Analysis-Lula unlikely to repeat Brazil state bank lending binges

2022.09.15 07:09

[ad_1]

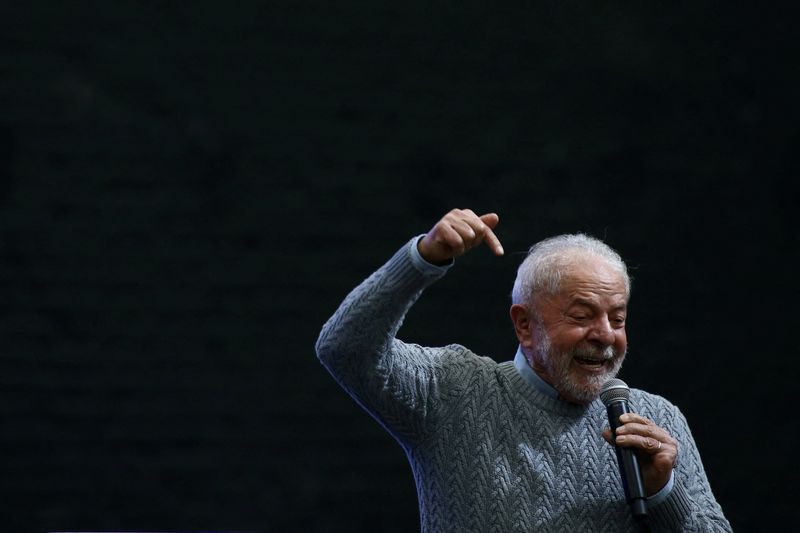

© Reuters. FILE PHOTO: Former Brazil?s President and current presidential candidate Luiz Inacio Lula da Silva speaks during a food cooperative seminar as he campaigns for the national election, in Sao Paulo, Brazil, September 14, 2022. REUTERS/Carla Carniel/File Pho

By Aluisio Alves

SAO PAULO (Reuters) – Over more than a decade in power, Brazilian leftist Luiz Inacio Lula da Silva and his handpicked successor used state banks to bolster corporate “national champions” and major sectors their Workers Party saw as essential to the economy.

Lula is expected to retake the presidency in the October election according to opinion polls, but his advisers and private sector financial executives see little space for development bank BNDES or retail banks Banco do Brasil and Caixa Economica Federal to reopen the lending spigot on the same scale as before.

Lula and former President Dilma Rousseff fueled aggressive credit policies by injecting some 500 billion reais ($96.5 billion) into the three state lenders from 2008 to 2014. The banks remain on the hook to pay back around 150 billion reais to the Treasury.

Current budgetary constraints, governance rules and higher compliance requirements, along with a recognition that government-backed loans should go to small business and infrastructure rather than major conglomerates, should prevent a return to earlier policies, economists said.

“There is not a lot of budgetary space to inject cash into the banks,” said Roberto Troster, former economist for Brazil’s largest banking industry group, Febraban. Two current and two former executives of state-controlled banks echoed that view but requested anonymity.

One source close to BNDES said the subsidized credit model once favored by Workers Party (PT) governments would reduce the central bank’s ability to fight inflation – an urgent priority for the next government. Recent history shows how another lending spree would drive up a budget deficit while reducing the effect of monetary policy with subsidized credit.

Even members of Lula’s campaign play down the chances of the government bankrolling another public lending spree.

“We do not expect new Treasury transfers to the banks,” said Guido Mantega, who served as finance minister under Lula and is advising his campaign on economic policy.

TENSIONS Under Lula and Rousseff, the state banks pumped billions of dollars in loans into large companies deemed “national champions” such as meat processor JBS SA (OTC:). That policy concentrating risk in a small number of clients led to tension between both Caixa and BNDES and their auditors over how to account for losses on loans to some companies and projects. “Priorities are different today”, a Banco do Brasil vice-president said, pointing to a recognition by the campaigns of both Lula and right-wing President Jair Bolsonaro of the importance of lending to small and medium enterprises.

That would be in line with policies under Bolsonaro, whose advisers have said lending to SMEs would continue to be a priority in a hypothetical second term.

At a recent event, BNDES Chief Executive Gustavo Mantezano said that “lending 1 billion reais to small companies brings more development and votes than lending 10 billion reais to large corporations.”

State-controlled banks have already been increasing lending to SMEs, in part as a way to soften the COVID-19 pandemic’s impact on jobs. “State-controlled banks should be in areas not well covered by the private sector, such as SME lending,” said Guilherme Mello, another Lula campaign adviser.

Mello said he opposes reviving the former PT policy of using state-controlled banks to try to push down borrowing costs across the board. “The agenda to reduce credit cost is much larger than this,” he said, declining to be more specific.

DIFFERENT APPROACH

A different approach to infrastructure financing is also expected, although there is still a lack of state capital for such projects. Most finance executives said BNDES has improved its financing model, structuring projects rather than financing them directly with subsidized loans.

“BNDES going back to financing would be a step back, subsidies distorted the projects’ viability,” said Karin Yamauti Hatanaka, infrastructure partner at law firm TozziniFreire.

BNDES could use its own capital for projects where there is no interest from the private sector, such as building prisons, schools and public lighting, other executives said.

“We need to find a middle ground,” said Banco Fator’s infrastructure director Ewerton Henriques. Since 2018, as it reaped 80 billion reais selling off stakes in companies like Petrobras and JBS, BNDES has enjoyed higher profitability than even some private banks. For now, that gives it more room to fund such projects without needing fresh capital from the government. Former finance minister Mantega said PT governments had used the Treasury to fund BNDES during the 2009 financial crisis, but they were unlikely to repeat such a move. He said he favors a renewed BNDES focus on long-term projects that have trouble raising funds from private lenders.

Roberto Guimaraes, director of Brazilian heavy industry association ABDIB, said there are “investment gaps” in areas such as transportation, sanitation and urban mobility.

The view is shared by some BNDES directors, according to two sources, with management eager to take a more active approach to some infrastructure projects that have failed to lure interest from private investors.

($1 = 5.1849 reais)

[ad_2]

Source link