Apple, Microsoft and Alphabet: Even More Overvalued After Nasdaq 100 Rebalancing?

2023.07.25 06:37

- Tech companies on Nasdaq 100 have seen their weightage reduce post rebalancing

- Apple, Microsoft, and Alphabet are all trading in overvalued territory

- Can these 3 companies continue their uptrend post rebalancing?

It’s no secret that large U.S. tech companies have experienced a reduction in their weighting on the after the ‘special’ rebalancing. The weightage of the 7 biggest companies in the index has decreased from 56% to 44%.

As we make our way through earnings season, with some companies having already reported and others yet to do so, there’s a lingering question on many minds. People are contemplating whether these influential companies, which played a pivotal role in the market’s recovery from the October 2022 lows, still have room for growth or if a downturn awaits them.

While we can’t claim to foresee the future with absolute certainty, we’ll delve into a thorough analysis of the top 3 companies using InvestingPro.

1. Apple

Let’s begin with Apple (NASDAQ:), the largest holding in Warren Buffett’s portfolio. The company has surged to all-time highs since the beginning of the year, and its upward trajectory suggests the potential for reaching even higher levels in the near future.

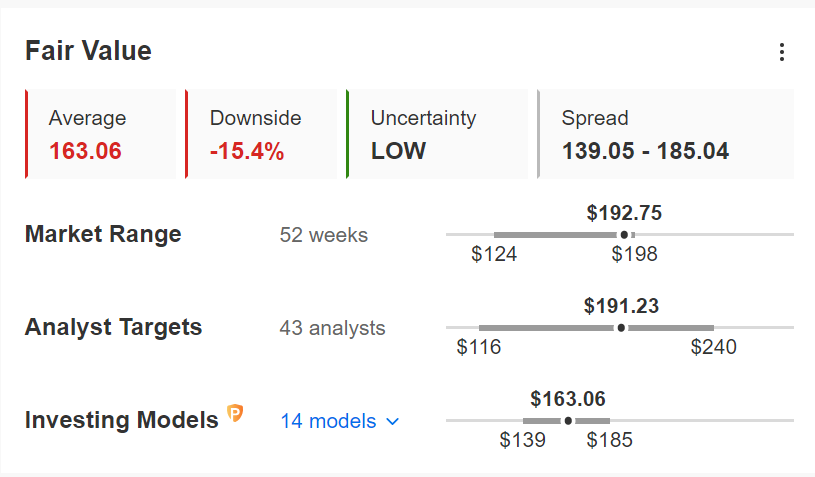

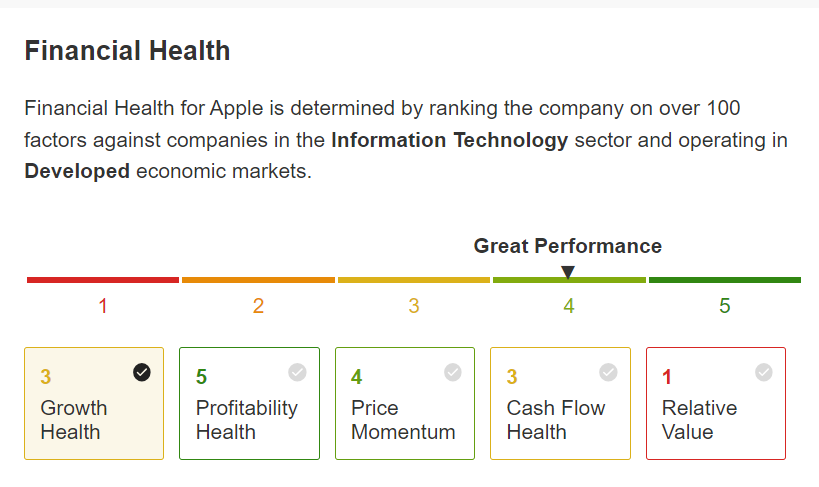

Valuation-wise, the stock appears to be on the expensive side, with a 14.5% premium (without the famous “margin of safety”). However, its financial health score is 4 out of 5, taking all elements into account, where the only concern lies in its relatively high valuation.

Source: InvestingPro

Source: InvestingPro

2. Microsoft

As for Microsoft Corporation (NASDAQ:), chart-wise, we are currently retesting the highs at $345. However, a decisive breakthrough has not occurred yet. Today’s quarterly earnings call could play a crucial role, either providing the boost needed for further upward movement or potentially leading to a double-high scenario if the stock retraces.

