Asia stocks stagger into September as dollar spikes

2022.09.01 05:30

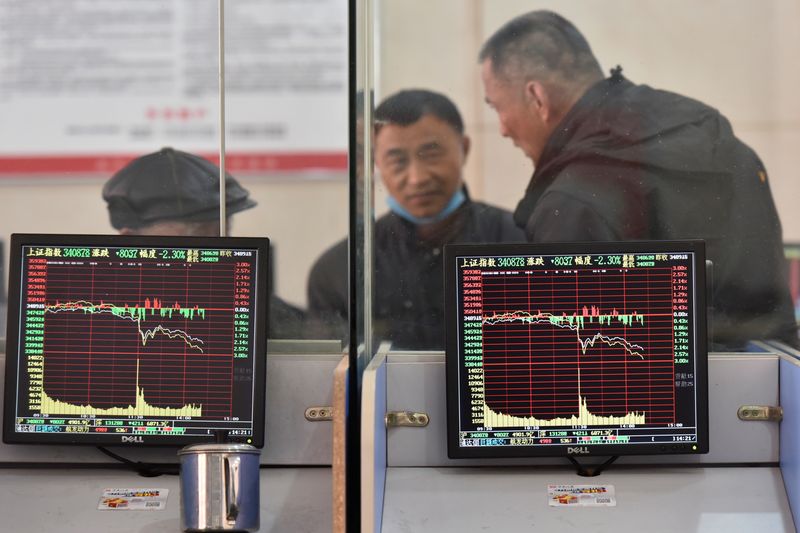

Investors are seen behind screens displaying stock information at a brokerage house in Fuyang, Anhui province, China February 24, 2022. China Daily via REUTERS

SYDNEY (Reuters) – Asian stocks slid and the dollar spiked on Thursday as investors greeted September by selling everything that was not nailed down after a month battered by concerns about aggressive rate hikes from global policymakers.

MSCI’s broadest index of Asia-Pacific shares outside Japan slumped 1.3% in early Asia trade, following a slide in U.S. stock futures. The S&P 500 futures dropped 0.6%, while Nasdaq futures declined 1.1%.

Japan’s Nikkei skidded 1.6% and Hong Kong’s Hang Seng index fell 1.4% while Chinese stocks dipped 0.3%.

Tech stocks took a hit, dragged lower by a 6.6% after-hour plunge in chip designer Nvidia (NASDAQ:NVDA) Corp, after U.S. officials told the company to stop exporting two top computing chips for artificial-intelligence work to China.

Regional purchasing managers’ indexes from South Korea, Japan and China on Thursday all pointed to slowing global economic activity as high inflation, rising interest rates and the war in Ukraine took a heavy toll.

“August has been a terrible month for balance fund investors with no diversification gains from holding a portfolio of equities and bonds,” Rodrigo Catril, senior FX strategist at National Australia Bank (OTC:NABZY), said in a note to clients.

“Month end yields no surprises, but rather an extension of the major themes seen during August with further increases in core global bond yields and weaker equities.”

This month, both the U.S. Federal Reserve and the European Central Bank are expected to raise borrowing costs aggressively.

Overnight, Cleveland Fed President Loretta Mester said the U.S. central bank would need to boost interest rates somewhat above 4% by early next year and hold them there in order to bring inflation back down to the Fed’s goal, and that the risks of recession over the next year or two had moved up.

The ECB’s move on interest rates must be “orderly and predictable”, French ECB policymaker Francois Villeroy de Galhau said on Wednesday, as data showed euro zone inflation had risen to another record high last month, solidifying the case for a 75 basis point rate hike next week.

U.S. stocks ended the month with the worst August performance in seven years. For the month, the Dow Jones Industrial Average fell 4.06%, the S&P 500 4.24% and the Nasdaq 4.64%.

In currency markets, the dollar advanced 0.4% against the Japanese yen to a 24-year high of 139.5 while gaining 0.5% over the Australian dollar. [FRX/]

Hawkish Fed expectations saw Treasury yields hit fresh highs. The yield on benchmark two-year notes jumped 6 basis points to the highest since late 2007, at 3.51%, while yield on 10-year bonds rose 8 basis points to 3.21%.

U.S. crude fell 0.65% to $88.97 a barrel, while Brent crude declined 0.7% to $95 per barrel. Russia on Wednesday halted gas supplies via Europe’s key supply route.

Gold was slightly lower. Spot gold was traded at $1705.814 per ounce. [GOL/]