Amazon: Down 13% Since Reporting Earnings, Giant Looks Ripe for a Rebound

2024.08.07 08:35

Markets tend to focus on future potential rather than current performance. This was evident with the Magnificent 7, including Amazon (NASDAQ:), who struggled to justify high valuations despite strong earnings.

Amazon’s latest quarterly showed solid growth: revenues increased by 10% year-on-year, operating profit surged to $14.7 billion from $7.7 billion in Q2 2023, and diluted earnings per share rose from $0.60 to $1.26.

Yet, despite these impressive numbers, investors sold off aggressively on Friday, causing the stock to plummet by 12% in one day.

This could have had something to do with the fact that the third-quarter forecast fell short of expectations, projecting operating profit between $11.5 billion and $15 billion.

Additionally, investors were closely watching how Amazon’s substantial investments in Artificial Intelligence translated into earnings.

Going forward, while the latest figures suggest a positive outlook, significant macroeconomic challenges remain, making the situation complicated for potential ‘buy the dip’ opportunities.

Amazon’s AI Bets Paying Off Already

Amazon is effectively leveraging AI to drive growth, particularly in its cloud computing sector. Amazon Web Services (AWS) saw a 19% increase year-over-year, holding a 48% market share, while its e-commerce segment contributed an operating profit of $5.3 billion.

Bank of America analysts attribute the strong second-quarter results to AI-driven demand. AWS’s 19% growth surpassed the 17% expected, showing a 2 percentage point acceleration from the first quarter.

The key to Amazon’s success has been integrating AI with other services, boosting AWS’s operating income to $9.3 billion—exceeding forecasts. AWS has become Amazon’s core business, surpassing revenue from its North American and international e-commerce segments.

Looking ahead, Bank of America predicts that Amazon’s total capital expenditures for the second half of the year will exceed $30.5 billion, with a significant portion allocated to AWS to meet rising AI-related demand. Analysts expect AWS to grow by 18% throughout 2024.

The bank maintains a positive outlook on the cloud sector as a major beneficiary of AI, reaffirming its recommendation to buy shares of Amazon, Alphabet (NASDAQ:) (NASDAQ:), and Microsoft (NASDAQ:). Amazon remains their top pick among large tech companies due to AWS’s acceleration and AI opportunities.

Analysts Back Amazon

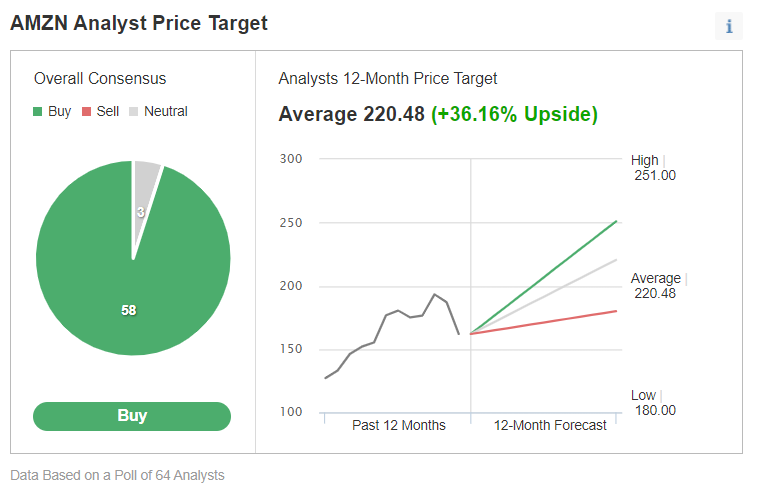

Bank of America analysts are bullish on the tech giant. As of August 7, Amazon holds 53 Buy ratings, 3 Hold ratings, and no Sell ratings.

Analysts have set an average target price of $220.48 per share for Amazon, reflecting a 36.16% increase from its closing price of $161.93 on August 7.

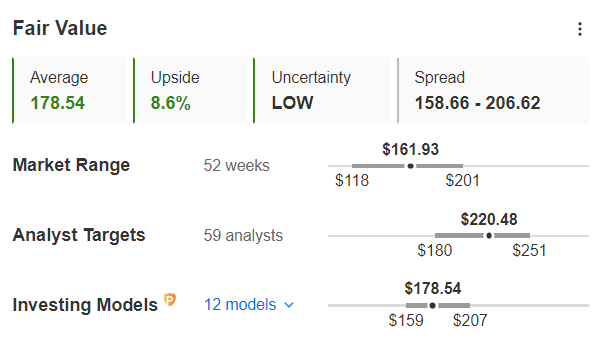

InvestingPro’s Fair Value assessment also suggests that, following recent declines, the stock’s intrinsic value is 8.6% higher than its current price.

Source: InvestingPro

Bottom Line: Beware of Volatility Going Ahead

However, Wall Street and global markets are currently swayed by macroeconomic data. While Amazon might seem like a promising investment, buyers should brace for volatility.

The economic landscape has shifted significantly in recent months, with high interest rates and rising unemployment fueling recession fears that could impact retail margins. Additionally, escalating tensions between Iran and Israel are driving investors to seek safety in less volatile assets.

In summary, until the economic and political climate stabilizes, the market is likely to remain volatile. Investors will have ample opportunities to reassess their positions and make decisions based on ongoing developments.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you’re left on the sidelines?

InvestingPro’s revolutionary AI tool, ProPicks, puts the power of Wall Street’s secret weapon – AI-powered stock selection – at YOUR fingertips!

Don’t miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest and is not intended to incentivize asset purchases in any way. I would like to remind you that any type of asset is evaluated from multiple perspectives and is highly risky; therefore, any investment decision and associated risk remains with the investor.