Apple: Can Today’s iPhone 15 Launch Be the Next Catalyst for Growth?

2023.09.12 08:01

- Apple is set to launch the iPhone 15 series today

- The Tim Cook-led company is facing challenges in the global economy and in China

- Could this launch be the catalyst for the tech titan to regain market share and spark growth?

The world’s largest company, Apple (NASDAQ:), aims to dispel recent controversies and reinvigorate growth as it unveils the highly anticipated iPhone 15 series today. This product launch is a pivotal event for Apple, garnering the attention of millions, as it does every year.

The Cupertino, California-based giant is set to introduce four new phone models, including two high-end “Pro” models expected to come at a premium compared to the iPhone 14 Pro.

The company recently faced setbacks, especially in China, ahead of the highly anticipated launch, casting a shadow over the company. Last week, China banned government officials from using iPhones in their workplaces, resulting in Apple’s market capitalization plummeting by nearly $200 billion.

Apple’s shares closed the week at $178, marking a nearly 6% decline prompted by this negative development.

While concerns have risen with rumors of an extended ban, the situation has also had a detrimental impact on numerous other companies. Apple employs hundreds of thousands of people in China and various parts of Asia and has numerous technology firms within its supply chain.

Now, Apple is looking to dispel these recent challenges with the launch of its new product line. The company has been striving to boost sales, which have seen a decline over the past three quarters.

In its August 3 report, Apple disclosed revenue of $81.8 billion, a 1.4% decrease from the previous quarter. Although this figure fell within expectations, it underscored the downward trend in sales.

Following concerns that the report indicated a weak outlook for the current quarter, Apple’s stock price dropped by 5.5%. However, the earnings report did reveal a profit per share of $1.26, exceeding InvestingPro’s forecast by 5.5%.

Forecast Vs. Actual EarningsSource: InvestingPro

Forecast Vs. Actual EarningsSource: InvestingPro

According to the last quarter results, Apple managed to increase its revenue by 5% on an annualized basis but saw a decline in sales of about 1%. Despite sales declining for 3 quarters, earnings growth could continue for the rest of the year, with Pro models set to be sold at higher prices.

