Apple Earnings: iPhone, Services Sales and China in Focus Ahead of Key Report

2023.11.02 08:28

- Apple’s results on Thursday will be the most important event of the week in terms of earnings.

- Consensus forecasts are relatively high, leaving little room for error

- Analysts and InvestingPro valuation models indicate the stock is currently fairly valued

Following the recent Fed decision, the spotlight now shifts to Apple (NASDAQ:) as the tech giant gears up to release its earnings report after the market closes today. This highly anticipated report is poised to be one of the most significant ones in this earnings season.

This release occurs in a backdrop where several technology giants, including Meta Platforms (NASDAQ:), Amazon.com (NASDAQ:), Microsoft Corporation (NASDAQ:), and Alphabet (NASDAQ:), have recently unveiled better-than-expected financial results. However, in some instances, these favorable figures did not translate into immediate stock price gains.

Fundamental View: What to Expect From Apple’s Key Financial Metrics?

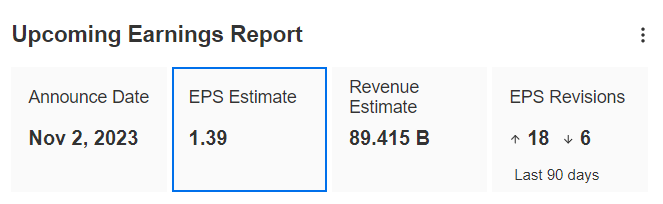

After two consecutive quarters of declining revenues and earnings, the consensus forecasts sales of $89.41 billion, up 9.2% quarter-on-quarter (and down 0.8% year-on-year), and EPS of 1.39, up 10.3% on the previous quarter (and 7.7% year-on-year).

Source: InvestingPro

It is also interesting to note that EPS forecasts for Apple’s results have been the subject of 18 bullish analyst revisions in the last 90 days, and only 6 bearish revisions, according to data available on the InvestingPro platform.

Last quarter, Apple exceeded EPS expectations by 5.5% but only matched revenue forecasts.

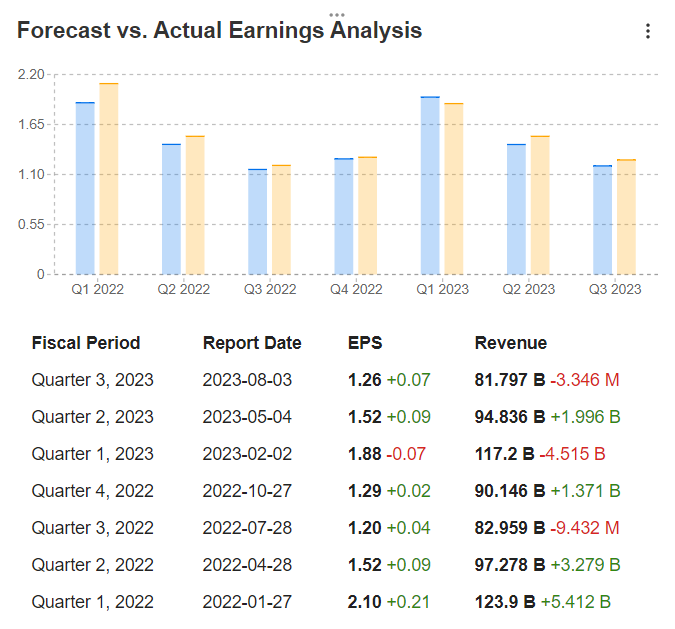

Source: InvestingPro

In order to properly approach the event, it should also be noted that in recent years, Apple has often exceeded expectations in terms of EPS, while the record is less clear on revenues.

Source: InvestingPro

As can be seen from the image above taken from InvestingPro, over the last 7 quarters, Apple has exceeded EPS expectations 6 times, while it has surpassed revenue forecasts only 4 times. On the other hand, we note that revenue overruns are, on average, much larger than misses.

iPhone, Services Sales and China in Focus

It’s also worth noting that Apple’s earnings release this Thursday comes less than two days after the company’s recent “Scary Fast” virtual event, at which it presented its latest MacBook Pro range and updated iMac, although it should also be noted that Macs only account for around 10% of the company’s revenues.

