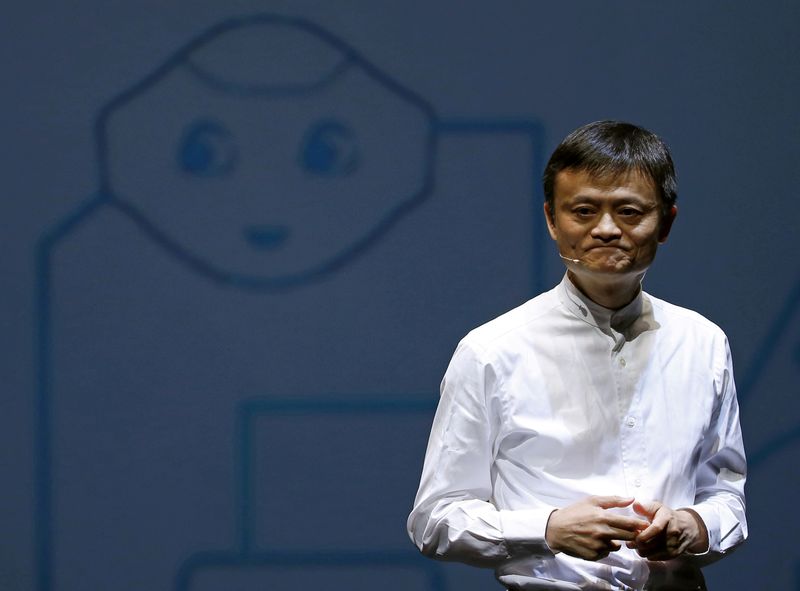

Ant Group founder Jack Ma loses control of the company

2023.01.07 09:52

Ant Group founder Jack Ma loses control of the company

Budrigannews.com – Jack Ma, the founder of Ant Group, will give up control of the Chinese fintech giant in an effort to end a regulatory crackdown that began shortly after the company’s massive stock market debut was postponed two years ago.

In November 2020, Ant’s $37 billion initial public offering (IPO), which would have been the largest in the world, was postponed at the last minute. This resulted in a forced restructuring of the financial technology company and speculation that the Chinese billionaire would have to give up control.

The group’s changes announced on Saturday are likely to result in a further delay due to listing regulations, despite the fact that some analysts have suggested that a change in control could allow the business to restart its initial public offering (IPO).

In China’s domestic A-share market, businesses must wait three years to list after a change of control. On the Nasdaq-like STAR market in Shanghai, the wait is two years, and in Hong Kong, it is one year.

Ma, a former English teacher, had more than 50% of Ant’s voting power before the changes, but according to calculations by Reuters, his share will now be 6.2%.

Ma only owns 10% of Ant, an affiliate of Alibaba’s online retail empire (NYSE:). Ant’s IPO prospectus, which was submitted to the exchanges in 2020, states that Group Holding Ltd. has exercised control over the company through related entities.

According to the prospectus, Hangzhou Yunbo, Ma’s investment vehicle, controlled two additional entities that held a combined 50.5% stake in Ant.

According to Reuters in November, Ma’s ceding of control occurs as Ant nears completion of its two-year regulatory-driven restructuring and Chinese authorities prepare to impose a fine of more than $1 billion on the company.

The anticipated penalty is a component of Beijing’s sweeping and unprecedented crackdown on the nation’s technology giants over the past two years, which has reduced revenues and profits and slashed their values by hundreds of billions of dollars.

However, in an effort to support a $17 trillion economy that has been severely impacted by the COVID-19 pandemic, Chinese authorities have softened their stance on the tech crackdown in recent months.

The chairman of the investment advisory firm BDA China, Duncan Clark, stated, “With the Chinese economy in a very febrile state, the government is looking to signal its commitment to growth, and the tech and private sectors are key to that as we know.”

Clark, who is also the author of a book about Alibaba and Ma, stated, “At least Ant investors can (now) have some timetable for an exit after a long period of uncertainty.”

Ant is in charge of Alipay, the most popular mobile payment app in the world and used by more than one billion people worldwide.

Ant, whose businesses also include distribution of insurance products and consumer lending, said that Ma and nine other major shareholders had agreed to no longer exercise their voting rights in concert and would only vote independently.

It also stated that the adjustments will not affect the economic interests of Ant’s shareholders.

Additionally, Ant stated that it would include a fifth independent director on its board to ensure that independent directors would make up the majority of the board. There are eight board members at the moment.

According to the company’s statement, “as a result, there will no longer be a situation where a direct or indirect shareholder will have sole or joint control over Ant Group.”

In April 2021, Reuters reported that Ant was looking into ways for Ma, one of China’s most successful and influential businessmen, to give up control and sell his stake in Ant.

Unnamed sources told the Wall Street Journal in July of last year that Ma could give up control by giving some of his voting power to Ant officials like Chief Executive Officer Eric Jing.

After Ma publicly criticized regulators in a speech in October 2020, Ant’s market listings in Hong Kong and Shanghai were derailed. His vast empire has undergone a reorganization and regulatory scrutiny since then.

Since the regulatory crackdown that has reined in the country’s technology giants and eliminated the laissez-faire approach that drove rapid growth, Ma, who was once outspoken, has largely avoided public view.

According to Andrew Collier, managing director of Orient Capital Research, “Jack Ma’s departure from Ant Financial, a company he founded, shows the determination of the Chinese leadership to reduce the influence of large private investors.”

“This trend will continue the erosion of the Chinese economy’s most productive sectors.”

According to a report published by Reuters in the previous year, Ant and Alibaba have been independently seeking new business as monopolies and unfair competition are frowned upon by Chinese regulators.

A change that began in the middle of last year was confirmed on Saturday when Ant said that its management would no longer serve in the Alibaba Partnership, a body that can nominate the majority of the e-commerce giant’s board.

More China celebrates first day of «chun yun» despite COVID