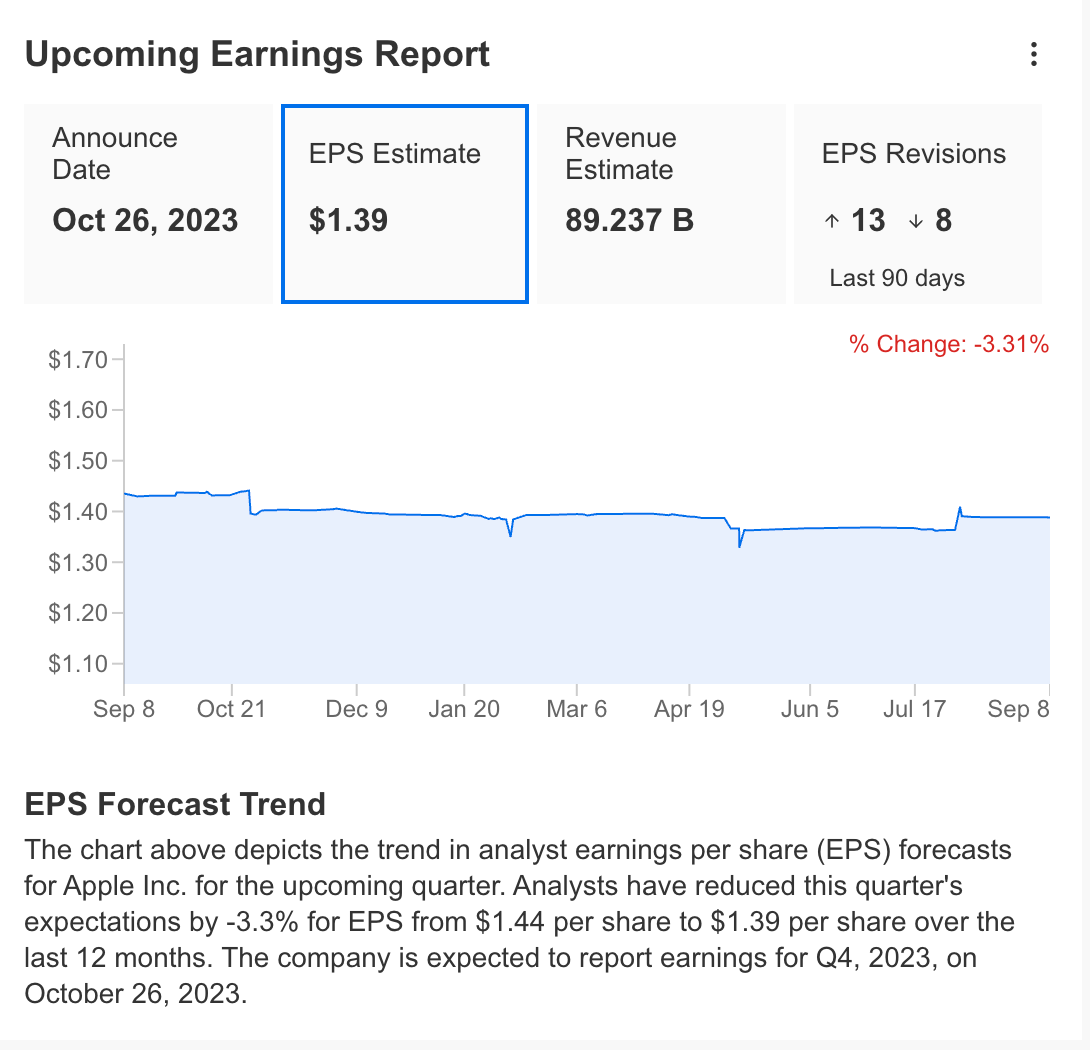

Forecasts for the next earnings report on October 26 remain positive. On the InvestingPro platform, 13 analysts have revised their earnings per share and revenue estimates upwards. Accordingly, the consensus forecast includes EPS of $1.39 for the current period and revenue of $89.2 billion.

