As China’s controls take effect, wait for gallium, germanium export permits begins

2023.08.01 06:45

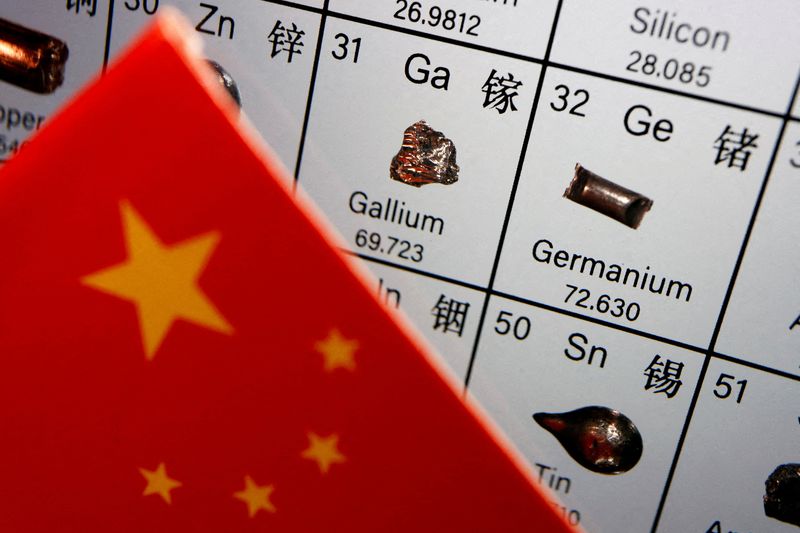

© Reuters. FILE PHOTO: The flag of China is placed next to the elements of Gallium and Germanium on a periodic table, in this illustration picture taken on July 6, 2023. REUTERS/Florence Lo/File Photo

BEIJING (Reuters) – China’s export controls on some gallium and germanium products take effect on Tuesday with traders braced for a drop in international supply in August and September while exporters sort out newly required permits.

China, the world’s top supplier of the two minor metals used to make semiconductors, in early July announced restrictions on the exports of eight gallium and six germanium products, citing national security reasons.

Exporters of these products from Tuesday need to apply for export licences for dual-use items and technologies, four traders said.

Two of the sources told Reuters they are still preparing needed documents and are likely to file their applications in the coming week.

Dual-use refers to items and technologies with civil as well as potential military applications, according to China’s Ministry of Commerce.

The ministry did not immediately respond to a Reuters request for comment.

It typically takes about two months to obtain such licences, the traders and two producers said.

It was unclear how many licences would be issued, they added.

Stockpiles outside China, which could last for two to three months, will need to be tapped while traders await Beijing’s export permit approvals, said Willis Thomas, a consultant at London-based consultancy CRU.

At the same time, the export restrictions are expected to result in a growing surplus of the products in China.

Offer prices for gallium ingot at Rotterdam jumped 43.4% to $370 per kg last week, from $258 per kg in late June. Offers for germanium ingot at Rotterdam rose 9.1% to $1,473 per kg last week, from $1,350 per kg one month earlier, according to the China Nonferrous Metals Industry Association.

CRU’s Thomas said he expects prices to rise and stay supported over the next several months before cooling down by the end of the year as China’s exports and overseas supply are expected to improve.

China’s wrought germanium and germanium products exports in the first half of the year totalled 27,825 kg, up 75.5% from a year earlier, customs data showed.

Exports of wrought gallium and gallium products totalled 17,565 kg, down 53.5%.