Another Short Squeeze Or Will Fed’s Change Of Tone Support Current Rally?

2022.10.26 20:30

[ad_1]

Last week, Mary Daly, head of the San Francisco Fed, said:

“One can easily find yourself over-tightening… the time is now to start talking about stepping down.

We might find ourselves, and the markets have priced this in, with another 75 basis-point increase, but I would really recommend people don’t take that away as it’s 75 forever.”

The shift to a more dovish tone and apparent capitulation on inflation was all it took last Friday for the indices to end their best week since June, with the Dow rising more than 700 points despite some disappointing earnings.

This positive sentiment has continued, and all four of the instruments we track, namely the , , , and the iShares Russell 2000 ETF (NYSE:) closed strongly.

From a fundamental perspective, this price action appears counter-intuitive given the economic data, the strength of inflation, and bond yields from 3m to 30 years, above 4%. Only the falling is in step with equities.

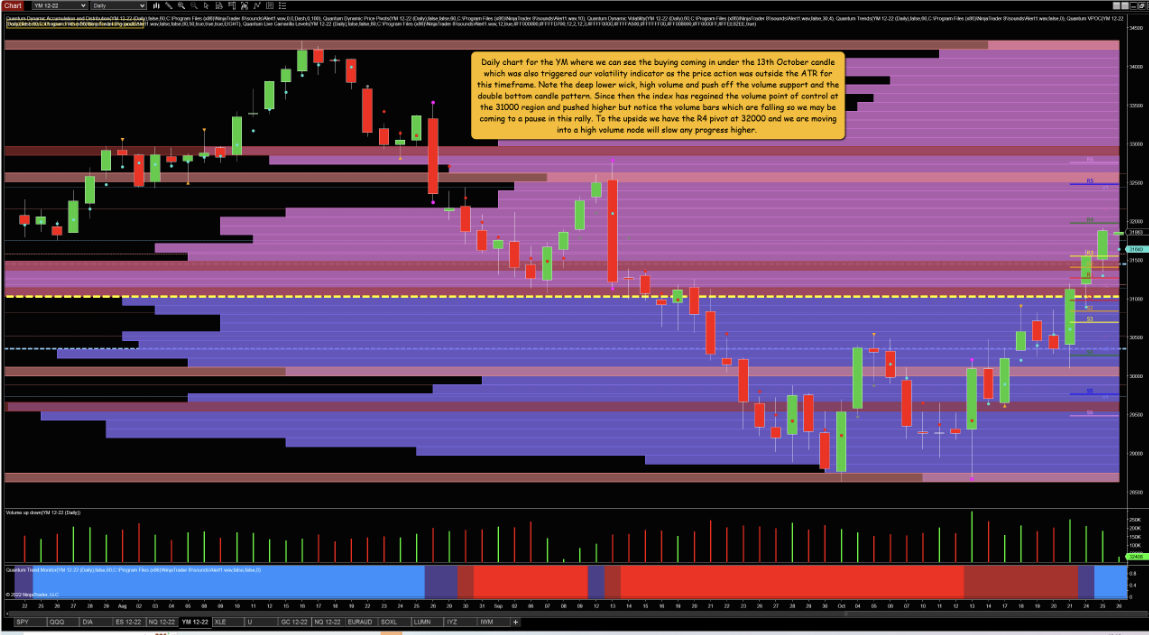

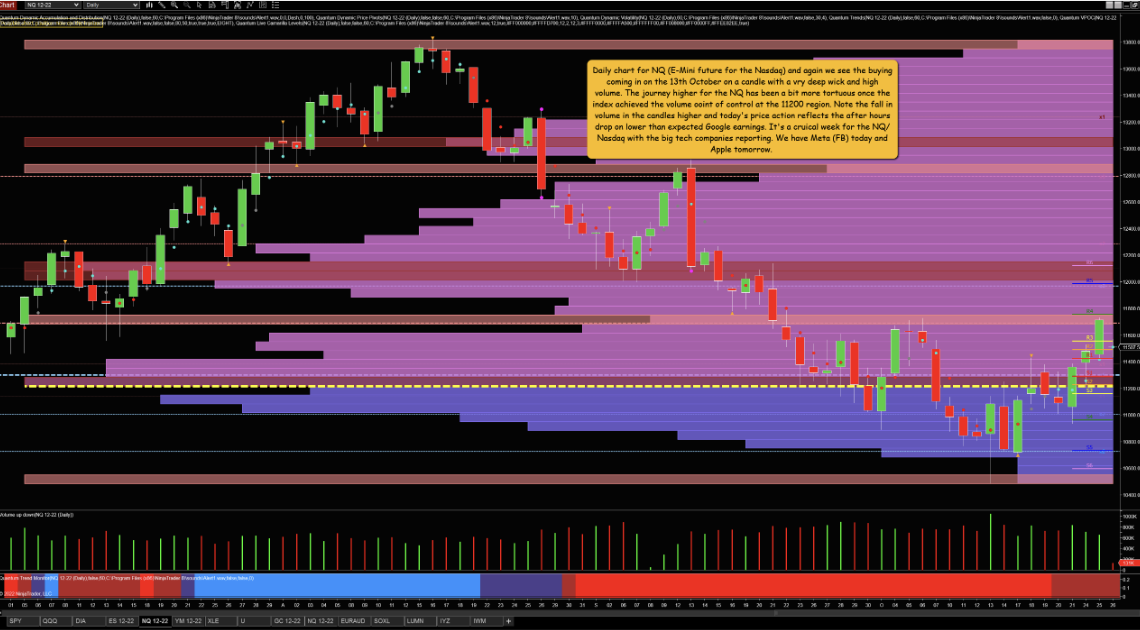

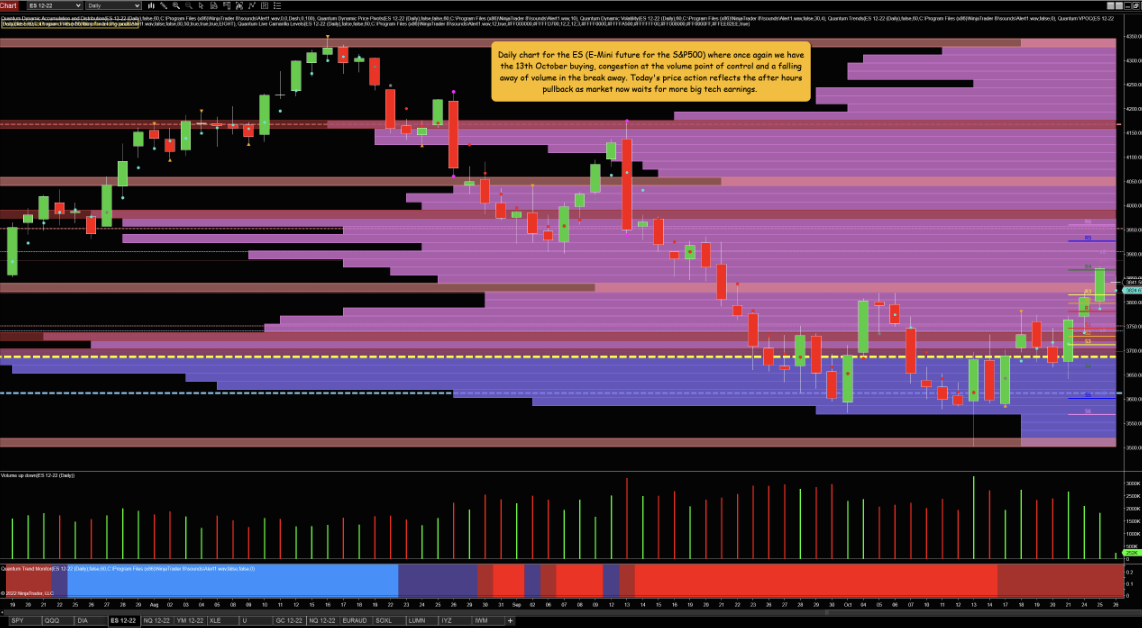

However, looking at the daily charts for the indices, we have very similar price action and volume profiles dating back to 13th October, when the current rally started. In other words, big candles and high volume at significant support. David and I highlighted this in our webinar at the time while reminding everyone that, as vpa traders, we often have to take a contrarian view of what is happening in the market or being said and written in the media. We also must remember that week was very volatile, with a bad print, hawkish , and a gloomy global growth forecast from the IMF. In addition, David and I also explained that all vpa signals need to be validated and take time to play out in the slower time frame.

One reason for the current spike higher is we are simply seeing a very sharp short squeeze higher which will come to an end once the majority of shorts have been taken out, and once again, vpa will signal this. Earnings will also play a part in determining whether the indices continue to rise. Generally, earnings have been holding up well until yesterday’s after-hours reporting of the slowdown in Google’s ad revenue, which was enough to dent the rise in both the NQ & ES. But we can see on the daily chart the volume bars were already signaling a pause.

So far YM (E-Mini future for the Dow) is holding up but note the most recent volume bars.

Both NQ and ES are now waiting for earnings.

[ad_2]

Source link