Source: InvestingPro

Source: InvestingPro

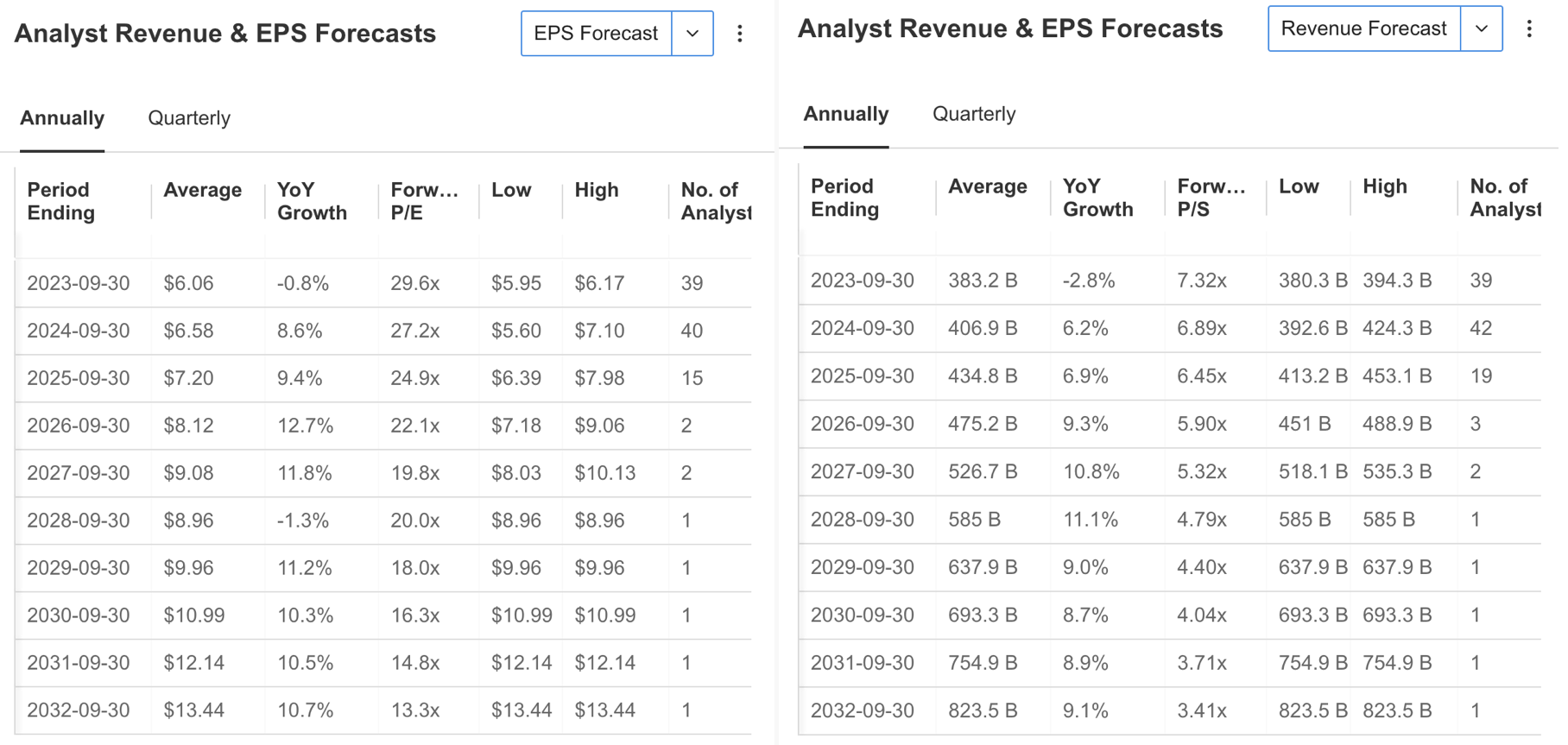

Looking at longer-term projections, analysts anticipate that Apple’s earnings per share (EPS) will experience a nearly 10% growth trajectory in the coming years, following a slight decline in the most recent quarter.

On the revenue front, forecasts indicate a resurgence, with an anticipated increase of around 6% for both 2024 and 2025. This follows a minor dip of nearly 3% in revenue for the current year.

