Analysis-Apple aims to tell an AI story without AI bills

2024.05.03 05:15

By Stephen Nellis

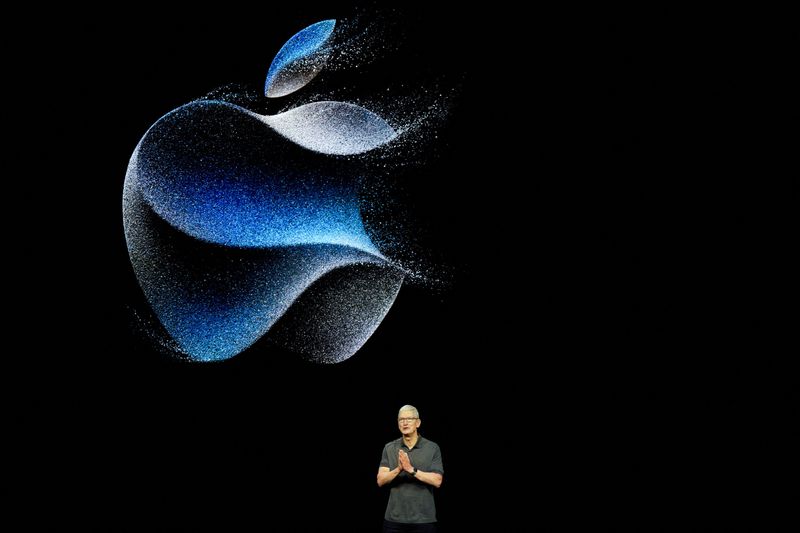

(Reuters) – For most of the past year and a half, Apple (NASDAQ:) Chief Executive Tim Cook has fielded questions from Wall Street analysts about his plans for artificial intelligence amid grumbling that the iPhone maker has no AI story to tell.

After the company reported quarterly earnings on Thursday, Cook insisted that Apple will have concrete details about its plans for AI to talk about very soon.

“We continue to feel very bullish about our opportunity in generative AI and we’re making significant investments,” Cook told Reuters in an interview, noting the company has spent $100 billion over the past five years on research and development.

Apple’s Big Tech rivals have spent comparable or even greater amounts on R&D over the same period, but they have also been spending heavily to build data centers to host AI services.

Microsoft (NASDAQ:) shelled out $14 billion in the most recent quarter on capex, with Alphabet (NASDAQ:)’s Google not far behind, at $12 billion. Meta Platforms (NASDAQ:) told investors last week to expect as much as $40 billion in capital expenditures this year.

Apple thinks different. Its capital expenditure for all of 2023 was just over $10 billion.

Apple, which makes most of its money selling consumer devices, has paid a price for that stance most of this year, with its shares falling 10% as investors worried the company was falling behind in the AI race. Shares of Meta, Google and Microsoft — all of which make money selling software or advertising services — have all soared to record highs as the companies grapple to dominate the emerging AI landscape, though investors have also flinched at skyrocketing price tags for data centers and specialized processors required to train AI models.

Apple hinted Thursday it won’t take the same tack. While Apple is expected to unveil new AI features at its annual software conference next month and overhaul its product lines with AI-ready chips, Chief Financial Officer Luca Maestri said Apple investors should not expect a huge change in how the company handles capital expenditures.

Responding to an analyst’s question, Maestri noted the company’s longstanding practice of splitting the cost of manufacturing tools with its suppliers, which has kept Apple’s costs down and its cash generation up for more than a decade.

“We do something similar on the data center side,” Maestri said. “We have our own data center capacity, and then we use capacity from third parties. It’s a model that has worked well for us historically, and we plan to continue along the same lines going forward.”

That could be just as well for Apple, because it remains unclear whether AI features such as chatbots that run directly on a device will spur users to buy new phones, tablets or laptops, which remain Apple’s biggest source of revenue and profits.

Ben Bajarin of Creative Strategies said that while better processors could serve as a “line in the sand” for some users who need AI tools for professional use, those features may not ignite a sales boom.

“It’ll be something that helps lift sales, but I don’t expect it to be super cycle,” Bajarin said. “You have to be careful to temper expectations.”