Are Small Caps Really That Cheap?

2022.06.23 11:51

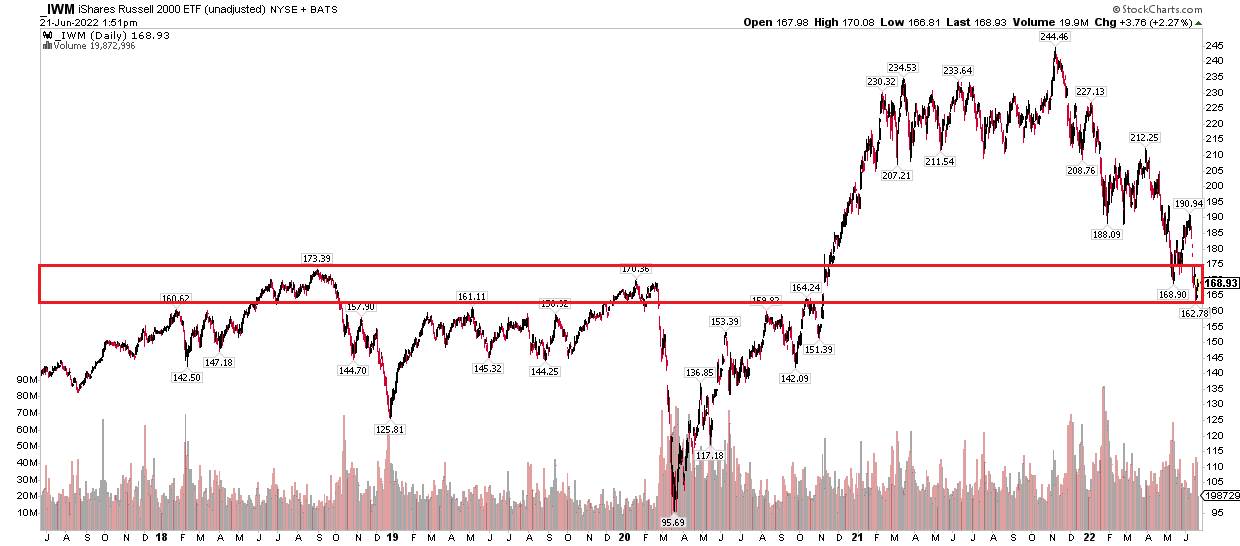

- A popular U.S. small-cap index ETF is back down to the same level as four years ago

- With an attractive P/E, the small space of the stock market looks inexpensive

- Another metric, however, suggests caution is still warranted after a more than 30% plunge from the November 2020 all-time high

Everybody is out and about now that summer’s officially underway (for those of us in the northern hemisphere). Hitting the beach and taking fun flights across the country is so common that just about every seat on airlines is taken. Also embarking on a round-trip is the Russell 2000 Small-Cap Index (IWM).

Here’s what I mean: Unlike the S&P 500, small-cap shares have returned to their pre-pandemic high notched in February 2020. More remarkable is that IWM is unchanged from this time in 2018.

IWM 5-year Zoom: Long-Term Support In-Play

IWM Daily 2017-2022

IWM Daily 2017-2022

The ‘great small-cap roundtrip’ is important right now because price is back to key support. The $164 to $173 range is critical for the smalls. This is a good spot to put on swing long trades, but it’s a prudent move to set stop levels underneath the low hit earlier this month.

