fed to moderate its aggressive stance, said Rodrigo Catril, senior currency strategist at National Australia Bank (OTC:) in Sydney.

Financial markets have now priced in an 85% likelihood of a smaller, 50 basis-point interest rate hike at the conclusion of next month’s FOMC policy meeting, according to CME’s Fedwatch tool.

Mainland China stocks opened 2.1% higher, while Hong Kong shares shot up 6.5% in early trade.

China stocks have had a turbulent few weeks – sliding on outbreaks of COVID-19, the ensuing lockdowns as well as feeble economic data, but also surging sporadically on hopes of an eventual economic reopening.

In the currency market, the slumped more than 2% overnight to 108.100, the most in over a decade. It was last at 108.230. [/FRX]

The greenback on Thursday recorded its worst day against the Japanese yen since 2016, having fallen 3.7%. It has since clawed back some of those losses and on Friday was up 0.53% at 141.69 yen.

The CPI data sent U.S. Treasury yields to a five-week low overnight. [US/]

fell 1% as crypto exchange FTX scrambles to raise about $9.4 billion from investors and rivals in a bid to save the firm.

Meanwhile, oil prices rose on Friday as fears of a U.S. recession eased but they were on track for weekly declines of more than 4% due to COVID-related worries in China. [O/R]

rose 0.25% to $86.69 per barrel and was at $93.88, up 0.22% on the day.

[ad_2]

Source link