Revenue and EPS ForecastsSource: InvestingPro

Revenue and EPS ForecastsSource: InvestingPro

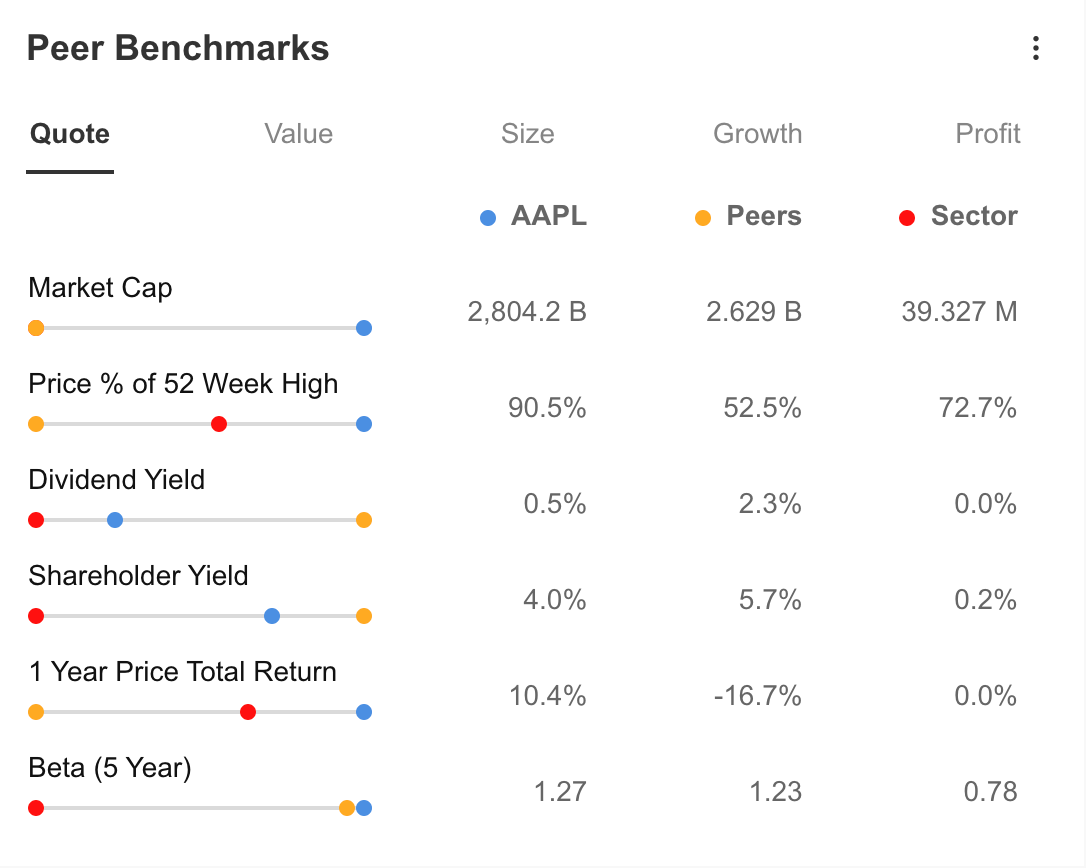

Despite the recent challenges, Apple maintains its position as a market leader with an impressive market capitalization and annual returns compared to its competitors. While the company’s market cap briefly dipped by $200 billion due to China’s ban on iPhones for public employees, it still hovers at a substantial $2.8 trillion.

In contrast to its peers, many of which are currently trading around 50% below their one-year peaks, Apple remains on an upward trajectory, with its stock price coming close to its peak of $198 earlier this year. As a result, Apple has delivered a one-year share return of 10%, while its peers have experienced an average undervaluation of 16%.

However, it’s worth noting that Apple lags behind its competitors in terms of dividend yield. Additionally, the company’s stock beta for the last 5 years remains above 1, indicating that AAPL may exhibit more aggressive price movements compared to the broader market.

