Amazon Vs. Apple: Here’s the Top Bet Among Tonight’s Bombastic Earnings Reports

2024.10.31 06:15

When Amazon (NASDAQ:) reports its Q3 ’24 quarterly earnings after the closing bell on Thursday night, October 31, analyst consensus is expecting:

- EPS: $1.14 for expected y-o-y growth of +21%

- Revenue: $157.2 billion for expected y-o-y growth of +10%

- Operating income: $14.6 billion (GAAP) -14% y-o-y growth (distorted against non-GAAP compare)

Last quarter, Q2 ’24, the disappointment was in online stores and advertising revenue being a little light, as Amazon is in full “flywheel” mode, using their various business segments to drive additional revenue.

No question, the big plus for the 2nd quarter was the 300 bp’s y-o-y expansion in the operating margin. GAAP operating income came in at $14.7 billion versus the $14 billion expected.

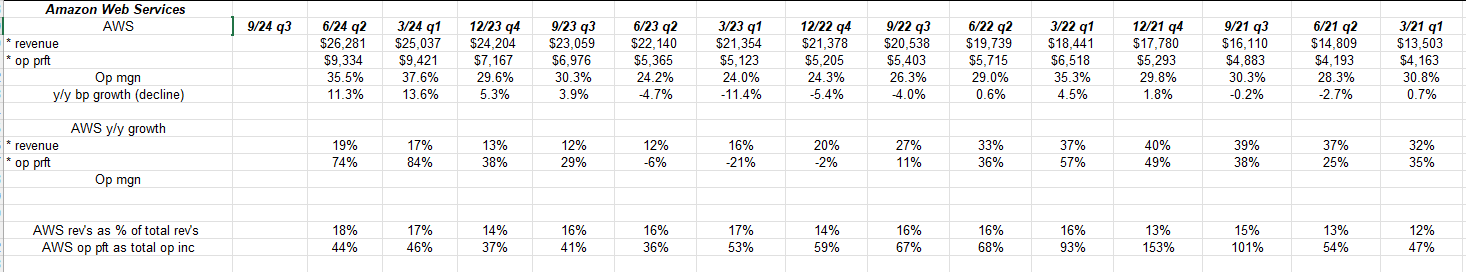

For readers who like to see the numbers, the above spreadsheet (click to enlarge) shows AWS progression in terms of revenue growth, margin, and percentage of overall AMZN revenue and margin. During the inventory build after Covid, AWS accounted for almost all of AMZN’s operating margin as the corporate constipation took place, and inventory backed up.

To my knowledge, Amazon doesn’t disclose capex by segment (i.e. how much is distribution center growth, vs AI spending at AWS, etc. etc.), so trying to decipher the spend right now is opaque.

Valuation:

Like Google (NASDAQ:) before it, AMZN’s valuation has compressed since the peak in the stock in the late summer of 2021. AMZN is expecting to grow EPS in ’24 and ’25 by 31% and 22% given current estimates, with the stock trading at 40x and 33x times those estimates, so the PEG ratio on Amazon (PE-to-growth or the PE ratio of 40x / divided by the expected EPS growth of 31%) is 1.29x and could be considered quite attractive relative to the 2.0x peak metric most analysts consider fully valued.

However, that’s just one metric; AMZN’s price-to-cash-flow is 16x and price-to-free-cash-flow is 39x. AMZN’s trailing-twelve-month (TTM) cash-flow per share is $10.58 per share, while AMZN’s TTM EPS per share is $4.68.

AMZN’s cash-flow is quite healthy and shows readers the difference between “earnings per share” and “cash-flow per share”.

AMZN’s price-to-sales is 2.8x, which would be pricey for a straight-up retailer, but you have to factor in AWS and advertising revenue and the subscription side of the business. That being said, the cheapest I’ve seen AMZN valued on a price-to-sales basis was in the middle of the inventory build post-Covid when the stock traded down 1.89x and 1.91x in September and December of ’22.