Indeed, it’s iPhone sales, which make the biggest contribution in terms of revenue, and sales of services, the group’s most profitable division (and the one with the greatest growth potential as the smartphone market matures), that will be most closely watched.

For the iPhone, analysts expect iPhone revenues to reach $43.73 billion, up slightly from $42.63 billion in Q4 2022. As for services, which notably include the App Store, Apple TV, or Apple Music, revenues are expected to reach $21.36 billion, compared with $19.19 billion in Q4 2022 (up 11.3%) according to analysts.

Investors will also be looking for more information on how device sales are faring in China, where the company faces an uneven recovery and tougher competition from Huawei after the Chinese company’s new Mate 60 Pro series phones enjoyed strong sales earlier this year.

Apple’s iPhone 15 range, on the other hand, got off to a slow start in the country. Commenting on iPhone sales in China, Bernstein analysts stressed that “the strength of the iPhone 15 cycle is the key question heading into” the results, adding that they expected “moderate” sales of the device due to a lack of new features, strained consumer spending and competition from Huawei.

Analysts, InvestingPro Forecasts Not Optimistic

Apple shares are down by more than 12% since hitting an all-time high of close to $200 in July but are still up by a solid 38% since the start of the year.

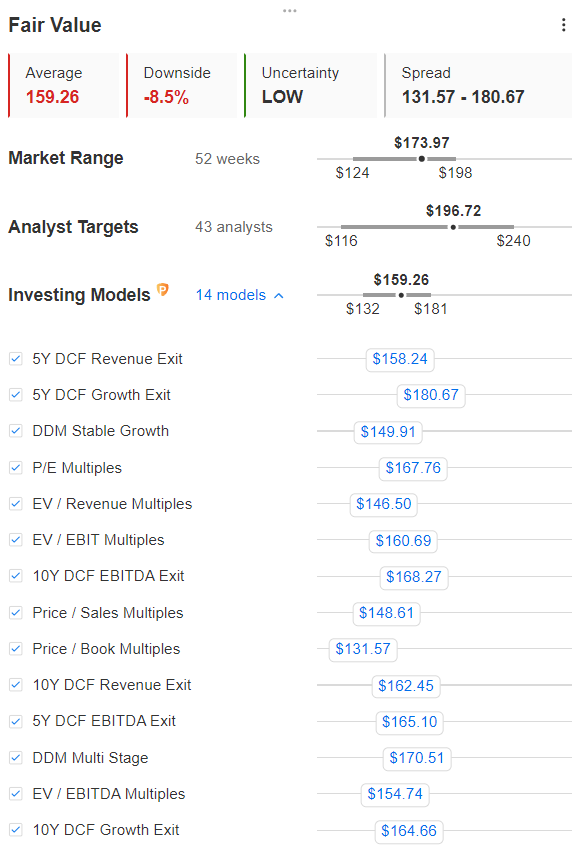

This has led analysts to conclude that further upside potential for the stock is limited. Indeed, InvestingPro data shows that the 43 analysts tracking Apple shares have an average target of $196.72, representing a modest 13% upside potential from the current price.

Analysts and Pro Forecasts for Apple

Source: InvestingPro

Above all, the InvestingPro Fair Value, which synthesizes 14 recognized financial models, stands at $159.26, or 8.5% below the current price, which calls for caution.

Source: InvestingPro

Finally, we note that InvestingPro assigns a neutral overall financial health score to Apple shares, reflecting balanced risks.

Conclusion

In conclusion, the performance of iPhone sales, particularly in China, will undoubtedly be the central focus of Apple’s earnings release tonight. However, it’s crucial to note that Apple finds itself in a position where there is minimal margin for error.

Analysts have already assessed the stock’s growth potential as limited, and according to InvestingPro’s valuation models, the stock currently appears to be reasonably valued when considering its financial metrics.

Apple’s ability to navigate these challenges and deliver robust results will be closely scrutinized by investors and market observers alike.

***

Find All the Info You Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.