Asia stocks rally as China data buoys mood; dollar stays strong

2023.09.14 23:31

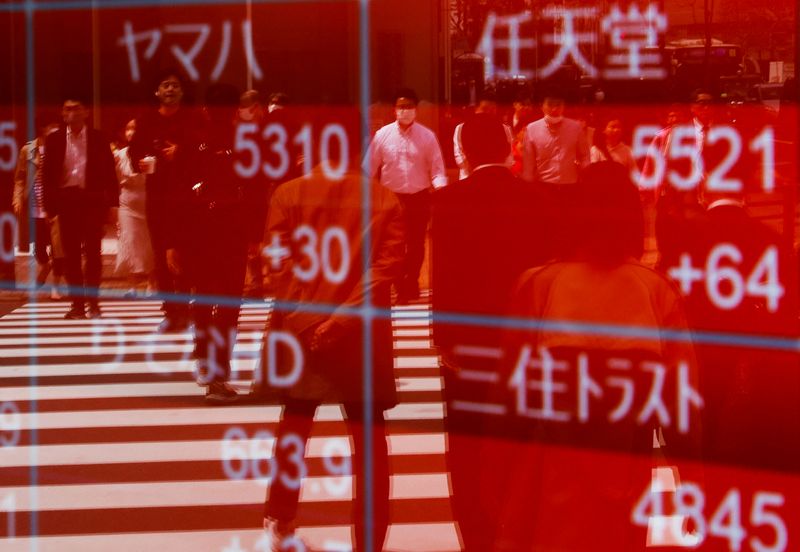

© Reuters. FILE PHOTO: Passersby are reflected on an electric stock quotation board outside a brokerage in Tokyo, Japan April 18, 2023. REUTERS/Issei Kato/File Photo

By Kevin Buckland

TOKYO (Reuters) – Asian stocks rose strongly on Friday, extending a global equity rally, after better-than-expected Chinese economic data added to the good vibes from expectations that tightening campaigns by the world’s biggest central banks were close to over.

The dollar stuck close to a six-month peak from overnight against major peers, buoyed by robust U.S. economic data, while the euro sagged following the European Central Bank’s signal that Thursday’s rate hike was probably the last this cycle.

Crude oil hit a fresh 10-month top.

MSCI’s broadest index of Asia-Pacific shares rallied 0.84%.

jumped 1.33% to a two-month high.

Hong Kong’s added 1.2%, and mainland Chinese blue chips rose 0.2%, flipping from early small losses.

Australia’s stock benchmark surged 1.75%.

U.S. pointed to a 0.17% rise, after the cash index rallied 0.84% on Thursday.

Chinese gauges of retail sales and industrial output for August handily topped economists forecasts, providing additional tailwinds from the central bank’s decision overnight to cut banks’ reserve ratio requirements for a second time this year.

It was not all blue skies though, with data earlier in the day showing the biggest drop in new home prices in 10 months – another reminder of the property sector’s struggles, after Moody’s (NYSE:) cut the sector’s outlook to negative on Thursday.

“It’s certainly not a definitive turning point, but perhaps we’re seeing green shoots in China’s economy,” said Kyle Rodda, senior market analyst at brokerage firm Capital.com, calling the retail sales figures “particularly heartening.”

“It’s a nice little shot in the arm to end the week” for stock markets, but “I think investors will be searching for more in terms of support from the central government, and ultimately, more fiscal support is what’s required to boost demand,” he said.

The overall improving economic outlook bolstered the , which gained about 0.3% to 7.2709 per dollar in offshore markets.

Australia’s dollar, which often trades as a proxy for the country’s top trading partner, rose 0.3% to $0.6460.

However, a gauge of the U.S. dollar against six of its biggest developed-market peers stuck close to the six-month peak it reached overnight, buoyed primarily by the euro’s steep overnight slide.

The so-called edged down 0.08% to 105.33, after hitting the highest since early March at 105.43 on Thursday.

The euro was flat at $1.0643, languishing near the overnight low of $1.0632, the lowest level since March 20.

The European Central Bank (ECB) hiked its key interest rate to a record 4% on Thursday, but hinted that this latest increase would likely be its last.

Meanwhile, U.S. data showed producer prices increased by the most in more than a year in August and retail sales also rose more than expected. But both of those figures were swelled by higher gasoline prices.

As a result, traders stuck to bets for the Federal Reserve to skip a rate hike next week, in what might be the end of the tightening cycle.

“A dovish ECB rate hike contrasted against a U.S. economy ticking all the boxes to retain its Goldilocks status into year-end,” said Tony Sycamore, a market analyst at IG.

The is on track for a ninth straight weekly advance, the longest run in nine years.

Whether it can extend that to a tenth week depends of Fed Chair Jerome Powell’s tone after the central bank policy decision on Sept. 20, Sycamore said.

In energy markets, extended its rise in Asia trading, touching fresh highs since November.

rose 0.5% to $94.16, while the U.S. West Texas Intermediate crude (WTI) was up 0.6% at $90.74.