Technical Analysis:

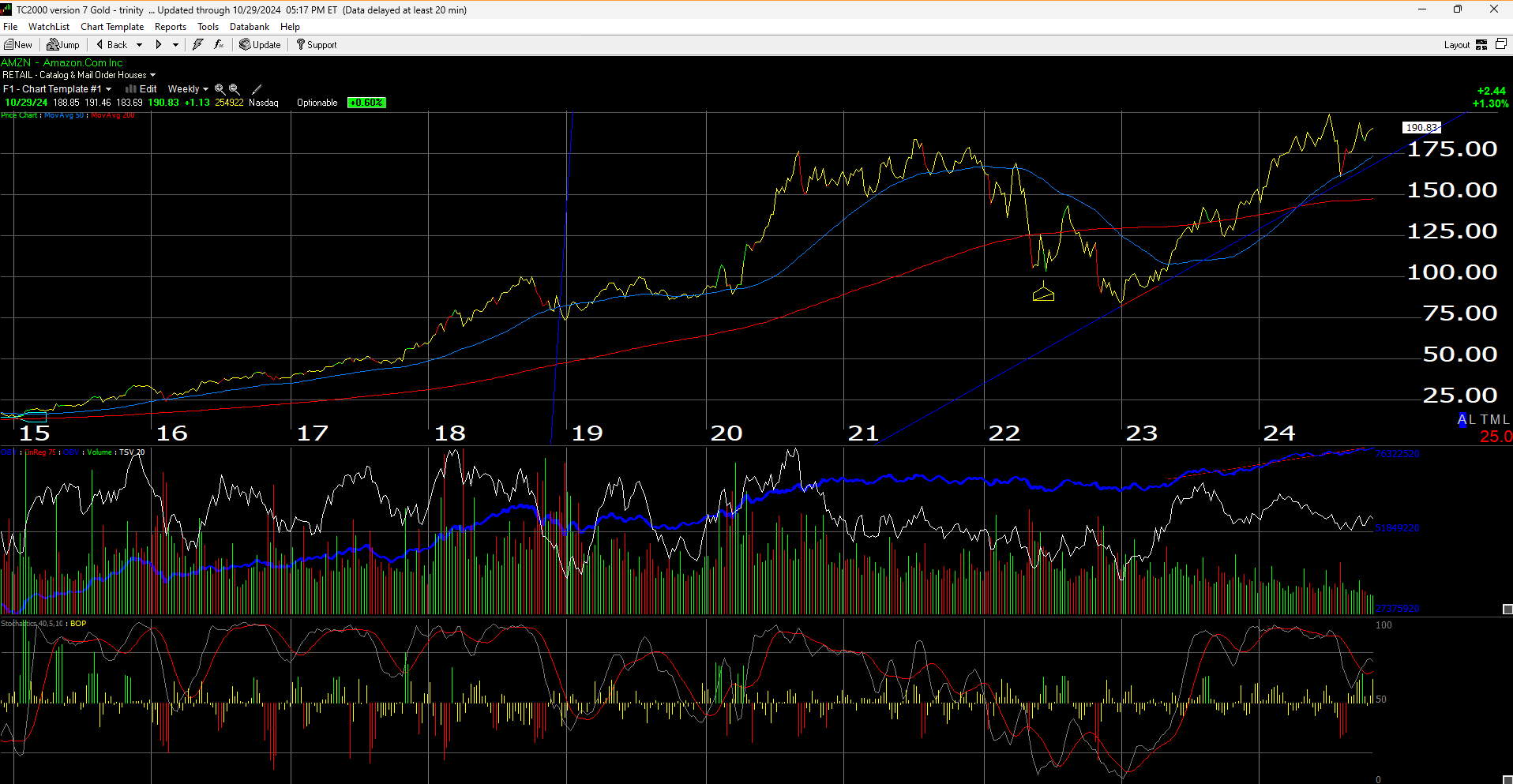

Source: Worden TC2000

Amazon’s stock price peaked when Jeff Bezos resigned from Amazon in July – August ’21, and since then the stock has not traded convincingly above that ’21 high. Annual revenue growth has slowed from the +20% annual growth from 2000 through 2021 (yes, you read that right), but has since slowed to just +11% annual growth in the last 3 years.

