Amazon Stocks: Here’s a Compelling Case for 30% Upside

2024.05.14 04:23

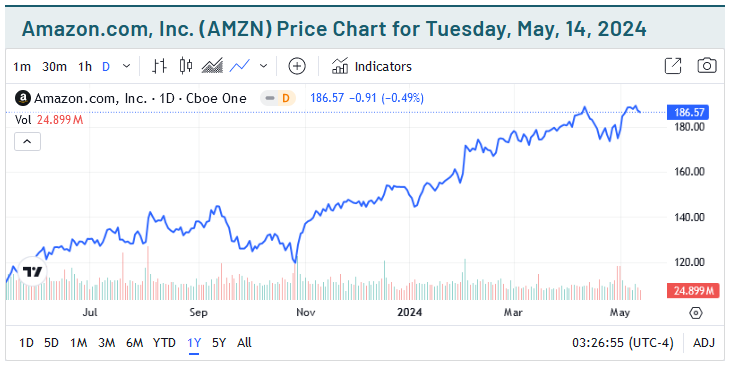

Few would have expected Amazon’s (NASDAQ:) rally to continue strong when it kicked off at the start of last year. The tech titan’s shares had just taken a 50% haircut in the face of rampant inflation and a broad flight from equities, and there were serious concerns all around.

However, what started in January 2023 as a brief and final leg down to 2018 levels soon turned into a bottom. Notwithstanding a couple of bumps along the road in the meantime, it’s been, broadly speaking, one-way traffic. Just as high inflation was hurting Amazon two years ago, its retreat is helping it now.

The effect is doubled for Amazon compared to the average tech company. Lower inflation helps drive consumer spending on Amazon’s e-commerce platform while also strengthening the case for lower borrowing rates, which reduce costs.

Considering the Potential

But with its shares after tagging a fresh all-time high this past Thursday, what kind of legs does this rally have, and what can investors expect for the coming months? According to one team of analysts, however, the short answer is more gains, 25% more of them to be specific.

This is according to the team o at Citigroup, who last week boosted their price target on Amazon shares from $215 up to $225. The move came off the back of Amazon’s Q1 earnings report from the last day of April, which impressed Citi enough to have them revising their outlook. The team feels even with the recent share price appreciation, the market is still underestimating the company’s growth potential.

This is good news for those of us on the sidelines, as Citi’s price target implies an upside of some 30% from where shares closed on Friday. But just how realistic is this, and what kind of support does that case for a 30% upside have?

Strong Earnings

Well, for starters, there’s no getting around to the fact that Amazon crushed analyst expectations for their earnings report, with solid beats on both headline numbers. The company’s revenue was up 13% year on year, and was Amazon’s second highest revenue print ever. The fact that it was below Q4’s record will be of little concern to Amazon investors, given that Amazon’s year-end quarter is consistently at its best every year.

There was solid growth in their cloud business, with CEO Andy Jassy pointing out that “the combination of companies renewing their infrastructure modernization efforts and the appeal of AWS’s AI capabilities is reaccelerating AWS’s growth rate”; this is already at an incredible $100 billion annual revenue run rate.

This is solid news for investors to hear, especially with Amazon’s and the broader market’s shares on the verge of all-time highs.

Getting Involved

And it wasn’t just the Citi team that came out bullish. More than a dozen bullish updates came from Argus, Wells Fargo, BMO Capital Markets, and Morgan Stanley, which all reiterated their Buy or Outperform ratings and gave the stock a price target well above $200.

If Amazon shares trend up here in the coming weeks, they’d be breaking properly into blue sky territory for the first time since 2020. The technical factors suggest there’s a ton of room to the upside, too, with the 10% dip in the second half of April helping to have taken some of the steam out of the rally.

The stock’s relative strength index (RSI), a measure of its overbought or oversold status, swung from the former towards the latter in the back half of April. Though it’s been trending up since then, at 57, it’s still getting heated up again, which bodes well for those of us eyeing the 30% upside.

Original Post

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Source link