All The Major Asset Classes Lost Ground Last Week

2022.06.20 15:25

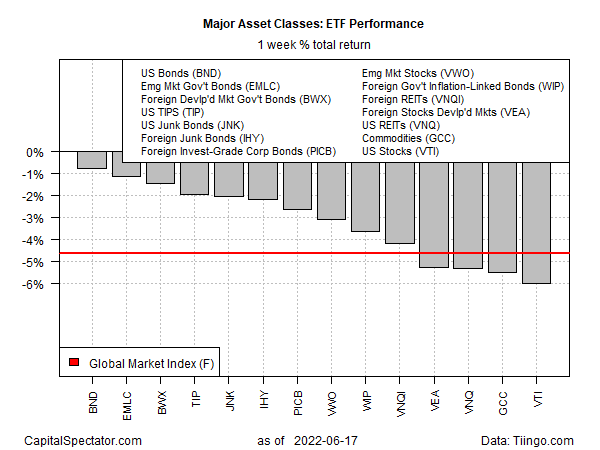

Markets suffered a clean sweep of losses last week. It’s a rare event, but it happens, as the trading week through Friday, June 17 reminded in the wake of all the major slices of global markets posting simultaneous declines, based on a set of ETFs.

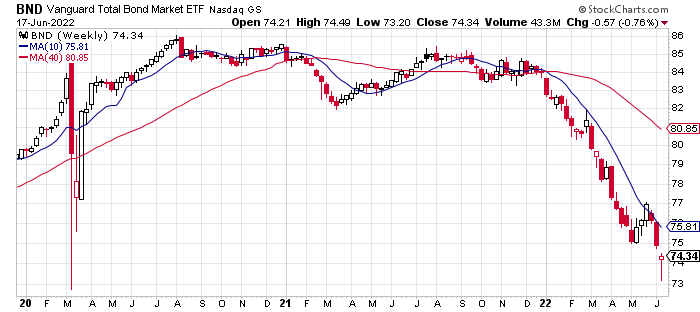

US bonds were the “best” performer by way of a relatively mild decline. Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND) fell 0.8% last week.

Despite outperforming the rest of the major asset classes, BND’s outlook still looks bearish, based on the fund’s weak technical profile, driven by expectations that the Federal Reserve will continue to raise interest rates (which move inversely with bond prices).

Fed funds futures are currently pricing in a 99% probability that a second rate hike of 75 basis points is on tap for July 27 FOMC meeting.

BND Weekly Chart

BND Weekly Chart

Tightening monetary policy at a time of slowing economic growth is raising fears that a US recession is lurking. But in the short term, at least, forecasts that that the Fed will continue to lift interest rates will probably keep bonds on the defensive.

At some point investors will be looking for a pivot in market sentiment from pricing in higher interest rates (i.e., lower bond prices) to heightened anxiety over recession fallout.

In the latter case, demand for safe havens, such as bonds, may rebound as concern for macro fallout overtakes worries related to higher interest rates.

In the meantime, macro risk is an equal-opportunity offender. “Our worst fears around the Fed have been confirmed: they fell way behind the curve and are now playing a dangerous game of catch up,” advised analysts at Bank of America in a research note.

Elsewhere in markets, there was no place to hide. The deepest loss for the major asset classes last week: US shares via Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI), which closed down for a third straight week, settling near its lowest close since November 2020.

The Global Market Index (GMI.F) continued to slide, too, losing 4.6%. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a useful benchmark for portfolio strategies overall.

ETF Weekly Total Returns

ETF Weekly Total Returns

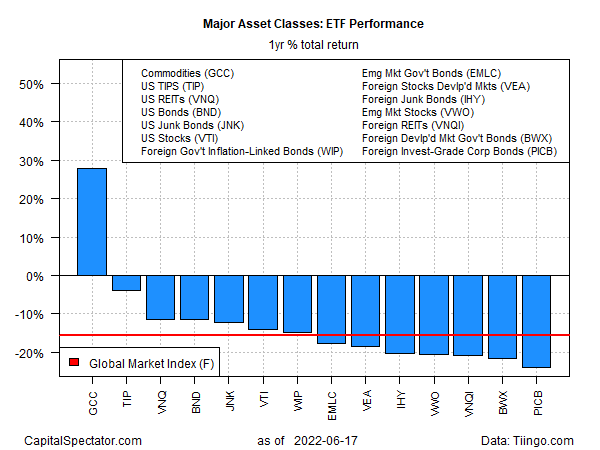

Commodities remain the only slice of the major asset classes posting a gain for the trailing one-year period. WisdomTree Continuous Commodity Index Fund (NYSE:GCC) was up nearly 30% for the past 12 months, far ahead of the rest of the field.

By contrast, the biggest one-year loser in the field: foreign corporate bonds—Invesco International Corporate Bond ETF (NYSE:PICB), which shed more than 20%.

GMI.F was off nearly 16% for the past year.

ETF Yearly Total Returns

ETF Yearly Total Returns

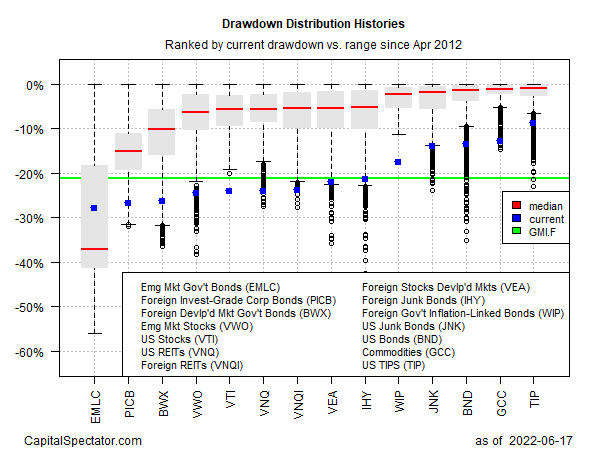

Profiling the ETFs listed above via drawdown shows that all the funds were now posting relatively steep peak-to-trough declines, or worse. The softest drawdown as of Friday’s close: -8.9% for iShares TIPS Bond ETF (NYSE:TIP).

At the far end of the curve: emerging markets bonds via VanEck J.P. Morgan EM Local Currency Bond ETF (NYSE:EMLC), which were nursing a near-30% drawdown.

GMI.F’s current drawdown: -22.2%.

GMI Drawdown Histories

GMI Drawdown Histories