Source: InvestingPro

Source: InvestingPro

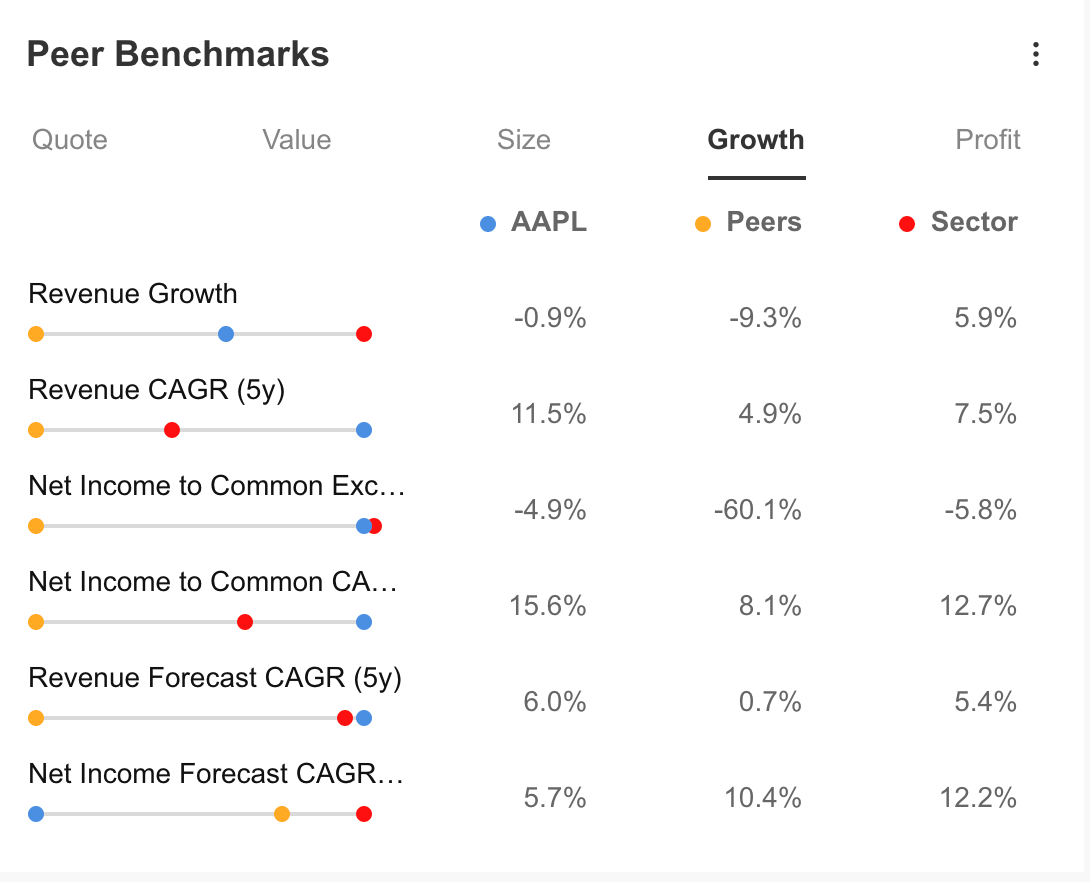

Apple’s recent revenue growth, which is perceived as a challenge, is actually better than that of its peers when compared to industry averages. While Apple has experienced a slight decline in revenue growth, it’s important to note that it still outperforms its competitors.

However, it’s worth mentioning that Apple has lagged behind the industry, which has seen growth of nearly 6% in the last year. Despite this, Apple’s long-term growth prospects are viewed positively, indicating that it may be positioning itself for future success.