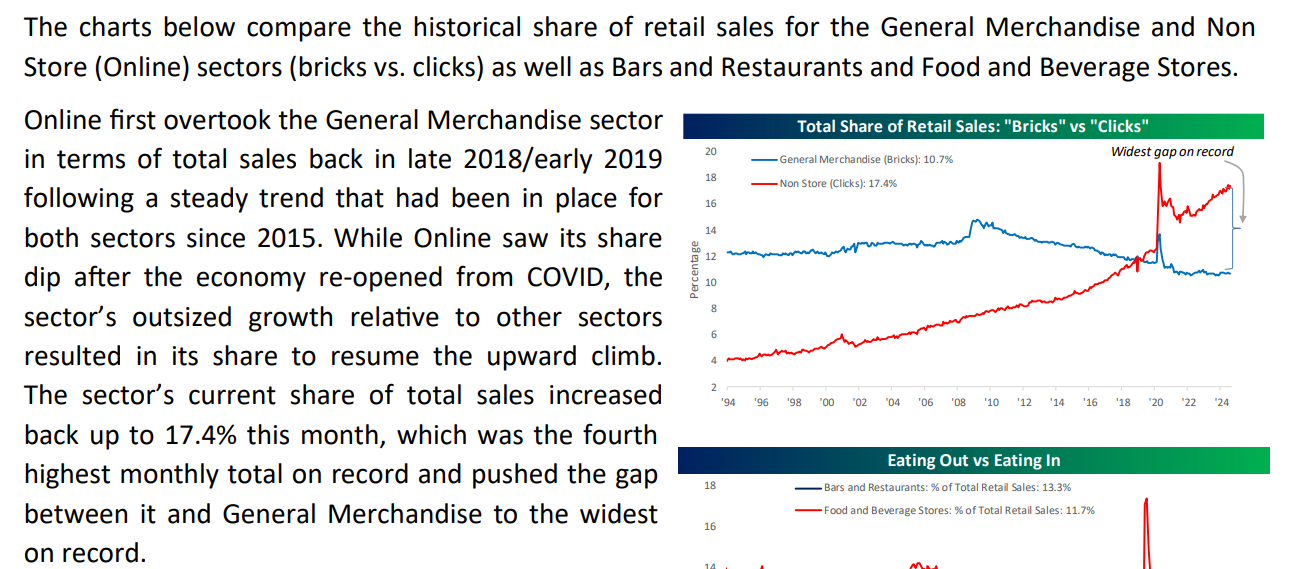

Of all the charts and graphs of e-commerce vs brick-and-mortar or traditional retail sales, this one from Bespoke always gets my attention:

Despite it’s sizable growth, e-commerce still has a lot of market share to gain from the traditional retail sales dollar. It likely won’t be as rapid as it has in the past 25 years, but the fact is e-commerce still has plenty of room to grow. Per the same report from Bespoke (not shown) is that traditional retail sales grew 1.5% y-o-y as of the mid-September ’24 retail sales report, while online sales grew 7%.

Conclusion:

No question the “bigger picture” take on Amazon has a lot to do with Walmart (NYSE:). Both Amazon and Walmart are expected to generate over $700 billion in revenue, for Amazon that $704 billion revenue estimate is expected to occur in calendar 2025, while for Walmart, the +$700 billion revenue estimate is also expected in their calendar ’25, but the fiscal year end is January ’26.

There was a decent book written on both Amazon and Walmart entitled, “Winner Sells All” and it talks about Walmart’s migration into e-commerce, and my own opinion is Walmart is making far better inroads into e-commerce and replicating AMZN’s “straight-to-your-door” delivery service, than what Amazon is doing with Amazon Fresh, which I try to patronize.

Walmart doesn’t report earnings until mid-November ’24, and while the retail giant is now also using the “flywheel” approach to leverage their substantial data to the retail consumer, as of today, it still appears that Walmart is a “low-to-mid-single-digit” revenue grower, and a “mid-to-high single digit” EPS grower.

It’s Amazon’s AWS segment that will ultimately make the difference. That difference is all about the operating margin too.

It’s not unreasonable to expect that Amazon will see slower revenue growth, and slower EPS growth with gradually better margins from AWS, advertising and the other “flywheel” businesses.

(One caveat or explanation for readers: the difference in GAAP and Non-GAAP operating income for Amazon is (I’m assuming) mostly SBC or stock-based compensation for employees. Some of it’s depreciation around the distribution centers too, although that build-out has supposedly slowed, so Amazon has been heavily diluting shareholders as fully-diluted share count has risen from 10.2 billion as of the June ’22 quarter to 10.7 billion as of the June ’24 quarter. That’s about 5% dilution. A lot of it could be Jeff Bezos personal selling of the stock.

Apple:

When Apple (NASDAQ:) reports their fiscal Q4 ’24 on Thursday night, October 31, after the closing bell, the Street consensus is expecting:

- EPS: $1.35 (vs 1.46 a year ago) for an expected y-o-y decline of 8%

- Revenue: $94.58 billion for y-o-y growth of 8%

- Operating inc: $29.2 billion for y-o-y growth of 6%

Rather than bury the lead, given all the discussions and press about the weak sales of the new iPhone model, the consensus revenue estimate for fiscal Q4 ’24 has increased from $94.24 billion as of late July ’24 to the above $94.58 billion currently, while the EPS has been revised lower from $1.59 as of late July ’24 to $1.35, presently.

