Analysis-Biden doubles down on emerging markets as Xi snubs G20

2023.09.07 05:23

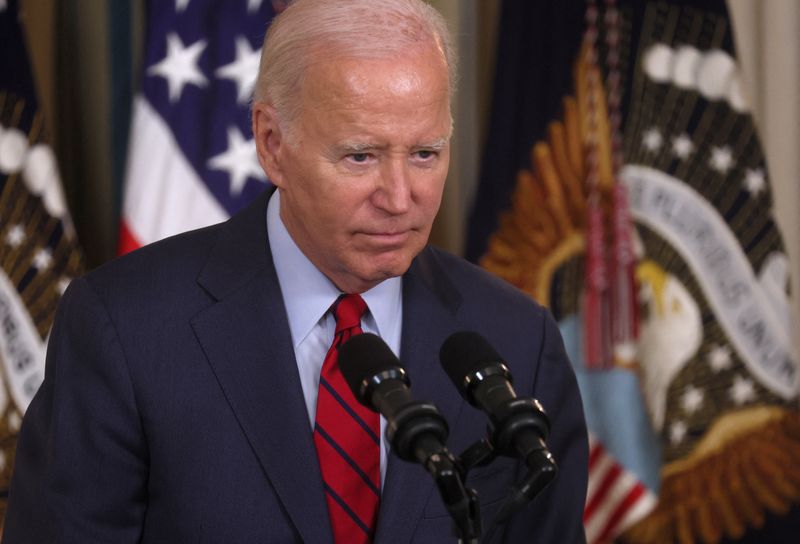

© Reuters. FILE PHOTO: U.S. President Joe Biden delivers remarks on International Longshore and Warehouse Union (ILWU) and Pacific Maritime Association (PMA) finalizing a new contract from the State Dining Room at the White House in Washington, U.S., September 6, 20

By Trevor Hunnicutt and Nandita Bose

WASHINGTON (Reuters) – U.S. President Joe Biden arrives at this weekend’s Group of 20 (G20) meeting in India with an offer for the “Global South”: whatever happens to China’s economy, the United States can help fund your development.

Armed with cash for the World Bank and promises of sustained U.S. engagement, Biden hopes to persuade fast-growing economies in Africa, Latin America and Asia that there is an alternative to China’s Belt and Road project, which has funneled billions of dollars to developing countries but left many deeply in debt.

He will have at least one advantage: Chinese President Xi Jinping will not be at the meetings.

While Biden said he was “disappointed”, Xi’s absence as China’s economy wobbles creates a narrow opening for Washington to reshape the agenda of a political club it has struggled to corral.

At the heart of Biden’s pitch are World Bank reform proposals and stepped-up funding for the lender’s climate and infrastructure aid in the developing world, which would free up hundreds of billions of dollars in new funding for grants and loans.

The White House is seeking $3.3 billion from Congress to complement earlier steps by the U.S. and close allies to raise $600 billion by 2027 in public and private money for the Partnership for Global Infrastructure and Investment, a Belt and Road alternative that excludes China.

“Xi’s absence from the G20 does give the United States an opening, which could be compounded by the challenges that China’s economic downturn will have for Belt and Road spending,” said Zack Cooper, a senior fellow focused on Asia at the American Enterprise Institute.

“But the question … is whether the United States will be able to step up.”

FAST GROWTH, HIGH DEBT

Chinese Premier Li Qiang will represent China at the G20 as its leaders cope with sagging growth and a possible property debt crisis. Russian President Vladimir Putin is also skipping the event, sending Foreign Minister Sergei Lavrov.

The IMF forecasts that the Middle East, Central Asia, developing countries in Asia and sub-Saharan Africa will deliver between 3.2% and 5.0% GDP growth next year, faster than the 1.0% they projected for the United States and 3.0% globally.

But those countries face serious challenges to reach their potential as climate change tests aged, often colonial-era infrastructure.

The COVID-19 pandemic, higher inflation and rising U.S. interest rates have conspired to make those countries’ debt burdens increasingly unsustainable, causing fears of problems similar to the Asian financial crisis that prompted the creation of the G20 in 1999.

Xi’s decade-old Belt and Road initiative has played a role. China has lent hundreds of billions of dollars as part of the project, which envisaged Chinese institutions financing the bulk of the infrastructure in mainly developing nations.

Yet the credit has dried up in recent years and many countries are struggling to repay their debts as interest rates rise.

Washington thinks a rebooted World Bank could meet the Global South’s needs and serve its own interests.

“Even the last administration – the biggest skeptic of all of this – made investments in foreign aid because those investments are in the naked self-interest of the United States, as well as being the right thing to do,” said Jake Sullivan, Biden’s national security adviser, referring to former President Donald Trump’s administration.

Sullivan, in a briefing for reporters before Biden’s trip, maintained that “World Bank reform is not about China, in no small part because China is a shareholder in the World Bank.”

But when the White House asked Congress for cash to fund the effort last month, the White House said in a letter to lawmakers that it was “essential that we offer a credible alternative to the People’s Republic of China’s coercive and unsustainable lending and infrastructure projects for developing countries around the world.”

‘TAKING SIDES’

Biden has premised his foreign policy on standing up to Russia’s war in Ukraine, managing competition with China and restoring U.S. alliances neglected by his predecessor Trump, the Democrat’s likely Republican opponent in the 2024 presidential election.

Those efforts have found success with traditional U.S. partners but has resonated less with developing countries, including Brazil, India and South Africa, which have tried to avoid being whipsawed by Washington’s conflicts with Beijing and Moscow even as they seek greater Western investment.

“We must be able to maneuver without taking sides, like we have done with the Ukraine war,” said Khulu Mbatha, a former foreign policy advisor to South African President Cyril Ramaphosa.

For his part, Xi is also finding new ways to engage the developing world, hosting a gathering of Central Asian leaders and discussing development in May. Last month, he told the BRICS summit in South Africa that the Chinese economy has “great vitality.”

That BRICS group, which includes Brazil, Russia and India alongside China and South Africa, is newer than G20, excludes Washington, and soon plans additions to its roster – Saudi Arabia, Iran, Ethiopia, Egypt, Argentina and the United Arab Emirates.

Xi is also expected to attend an Asia-Pacific Economic Cooperation (APEC) summit in San Francisco in November, where he may meet with Biden.