Almost 13% Yield Monthly? Come On

2022.06.24 13:11

Patience is the key to being a successful contrarian investor.

We buy when fear is widespread. Bear markets are our friends.

Today, we’ll discuss targets for retirement income —after all, a self-sustaining portfolio that allows you to live off dividends alone can give you enormous peace of mind once you’re past your working years.

And if those dividends land in your mailbox or account every 30 days or so, matching your monthly bills…well, that’s even better.

The Power of Monthly Dividend Stocks

Did you grab the mail today? Were there any bills in it—perhaps your mortgage statement, your water bill, the latest from your cable company?

Well, if so, just wait another month, and chances are you’ll get another one. That’s how almost every major expense works.

But that’s how most retirees get a significant portion of their income.

Retirees that have listened to the prevailing wisdom have loaded up on blue-chip stocks, and as a general rule, those companies tend to pay their dividends , not . So, a financial advisor might tell you to build a “dividend calendar,” in which you basically buy a certain amount of a few stocks that pay in January/April/July/October, another few that pay in February/May/August/November and another few that pay in March/June/September/December.

That might sound exhausting, and it is, but worse than that: Should anything happen to one of those stocks, your dividend calendar will be thrown for a loop, and you’ll suddenly be looking at much “lumpier” payments.

Monthly dividend stocks, on the other hand, are a special type of dividend payer that do exactly what their name suggests: They write dividend checks each and every month, which lines up perfectly with your monthly bills.

By the way, that’s about the only difference you’ll find. They’re otherwise no different than their peers, though you’ll usually find monthly dividend payers among the high-yielding acronyms: real estate investment trusts (REITs), business development companies (BDCs) and closed-end funds (CEFs).

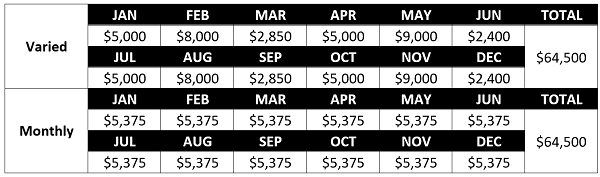

But to get an idea of how much smoother your retirement could go by investing in monthly dividend stocks, consider the table below. First is the dividend schedule for an outlandish 12.9%-yielding portfolio made up of “normal” stocks. Below that is the income from an equally high-yielding trio of monthly dividend stocks—

Both deliver roughly $64,500 in annual income—not on a million-dollar nest egg, .

Dividend Table

Dividend Table

Based on stability alone, I know which one I would pick.

Of course, we all know that we can’t just go buying stocks based on yield or dividend frequency alone. These need to be A+ companies that will act as good stewards of our investment funds for decades on end. After all, what good is a giant yield (monthly or otherwise?) if the checks won’t last?

Let’s look at three monthly dividends averaging a whopping 12% yield to see whether any of them make the grade for a reliable retirement portfolio.

Prospect Capital

Dividend Yield: 9.5%

Prospect Capital (NASDAQ:PSEC)is one of the market’s largest business development companies (BDCs). It has funded more than 375 investments over its 18-year business lifetime, and it currently boasts some $7.5 billion invested across roughly 90 companies.

PSEC’s primary business is middle-market lending, which makes up roughly 52% of the portfolio. It invests in American companies with EBITDA (earnings before interest, taxes, depreciation and amortization) of up to $150 million, primarily through senior secured loans. But it also has arms focused on middle market buyouts (17%), real estate (primarily multifamily) investing (18%) and subordinated structured notes (10%).

Prospect Capital’s size and scale would be a seeming advantage, but one that it hasn’t really leveraged to any meaningful extent. Shares are only slightly better than a broad BDC index fund over the past several years.

PSEC: A Back-and-Forth Rivalry with Mediocrity PSEC-BIZD Total Returns

PSEC-BIZD Total Returns

Not shown here is one of PSEC’s most worrisome faults: A dividend that, while paid monthly, has hardly given investors any sense of stability. The payout has been cut twice since 2014; current dividends are just barely covered by net interest income (NII).

The Incredible Disappearing Dividend!

PSEC Dividend Declines

PSEC Dividend Declines

The primary thing PSEC has going for it is a discount—currently, it trades at a whopping 36% discount to its net asset value (NAV). But you’re not only buying a company with a tattered dividend history. You’re also buying a company whose exposure to fixed-rate loans—a liability in the current interest-rate environment—is above the industry average.

Gabelli Utility Trust

Dividend Yield: 9.4%

It’s possible the bottom isn’t in yet—that the market’s just digesting its latest red ink and is resting before the next leg down. If so, utility stocks should continue looking awfully attractive as a defensive play. (Not to mention, they provide ballast and high dividends for any long-term investor.)