Source: InvestingPro

Source: InvestingPro

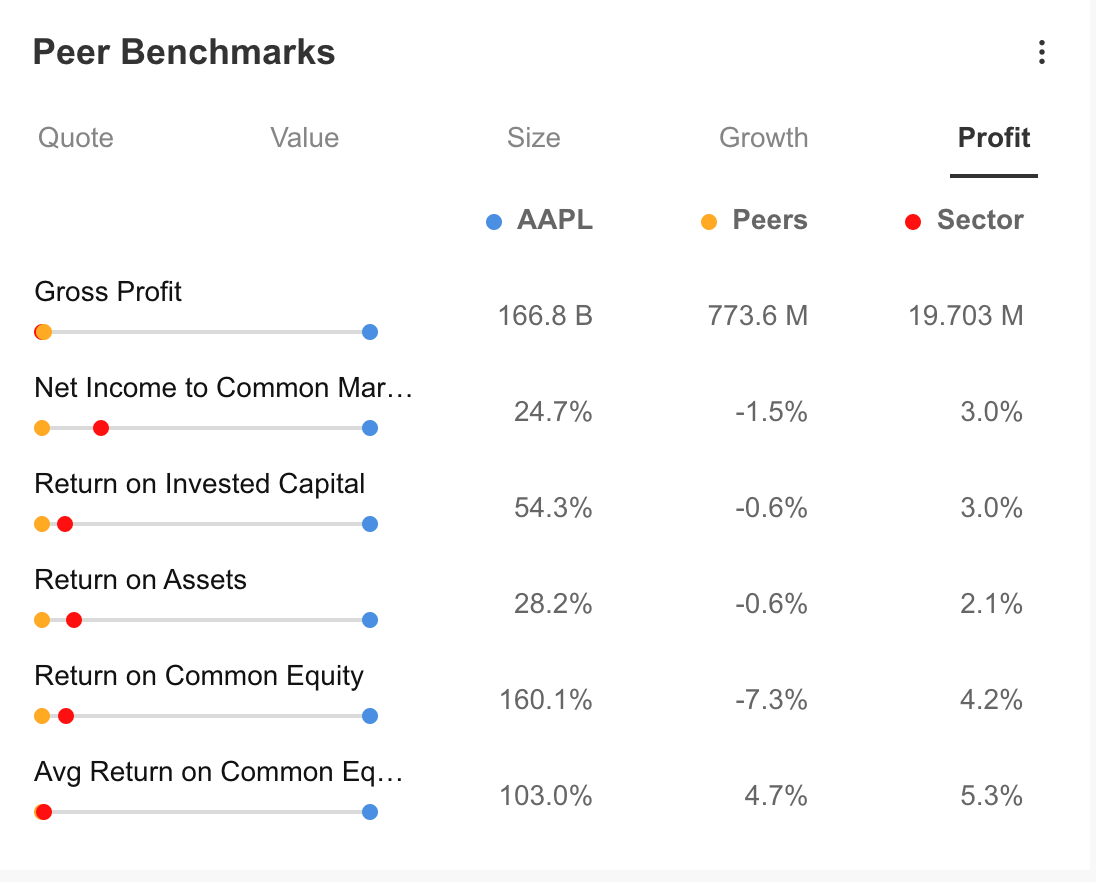

Despite areas where Apple can improve its growth, it’s evident that the company maintains strong profitability compared to both its peers and the broader industry.

Source: InvestingPro

Source: InvestingPro

Apple’s AAPL stock has been performing strongly this year, reaching near-record levels around $200, even though it’s currently trading at a relatively high price/earnings ratio of 29.6X compared to its historical average. However, this premium valuation is partly due to Apple’s long history of paying dividends, which attracts long-term investors, and its status as a safe haven in uncertain markets.

While Chinese pressure on Apple is a concern, it’s expected to have a limited impact. There’s also the risk of Huawei, Apple’s competitor, potentially regaining market share with its new phone models.

Nevertheless, Apple’s expansion into services and its product range contribute significantly to its strength in the tech sector. Despite a 4% decline in hardware sales, Apple managed to increase its service revenues by 8%, showcasing its diversification.

In the near future, the release of Apple Vision Pro mixed reality glasses could boost hardware sales. Moreover, there are rumors about Apple making more effective use of artificial intelligence and even venturing into self-driving electric vehicles.

While there are challenges and risks, Apple’s ability to adapt and expand into various tech sectors positions it as a formidable player with promising prospects.

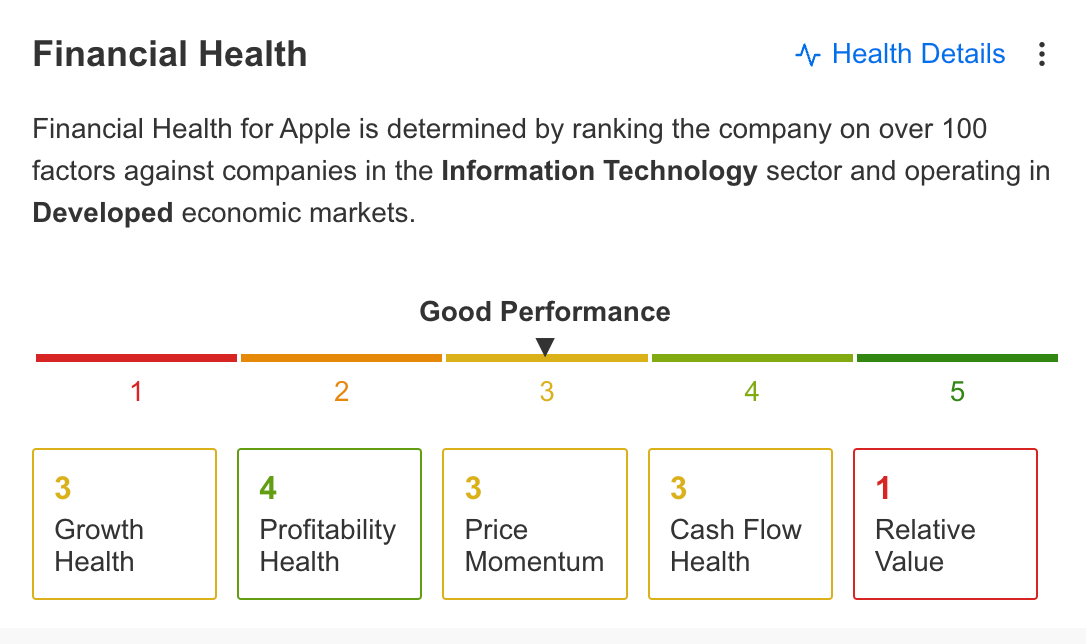

InvestingPro identifies several positive factors contributing to Apple’s health:

-

Aggressive Share Buyback: Apple’s commitment to buying back its own shares indicates a strong belief in the company’s future growth and financial stability.