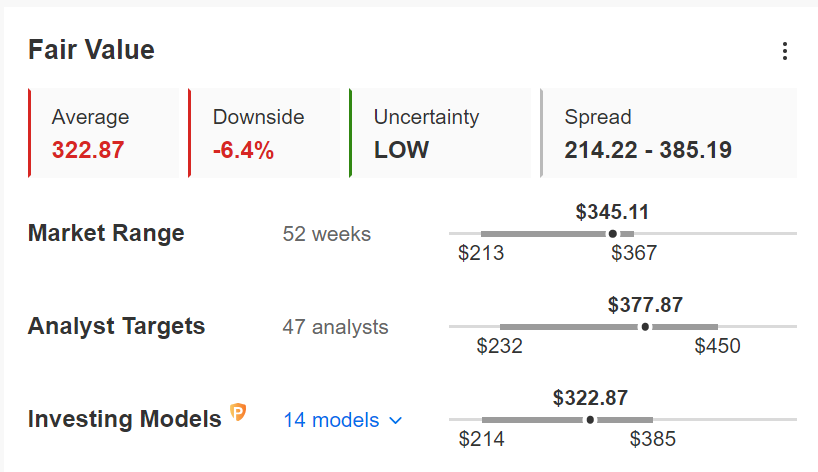

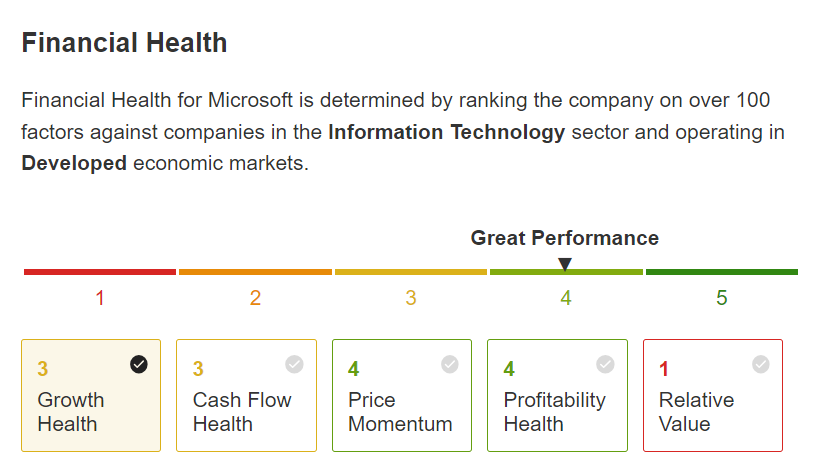

Both Apple and Microsoft find themselves in the overvalued territory today, though Microsoft is slightly less affected compared to Apple. Despite this, their financial health scores stand at a commendable 4 out of 5. However, the main factor affecting their financial health is, once again, the concern over valuations.

Source: InvestingPro

Source: InvestingPro

3. Alphabet

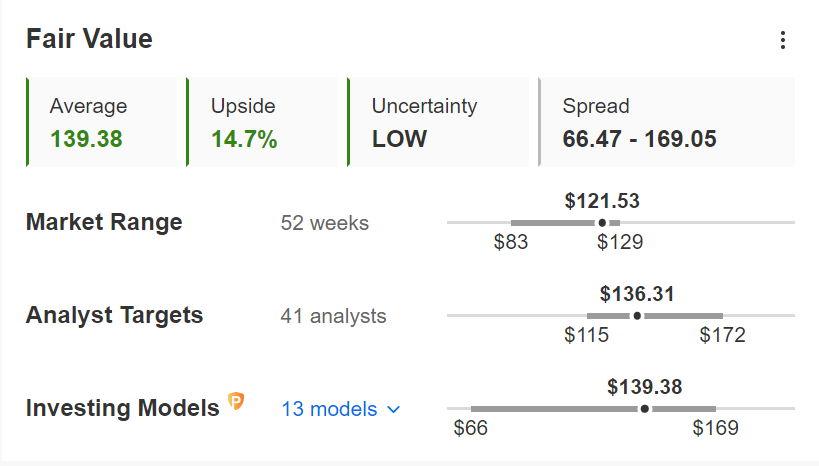

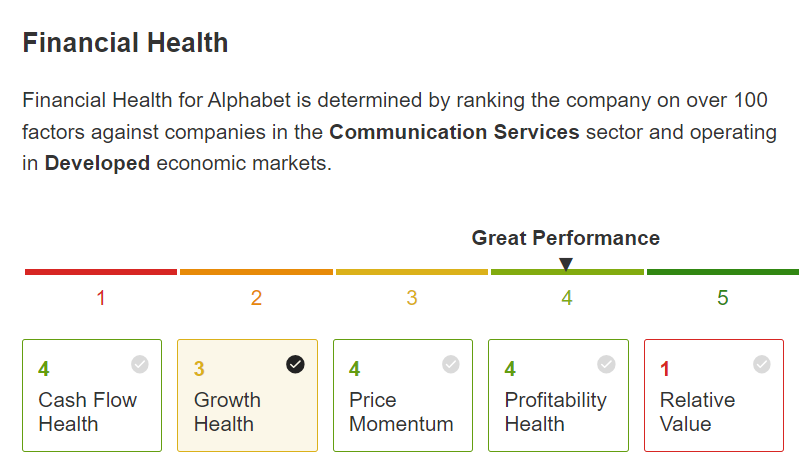

Lastly, let’s discuss Alphabet Inc Class A (NASDAQ:). Among the three companies, Alphabet retraced more than the others. However, it appears to be making an effort to regain ground recently, although it’s still about 25% away from reaching its previous highs.

Notably, the correction halted around the $86.60 mark, and since then, the stock has managed to recover more than half of its losses.

Due to this substantial drop, Alphabet’s stock now appears to be the most discounted in terms of valuation (though not by a significant margin). Its financial health is similar to the other two stocks, with a confirmed score of 4 out of 5, primarily impacted by the stock’s values.

Source: InvestingPro

Today’s quarterly earnings report holds significant importance as it could potentially give Alphabet the necessary boost to make a fresh attempt at reaching new highs. Investors will closely scrutinize Google’s revenues and advancements in artificial intelligence, as these factors are expected to have a substantial impact on the company’s performance.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remain with the investor. The author owns the stocks mentioned in the analysis.