Another Rough Week for the Australian Dollar?

2023.08.21 10:33

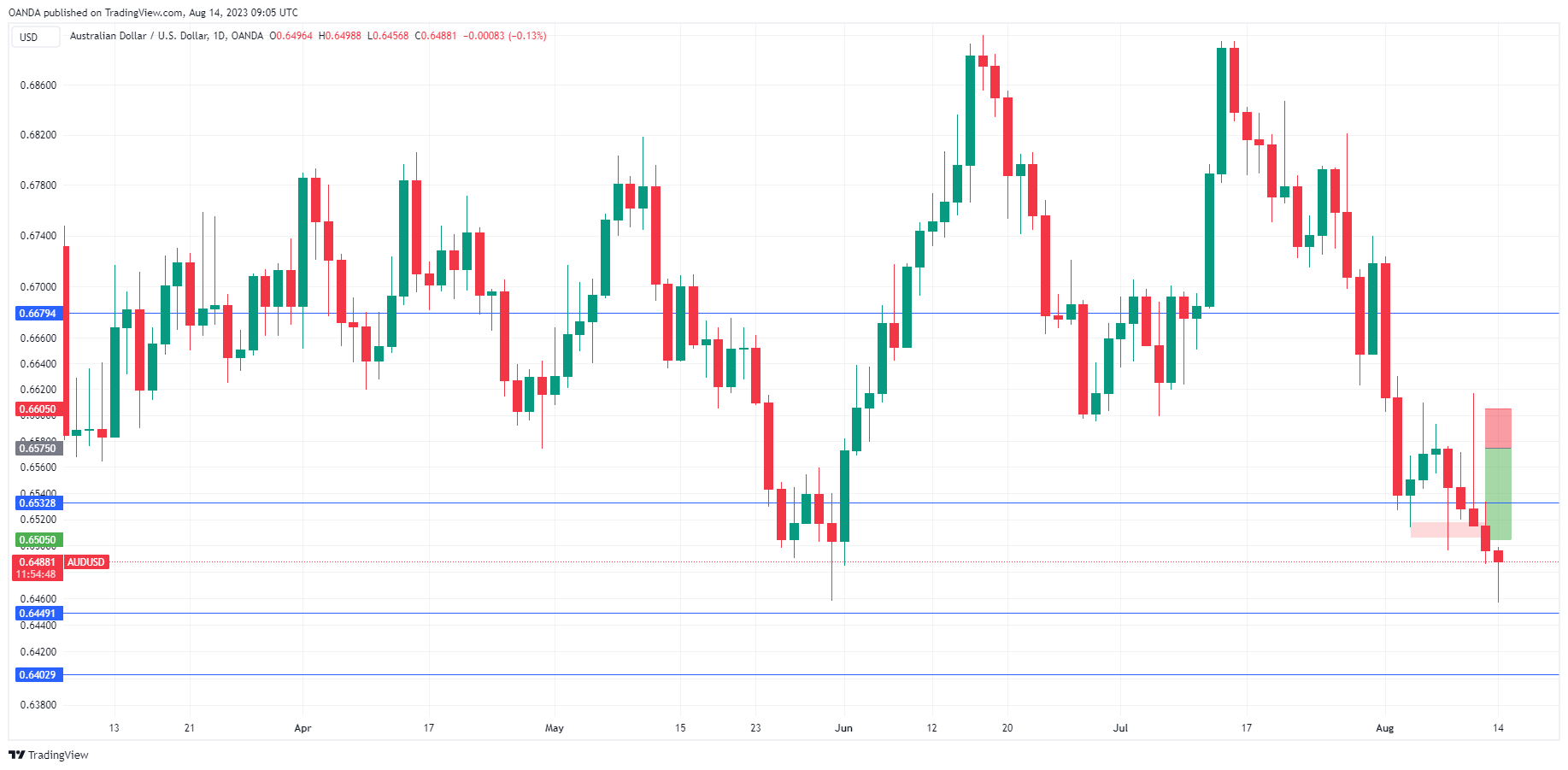

- AUD/USD close to 9-month lows

- China fails to cut 5-year LPR

The Australian dollar is steady at the start of the new trading week. In the European session, is unchanged at 0.6404. It’s a very quiet week for Australian releases, with no tier-1 releases. On Wednesday, Australia releases services and manufacturing PMIs for August. Services and manufacturing both contracted in July, with readings below the 50.0 level.

The Aussie has hit a rough patch and has reeled off five straight losing weeks against the US dollar, sliding over 400 basis points in that period. The economic picture in China continues to deteriorate, and this has been a major reason for the Australian dollar’s sharp deterioration.

China is Australia’s number one trading partner, and when China sneezes there’s a good chance Australia will catch a cold. China’s economic data has been pointing downward and the world’s second-largest economy is experiencing deflation. Last week, Evergrande, a huge Chinese property developer, filed for bankruptcy in New York, raising fears of contagion to other parts of the economy.

The People’s Bank of China (PBOC) responded to the economic slowdown with a surprise cut to the one-year medium-term lending rate. The central bank was expected to follow up with cuts to the one-year and five-year loan prime rates (LPR). On Monday, the PBOC trimmed its one-year LPR from 3.55% to 3.45%, but surprisingly, did not lower the 5-year LPR, a key lending rate that affects mortgages.

Lower lending rates are intended to boost credit demand, but the central bank’s lukewarm move is unlikely to provide much of a boost to China’s ailing economy. That does not bode well for the struggling Australian dollar, and if China’s economy continues to show signs of weakening, I would expect the Australian dollar to continue losing ground.

AUD/USD Technical

- AUD/USD is putting pressure on resistance at 0.6431. Next, there is resistance at 0.6496

- There is support at 0.6339 and 0.6274

Original Post