-

High Return on Invested Capital: A high return on invested capital (ROIC) is a positive sign, indicating that Apple efficiently uses its capital to generate profits.

-

Regular Dividend Payments: Consistent dividend payments make Apple attractive to long-term income-focused investors.

-

Low Stock Volatility: A relatively stable stock price can be seen as a positive factor, as it reduces investment risk and encourages investor confidence.

-

Healthy Cash Flow: A strong cash flow that can cover interest expenses is a sign of financial health and stability.

-

Continued Profitability: Apple’s ability to maintain profitability, even in a competitive market, is a positive indicator of its resilience.

The main challenge noted by InvestingPro is the acceleration of the decline in revenue growth. While this is a concern, Apple’s diversification into services and potential future product launches could help mitigate this challenge and sustain its overall health.

Source: InvestingPro

Source: InvestingPro

As seen here, profitability remains the strongest aspect of the company, while cash flow, price momentum, and growth are performing well despite the deceleration.

Source: InvestingPro

Source: InvestingPro

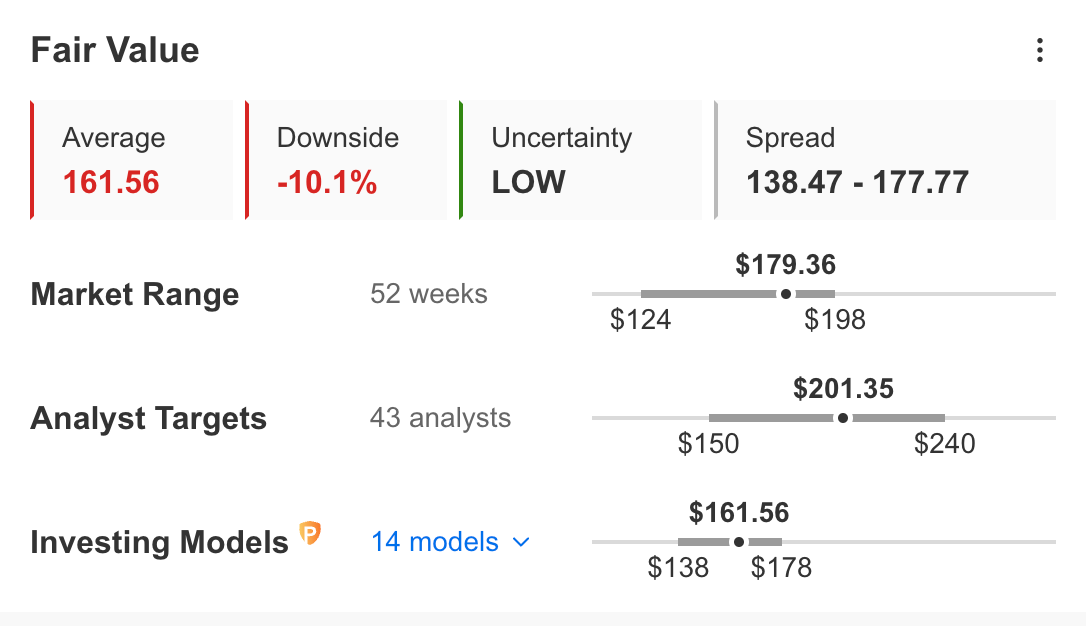

The fair value analysis for AAPL indicates an average price of $161.56 with low uncertainty, reflecting a 10% premium over the current share price. However, a more optimistic consensus among 43 analysts suggests that the company’s value could potentially reach $201 by yearend.

***

Find All the Info you Need on InvestingPro!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.