Amazon, Microsoft Aim for All-Time Highs Going All-In on AI: Hype or Opportunity?

2023.09.14 08:44

- Microsoft remains a leader in the artificial intelligence sector

- Amazon is expanding its services in the AI and end-to-end logistics segments

- As two tech titans heavily invest in AI, can their stocks make new all-time highs?

The artificial intelligence (AI) sector continues to be one of the most promising areas for future growth. Unsurprisingly, technology giants like Microsoft (NASDAQ:), Amazon (NASDAQ:), Alphabet (NASDAQ:), and Apple (NASDAQ:) are investing heavily in developing high-quality AI products and solutions.

However, Apple has fallen slightly behind its competitors due to delays in its own computing platform development using large language models available in the cloud. Catching up may be challenging due to customer reluctance to switch providers, as it requires reprogramming existing models. Meanwhile, competitors like Amazon and Microsoft show no signs of slowing down, unveiling more AI solutions that are expected to boost their AI segment revenue.

The stock prices of both Amazon and Microsoft are on an upward trend, which is expected to continue unless the Federal Reserve surprises by raising interest rates at its .

Microsoft’s AI Expansion

Microsoft recently announced a major collaboration with SAS to expand its artificial intelligence solutions. The collaboration will focus on two key areas: data management and transformation and generative AI-based tools. The partnership aims to leverage SAS’s industry knowledge and AI capabilities to create comprehensive management solutions. The first results of this collaboration are expected in the fourth quarter of this year.

Microsoft is also working on more AI-powered Office-related tools, including a virtual assistant called Copilot. Copilot will allow users to generate specific content, such as reports or emails, by simply requesting it. Additionally, Microsoft is developing a PDF analysis function to streamline office work processes.

Although Microsoft’s stock experienced a sharp correction in July and August due to lower-than-expected revenue and profit growth from cloud services, there are currently no signs of a change in the upward trend. The stock has strongly defended its first significant support level, around $312 per share.

In conclusion, the artificial intelligence sector remains highly promising, and companies like Microsoft are actively expanding their AI offerings, which should continue to drive their stock prices higher.

Microsoft Stock Daily Chart

The primary target for bulls is to test the all-time highs, which are currently in the vicinity of $366 per share.

Amazon’s Foray Into AI Propels Stock Price

Amazon is making a strong push into the field of artificial intelligence (AI), with its CEO announcing that all major divisions are actively involved in AI development. This underscores Amazon’s commitment to becoming a major player in this rapidly evolving sector.

Alongside its core logistics service, Supply Chain, which is cloud-based, Amazon is also working on other AI tools like CodeWhisperer, primarily designed for developers. Amazon holds a significant advantage as the world’s largest cloud computing provider, commanding a substantial 32% market share.

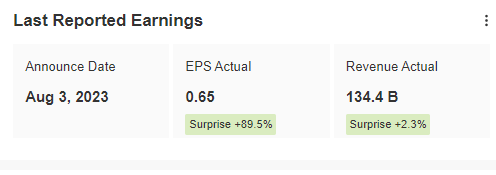

From a fundamental perspective, Amazon’s Q2 2023 have surpassed expectations, indicating robust performance and further potential for growth. The stock price is currently approaching a key resistance level, and the company’s strategic focus on AI development could be a significant driver of future expansion.

Amazon Earnings

Amazon’s strong earnings performance, combined with its increasing emphasis on AI-related solutions, is fueling continued upward momentum in the stock price.

Amazon Daily Chart

For buyers, the crucial factor will be breaking through the resistance level marked by the peaks observed last August, which is located around $145 per share.

If buyers manage to achieve this breakthrough, their next target will be the supply zone in the vicinity of $170 per share. This would mark a significant milestone in the stock’s upward trajectory.

***

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of assets is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author does not own the stocks mentioned in the analysis.