Asia stocks near 16-month peak on economic optimism, Aussie eases before RBA

2023.08.01 00:04

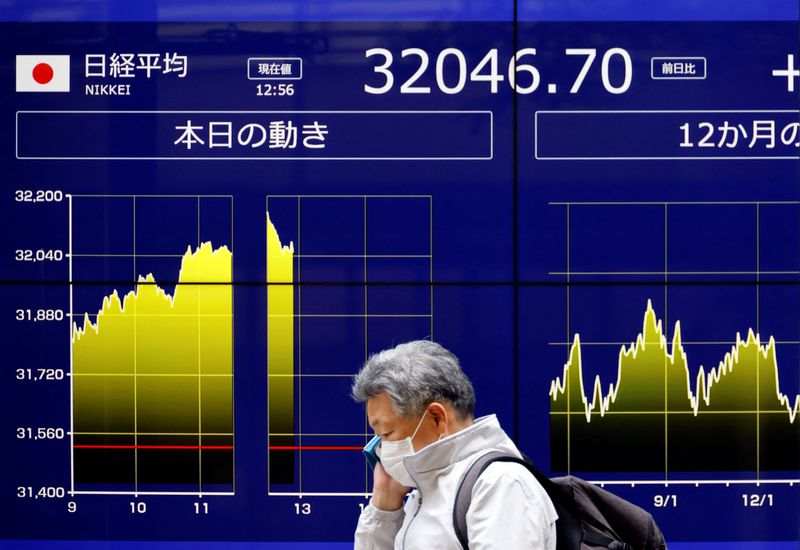

© Reuters. FILE PHOTO: A man walks past an electric monitor displaying Japan’s Nikkei share average and recent movements, outside a bank in Tokyo, Japan, June 5, 2023. REUTERS/Issei Kato/file photo

By Kevin Buckland

TOKYO (Reuters) – Asian stocks edged toward a sixteen-month peak on Tuesday and oil held near recent highs as investors began to find more cause for cheer over global economic prospects than reasons to worry, even as data showed risks remain.

The dollar hit a three-week high against the yen as investors continued to seek clarity on the Bank of Japan’s recent adjustment to its yield curve control and what that might mean for monetary policy.

The dollar, meanwhile, eased slightly heading into a central bank policy decision, with traders laying about 30% odds on a quarter-point rate hike.

MSCI’s broadest index of Asia-Pacific shares rose 0.25%, heading back toward the high reached Monday, which was its strongest level since April of last year.

The rose 0.84%, with a tech subindex up nearly 2%. rose 0.59%.

U.S. E-mini stock futures pointed to a 0.1% rise after the ticked up 0.15% overnight.

Signs of a peaking out in European inflation on Monday echoed the narrative in the United States, providing more evidence that the biggest central banks are nearing the end of their tightening cycles.

A surprise contraction in China’s manufacturing sector in a private-sector survey released Tuesday was largely ignored as investors focused on stimulus steps from Beijing to support the ailing post-pandemic recovery.

“We’re in a kind of economic nirvana, with an incredibly resilient economy, solid earnings reports and cooling inflation,” said Tony Sycamore, a markets analyst at IG in Sydney.

“A little more than halfway through the year, it feels like we’re in a very good spot.”

The positive narrative faces some crucial tests this week, with several closely watched jobs reports due in the United States, culminating with monthly payrolls on Friday. Corporate earnings later on Tuesday include global bellwether Caterpillar (NYSE:).

The – which measures the currency against six major peers – rose 0.2% to reached 102.07 for the first time since July 10.

That was aided by a continued retreat in the yen, as investors looked past the BOJ’s surprise tweak of its 10-year yield ceiling to view changes to the negative short-term rate as a still distant prospect.

The dollar added as much as 0.37% to reach a three-week high of 142.80 yen.

Japan’s benchmark 10-year yield hovered around 0.6%, far from the new de facto cap at 1%.

The Aussie weakened 0.34% to $0.66955, putting it around the middle of its trading range of the past week.

Leading cryptocurrency bitcoin slipped 0.9% to $28,965, and earlier touched $28,726, its lowest level since June 21.

eased back slightly after ending July at fresh three-month highs, supported by signs of tightening global supply and rising demand through the rest of this year.

U.S. West Texas Intermediate crude futures eased 0.3% to $81.54 a barrel, after reaching $82.00 in the previous session for the first time since mid-April.