Weaker revenue estimates or negative revenue revisions always make more nervous than EPS revisions, for obvious reasons, but that’s not the case with Apple, however, you still want to see positive both EPS and revenue revisions, rather than negative.

Slightly higher revenue estimates and lower EPS estimates usually implies a margin issue.

In fiscal Q3 ’24 (ended June 30 ’24) Apple saw revenue growth of 5%, operating income growth of 10%, and EPS growth of 11%.

For the all-important holiday quarter, the consensus is looking for $2.38 in EPS and $127.5 billion in revenue, which would result in y-o-y growth of 7% and 9% respectively, with operating income expected to grow 9% y-o-y as well.

The point being that Apple’s fiscal Q1 ’25 (ends 12/31/24) seems to have rather conservative assumptions built into it coming into the Q4 ’24 earnings release.

For full-year fiscal ’25, Apple is expecting 11% EPS growth on 8% revenue growth, again, these looks to be appropriately conservative estimates coming into expected guidance.

Valuation:

Apple is trading at 34x and 31x expected EPS growth for ’24 and ’25 of 9% and 11%, so Apple sports the PE valuation of a consumer staple stock, which is what it might be in the process of becoming. (More on this below.)

Price-to-cash-flow and price-to-free-cash-flow don’t look very appealing either at 28x and 31x (ex-cash), and price-to-sales is 8.5x as of the June 30 ’24 quarter.

The real appeal of Apple is the $19 to $24 billion of free-cash-flow spent each quarter on share repurchases over the last 13 quarters.

For some reason too, Apple has slowed their dividend growth to a low-single-digit increase. (Maybe that’s why Berkshire sold the stock.)

For the last 12 quarters, Apple has returned an average of $98 billion in capital to shareholders.

A more interesting metric for a numbers geek is that over the last 7 quarters, Apple’s cash-flow-from-operations has averaged a -2% growth rate. What Apple did to accommodate that was to reduce “capex” from an average of $11 – $12 billion to roughly $8 billion per quarter. (For all the talk of AI and it’s “capex” impact, Apple only spends 8% of its cash-flow on capex, versus Google’s 50% this last quarter.)

Apple did absorb that Berkshire Hathaway (NYSE:) selling rather well.

Conclusion:

While clients hold a bigger allocation to Amazon than Apple, and thus my interest in Amazon is a little higher than for Apple, I do think Apple is slowly becoming a consumer-staple-like product, and looking at revenue and EPS growth expectations certainly reflects that.

Apple’s valuation has seen “PE expansion” which is exactly what happens in the consumer staple sector, since investors can pay up a little for the consistency and dependability of that consumer staple growth, and not be too bothered by EPS and revenue misses.

10 – 15 years ago, I thought Apple would be able to make a significant dent in the healthcare vertical, given AppleWatch, and the degree to which the average American remains attached to their cell phone, and while strides have been made, when I ask my doc’s (usually internist’s) whether they are using client’s iPhone or AppleWatch data to analyze heart rate, blood pressure, etc. etc. the response is always no (so far).

That doesn’t mean it won’t happen, maybe it means that it’s taking longer to be accepted by the medical community.

Apple will figure out the healthcare vertical, but will doc’s risk the litigation to depend on it ?

Technicians seem to prefer Amazon’s set-up coming into Thursday night’s earnings releases, but both stocks have been stagnating the last several months, similar to the rest of the large-cap growth sector.

The strength of the consumer of late would seem to favor Amazon a little more than Apple, but Apple is sensitive to that early adopter around new iPhone and Apple products. Also, each new iPhone launch tends to see lowered expectations into the September quarter, and then the holiday quarter turns out just fine.

Some tax-sensitive clients have $6, $7, $8 cost bases in both stocks, which have been held for years.

There is some real angst starting to emerge around large-cap growth stocks and their inability to make further gains on the back of what seem like good results. Readers should gauge their own comfort around portfolio volatility and adjust accordingly.

None of this is a recommendation or advice, but only an opinion. Past performance is no guarantee of future results. Investing can and does involve the loss of principal even for short periods of time. This blog content may or may not be updated in the future and if it is updated, may not be done in a timely fashion. All EPS and revenue estimates are sourced from LSEG and all technical analysis charts are usually sourced from Worden or Trendspider or some other source.

Thanks for reading.