But rather than tapping into the 3%-4% yields of traditional utility mutual funds and exchange-traded funds, let’s examine a closed-end fund (CEF) instead—one that offers us a nearly double-digit yield.

Gabelli Utility Trust (NYSE:GUT), which boasts 87 years of industry experience between co-managers Mario Gabelli and Timothy Winter, is a pretty straightforward fund from a holdings perspective, carrying mainstay electric and gas utility firms including NextEra Energy (NYSE:NEE), WEC Energy (NYSE:WEC) and Duke Energy (NYSE:DUK).

Where GUT differs from other fund types is its ability to use debt leverage (at a high 30% rate currently), which allows it to double down on its highest-conviction names—and super-charge its monthly dividend, hence the 9%-plus yield.

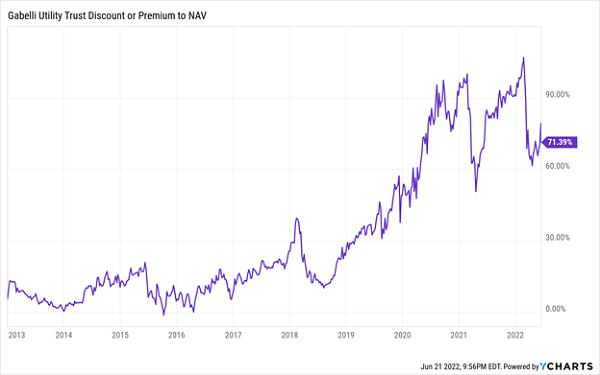

The big red flag, however, comes from another CEF feature. Closed-end funds trade with a fixed number of shares, and as a result, they can trade at discounts or premiums to their net asset value (NAV). Even a 5% or 10% premium should give an investor pause—

GUT’s Price Is Out of Control GUT – Premium To NAV

GUT – Premium To NAV

To put that another way, you’re paying $1.71 for every dollar of GUT’s holdings.

Orchid Capital

Dividend Yield: 19.7%

Orchid Capital (NYSE:ORC) boasts one of the market’s highest yields, well over 19% as I’m writing this. It’s too rich a yield too —but is it too rich a yield to

ORC is a mortgage real estate investment trust (mREIT). Your garden-variety equity REIT is going to own property: malls, apartment buildings, hospitals, driving ranges, you name it. But the only thing an mREIT will typically hold is…well, paper. Or to be more specific, securitized mortgages. Orchid Capital, for instance, deals in residential mortgage-backed securities (MBSs), like those issued by Fannie Mae and Freddie Mae.

But mREITs mimic traditional REITs in that they’re also required to pay out at least 90% of their taxable income as dividends—and that results in sky-high dividends that even put their traditional REIT brethren to shame.

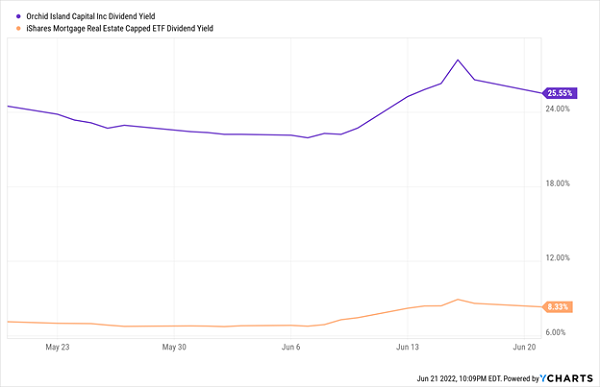

Roughly 3x the Industry Average … Sort Of ORC-Dividend Yield

ORC-Dividend Yield

That data isn’t correct—ORC yields closer to 20% right now—but you’ll have to give YCharts a pass. After all, it’s hard to keep up with Orchid’s rapid pace of dividend decreases, and ORC is fresh off yet another investor rug-pull.

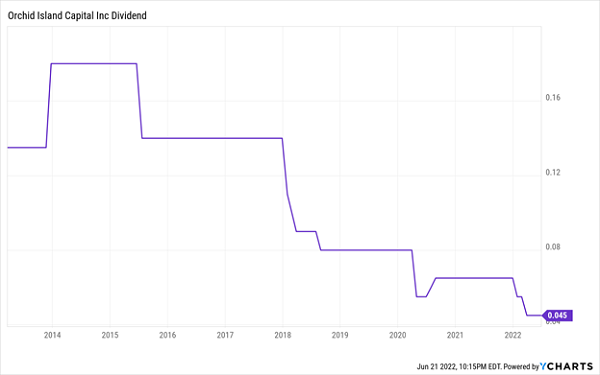

This Would Be a Healthy Dividend Chart…If It Were Upside-Down

ORC-Dividend Declines

ORC-Dividend Declines

The latest slap to investors was announced in March: an 18% reduction in the payout, to 4.5 cents per share from 5.5 cents previously.

Disclosure: