Asia snaps losing streak as chip stocks bounce

2024.07.22 22:01

By Tom Westbrook

SINGAPORE (Reuters) – Asian stocks bounced from one-month lows on Tuesday, with Taiwan’s market snapping a five-day losing streak as semiconductor shares took a lead from a Wall Street recovery, while sagging commodity prices weighed on the dollar.

MSCI’s broadest index of Asia-Pacific shares outside Japan, which touched a one-month low on Monday, rose 0.55%.

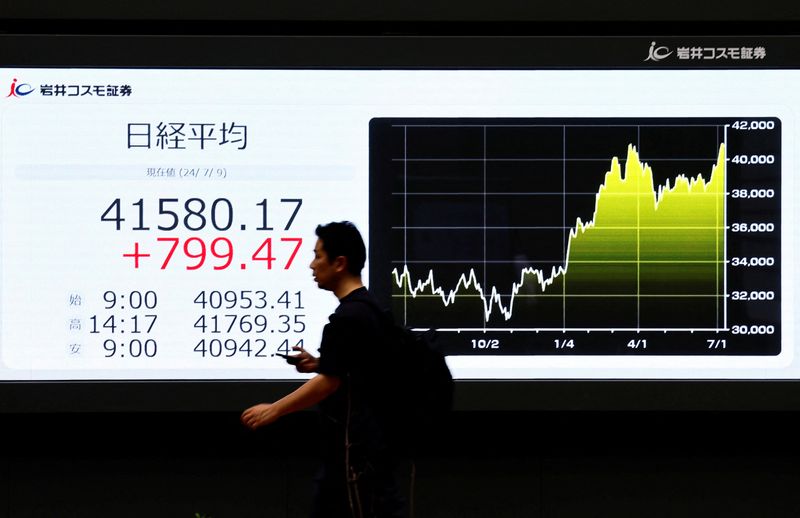

steadied thanks to stabilising chip stocks and the share average gained 0.3%. Overnight, the rose 1.1% and the tech-heavy Nasdaq went up 1.6% as stocks sold heavily in the last few days rebounded. [.T][.N]

Markets made little obvious reaction to the end of President Joe Biden’s reelection bid. Investors are looking ahead to earnings at Tesla (NASDAQ:) and Alphabet (NASDAQ:) due after the New York close and both stocks advanced sharply on Monday.

“Risk sentiments and Democrat support for Kamala Harris appear to be at least on the way to solid,” said Mizuho economist Vishnu Varathan in a note to clients.

“What remains to be seen is whether a bull rotation will see gains cascading down … more broadly into smaller caps.”

In Taiwan, the benchmark index was up about 1.7% in early trade and shares in chipmaker TSMC jumped 2%.

Over the week to Monday, the company – the most valuable listed firm in Asia – lost about $100 billion in market value after U.S. presidential candidate Donald Trump sounded equivocal about protecting Taiwan and its chip industry in a magazine interview.

South Korean chipmakers Samsung (KS:) and SK Hynix also rebounded with traders willing to look through the political risks to extremely strong demand.

“We believe that the dependence on Asian chipmakers is so large that they will not be easily replaced by potential U.S. counterparts for some time,” said ING economist Min Joo Kang.

In bond markets, U.S. yields ticked up overnight and were broadly steady in Asia, with benchmark 10-year yields at 4.25% and two-year yields at 4.51%.

Markets have priced two U.S. rate cuts for the second half of this year which has started to weigh on the dollar, even if uncertainty over the U.S. election is keeping it from falling too far.

The euro was steady at $1.089 on Tuesday and the yen ticked marginally higher to 156.8 per dollar.

China surprised markets with interest rate cuts on Monday and concern over the economic outlook following softer-than-expected growth figures last week have commodities under pressure.

Dalian iron ore futures traded at their lowest since April as did Shanghai while futures made a one-month low overnight and were last at $82.59 a barrel. [IRONORE/][MET/L][O/R]

That has dragged the Australian dollar to three-week lows and the New Zealand dollar to an almost three-month trough of $0.5966, though analysts say a rebound is due.

“While industrial commodity prices have fallen, from a longer-run perspective many of them remain at high levels,” said Corpay strategist Peter Dragicevich. “Based on the current level of the copper price the AUD looks to be ‘cheap,'” he said.

held steady at 7.2732 per dollar.