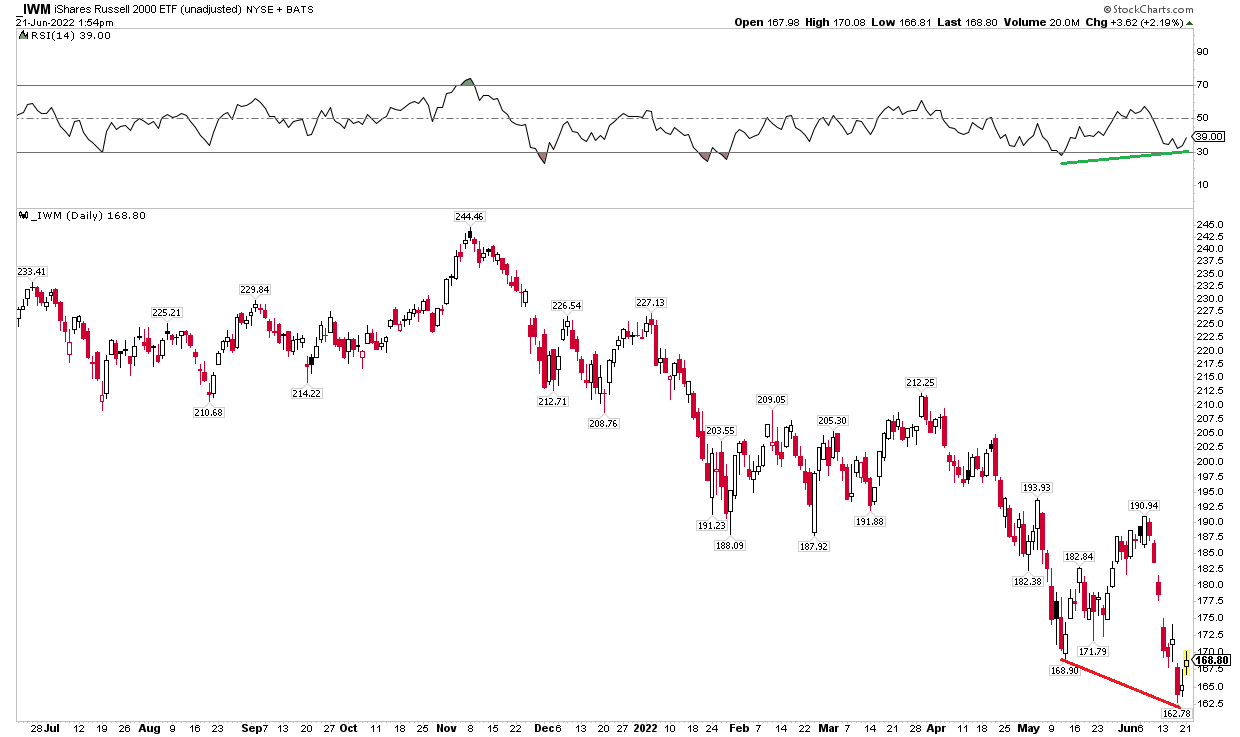

Another encouraging sign that catches my attention is a bullish divergence on IWM’s daily chart. Notice in the graph below that the popular (or infamous!) small-cap ETF notched a new low, but that happened along with a higher low in the RSI. It’s another arrow in the bulls’ quiver.

IWM Daily Chart: Bullish Divergence

IWM Daily

IWM Daily

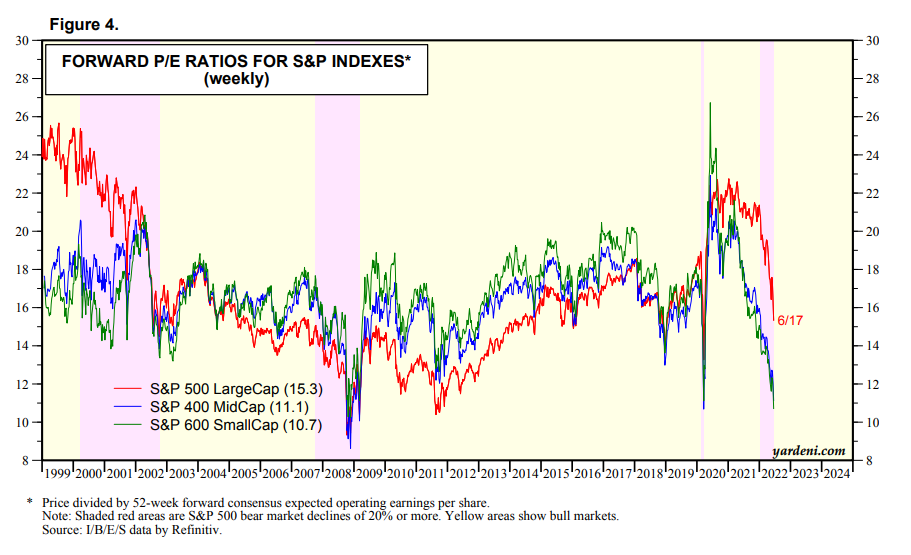

On valuation, small caps look downright cheap on the surface. According to Ed Yardeni’s great charts, the S&P 600 SmallCap Index (which is the 600 smallest stocks in the S&P 1500) sports a forward P/E ratio under 11.

Away from the Great Financial Crisis lows, that’s the most inexpensive the group has been in decades.

There are two big caveats to that fact, though. For one thing, the S&P 600 SmallCap excludes negative-earning companies. Also, we have no idea what the “E” will be in the forward P/E ratio.

It’s widely expected that earnings forecasts will be revised lower—perhaps during the upcoming corporate reporting season that begins in four weeks.

S&P U.S. Stock Market Index Valuations: Is Now the Time to Bet Big?

Forward P/E Ratios For S&P Indexes – Weekly

Forward P/E Ratios For S&P Indexes – Weekly

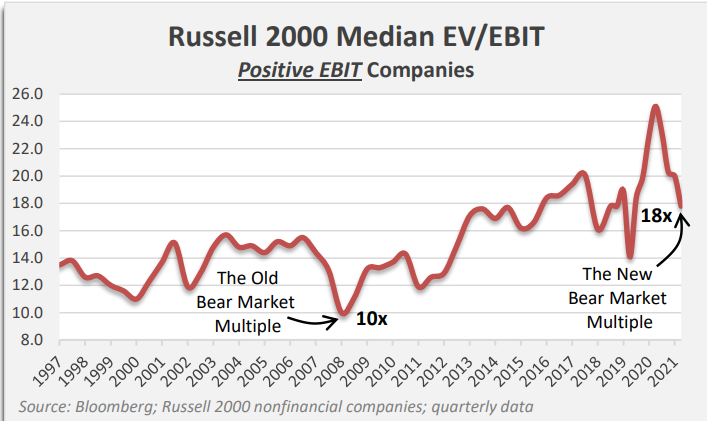

Readers know that I love my charts. There’s a great one from Palm Valley Capital Management’s portfolio managers Jayme Wiggins and Eric Cinnamond.

The graph below illustrates well that among positive EBIT firms in the Russell 2000, the median EV/EBIT multiple is still significantly above lows hit around 2000, 2008, and even March 2020. Moreover, that valuation metric is the 2003-2007 range high.

Maybe small-cap shares are not as cheap upon closer inspection.

A Different Valuation Approach, A Different Story

Russell 2000 Median EV/EBIT

Russell 2000 Median EV/EBIT

The Bottom Line

Rarely are things clear-cut in the investing and trading worlds. You must weigh bullish and bearish factors, then define what kind of risk you want to take and know your timeframe.

I assert that four years of zero appreciation among small-cap stocks presents a solid long-term opportunity. For near-term traders, taking a long position with a stop under the recent lows makes sense.