Asia FX Slips as Powell Talks Tough on Interest Rate Hikes

2022.11.03 01:33

[ad_1]

Asia FX Slips as Powell Talks Tough on Interest Rate Hikes

Budrigannews.com – Most Asian currencies fell on Thursday as hawkish comments from the Federal Reserve showed that U.S. interest rates are likely to remain elevated for longer, while weak economic data from China also dented sentiment towards the region.

The fell 0.2% and traded close to a near 15-year low after a showed the country’s services sector shrank more than expected in October, due to continued COVID-linked disruptions.

The data also cooled speculation over Chinese plans to scale back COVID-linked lockdowns. The prospect of a Chinese reopening was fueled by rumors circulating on social media, and supported Asian currencies this week, given the country’s status as a major trading destination for the region.

But government officials offered no comment on social media rumors that the country will phase out its zero-COVID policy by March 2023.

Broader Asian currencies fell, with the and losing about 0.2% each. The rose 0.4% in holiday-thinned trade.

The and rose 0.5% each after the hiked interest rates by an as-expected 75 basis points (bps) on Wednesday.

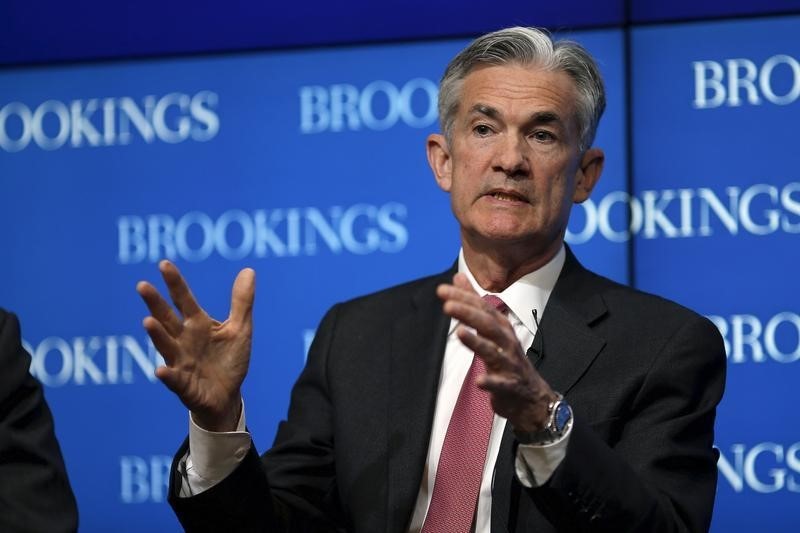

dismissed any speculation that the bank plans to pause its interest rate hikes, and said that the Fed is set to keep raising rates for longer than initially thought. Powell said that U.S. rates, which are currently at their highest level since the 2008 financial crisis, will also peak at a much higher level than initially thought, due to stubbornly .

While the Fed Chair also raised the prospect of smaller rate hikes going forward, most risk-driven markets plummeted on his otherwise hawkish stance. Still, a majority of traders are now pricing in a .

The fell 0.2%, hovering around record lows after the kicked off an off-cycle meeting intended to address in the country. While markets broadly expect the bank to hold interest rates at a 3-½ year high, the bank is likely to flag higher-than-anticipated inflation in the coming months.

Among antipodean currencies, the bucked the trend with a 0.3% rise. Data released on Thursday showed Australia’s rose far more than expected in September, buoyed largely by strong fuel exports.

The strong data is likely to give the more economic headroom to keep raising interest rates.

[ad_2]

Source link