Are Red-Hot Factor Funds Vulnerable to Ongoing Rate Hikes?

2023.07.07 09:03

Yesterday’s news that US companies accelerated hiring in June strengthens confidence that the Federal Reserve will continue to lift interest rates to tame . Equity risk factors with the strongest gains this year may be vulnerable if a renewed hawkish monetary policy unfolds.

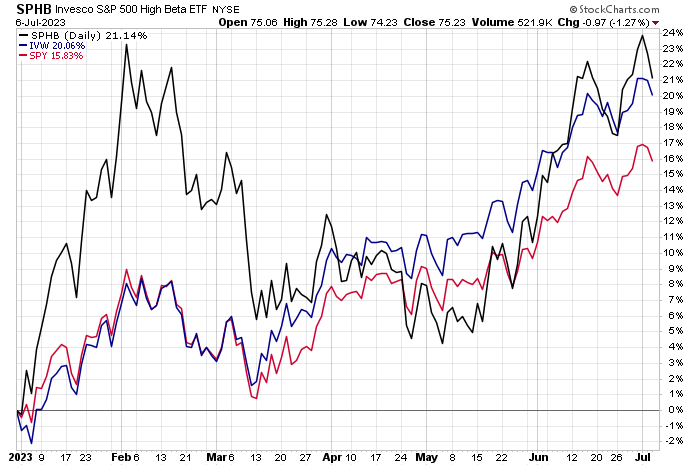

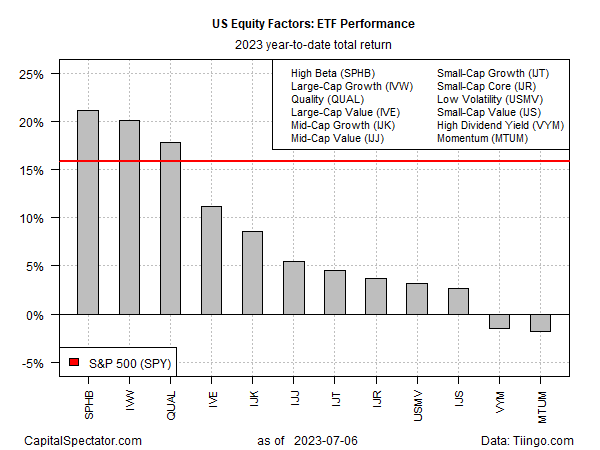

Using a set of ETF proxies shows that Invesco Invesco S&P 500® High Beta ETF (NYSE:) is currently leading the field so far in 2023 with a strong 21.1% return, as of Thursday’s close (July 6). The iShares Core ETF (NYSE:) is a close second via a 20.1% rally. The broad US stock market, by comparison, is up 15.9%, based on SPDR® S&P 500 (NYSE:).

The risk of red ink has already arrived for 2023 for a handful of equity factors. Although most risk factors are posting year-to-date gains, high dividend yield (Vanguard High Dividend Yield Index Fund ETF Shares (NYSE:)) and momentum (iShares MSCI USA Momentum Factor ETF (NYSE:)) are the exceptions. Both funds have been stumbling all year, alternating between modest/flat results and losses.

ETF Performance YTD Total Returns

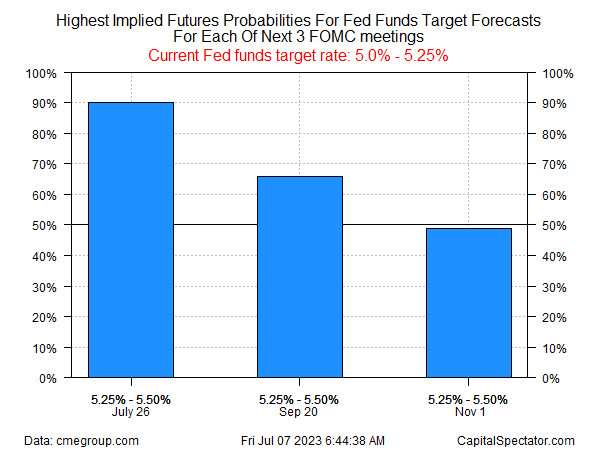

Market expectations have been pointing toward another quarter-point rate hike at the next FOMC meeting on July 26, following a pause at June’s meeting, based on Fed funds futures. The main change after yesterday’s hot jobs data: the crowd is now considering a higher chance that the Federal Reserve will continue to lift rates later in the year. Although the implied probabilities still favor a one-and-done forecast, confidence has faded that rates will peak after the July 26 meeting.

Fed Funds Target Forecasts

A key variable is how today’s US report for June from the Labor Department compares. As of this writing (roughly 90 minutes ahead of the 8:30 am Eastern release), economists are looking for a softer but still solid increase in hiring, according to Econoday.com’s consensus point forecast. If the numbers show a strong upside surprise, in line with the ADP report, the hawkish outlook for Fed policy will strengthen, creating more headwinds for the highest-flying equity factors.