Apple Earnings Preview: Quality Still High, but Stock Hinges on Q1 2024 Guidance

2023.11.02 04:33

In an earlier this week, a quick preview of Apple (NASDAQ:)’s (AAPL) expected fiscal Q4 ’23 was provided, but with the earnings expected on Thursday night after the close, I thought it worth the post to talk about Apple’s earnings “quality” and the fact is, it still remains high, for a hardware manufacturer.

Personally, I think Apple’s stock is going to trade off the fiscal Q1 ’24 guidance, which represents the 4th calendar quarter or the holiday quarter every year.

Street consensus for Q1 ’24 is looking for $2.09 in EPS on $122.9 – $123 billion in revenue for expected year-over-year (yoy) growth of 11% and 5% respectively. For full-year fiscal ’24, Street Consensus is expecting 8% growth in EPS and 6% growth in revenue for the coming four quarters, the revenue growth expected is in line with Apple’s revenue growth in fiscal years 2020 and 2022.

Earnings Quality Test Apple Earnings Quality Test

Apple Earnings Quality Test

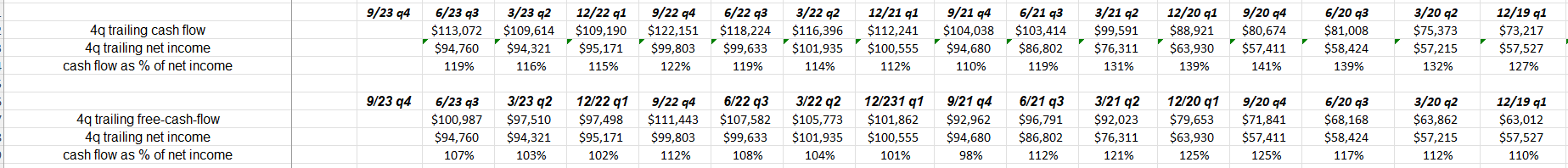

Readers can click on the above spreadsheet and see how Apple’s cash flow and free cash flow compare to net income, and as the percentages indicate, Apple’s cash flow is quite healthy and exceeds net income. More importantly, free cash flow exceeds net income.

Readers who are quick with the mathematical leap can infer from the above paragraph that Apple’s “cash-flow-per-share” and “free-cash-flow per share” exceeds it’s EPS, and that’s always a good sign.

Apple’s Uphill Battle

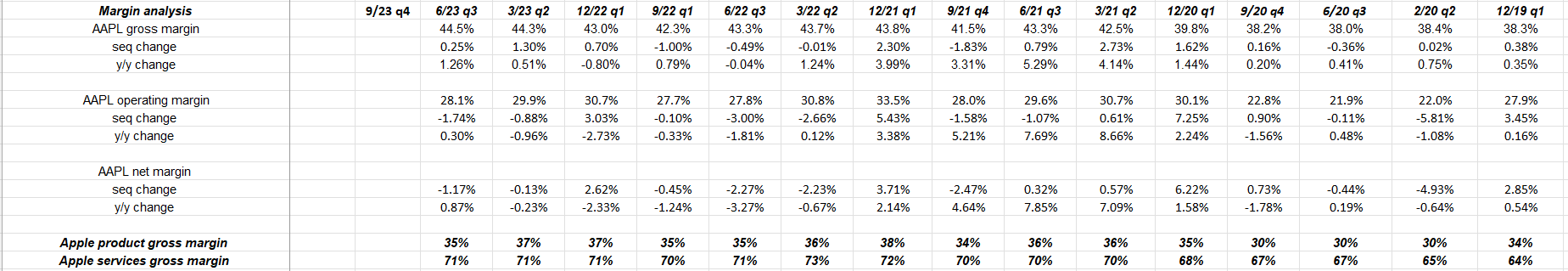

The above table shows how Apple’s operating margin peaked in December ’21 and has declined in 4 of the last 6 quarters.

Like a lot of manufacturers and companies with supply chains in China, it looks like Apple saw its margin clipped but the iPhone giant looks to be exiting that issue as well.

Conclusion:

The sentiment and commentary around Apple’s pre-earnings seem very similar to Nike’s in September, where pessimism reigned and worries over China dominated, and Nike (NYSE:) ultimately printed a 25% EPS upside surprise on inline revenue growth.

Apple may not repeat that, but the pessimism and caution are worth noting. I do think holiday quarter guidance will move the stock after-hours on Thursday night and then again on Friday morning, although Apple is typically cautious with guidance.

The December quarter every year is very important for Apple’s financials, accounting for roughly 1/3rd of Apple’s entire year. The Mac and iPad revenue growth have both declined in four of the last five quarters and comprise about 15% of total revenue.

***

Take this all as one opinion, and past performance is no guarantee of future results. Capital markets change quickly for both the good and bad. The forward EPS and revenue data with change after Thursday night’s earnings release. The information may or may not be updated here.