Aftermath of the Slump in the Technology Sector

2022.11.17 08:46

[ad_1]

- Earnings, not interest rates, are driving this leg down for tech

- Significant divergence in fundamentals reflected in stock prices

- Why we believe industrial tech has upside going into next year?

The tech giants started the earnings season with disappointing results. But instead of these reports re-setting expectations lower, they opened up a can of worms

At a high level, while the valuation impact of higher rates is largely priced in, the recent move in interest rates to ~4% is just starting to be reflected in earnings. Overall we expected revenue growth to be 5-10% lower than Street estimates across the board in CY23 driven by general caution as companies set their budgets ahead of a well telegraphed recession (extended sales cycles etc.). The interesting point was that this 5-10% disappointment in topline growth caused many companies to decline 30-40%+ resulting in panic selling across the board and creating many great opportunities.

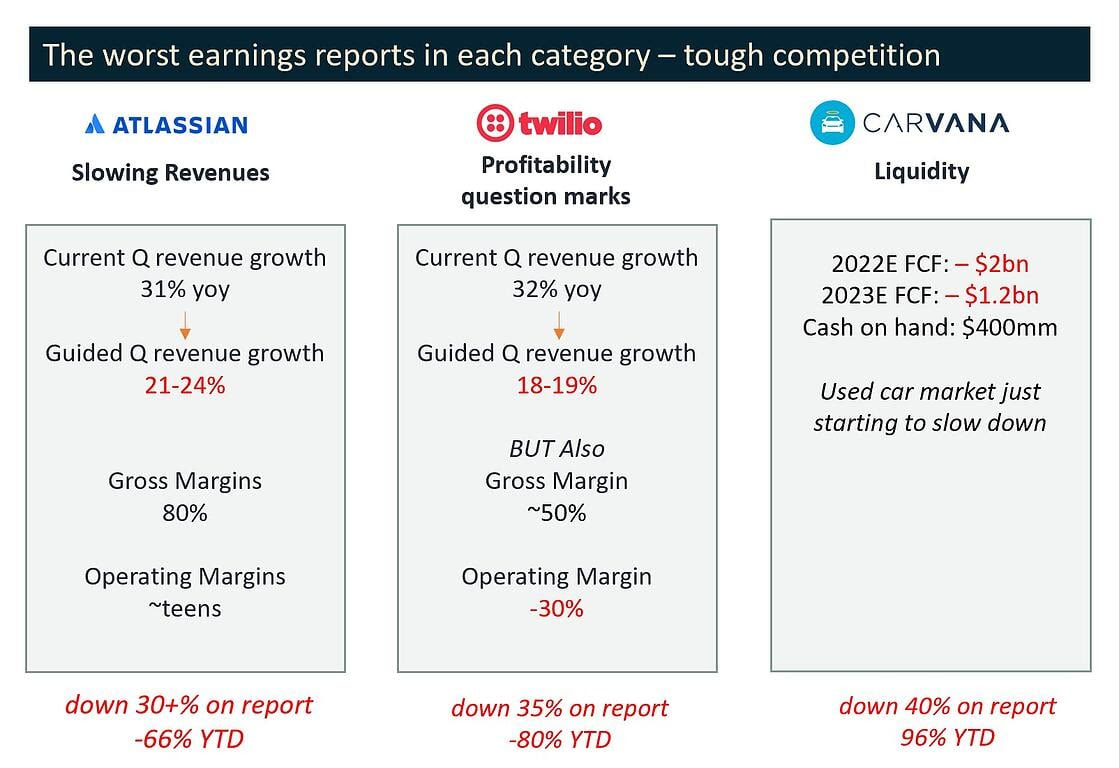

The challenges highlighted by this earnings season are:

- revenue growth slowdown

- profitability question marks

- liquidity.

In short, the first may ultimately offer many opportunities as investors are mis-modeling the medium term growth trajectory (i.e. extrapolating from 1-2 weak quarters). The second and third are comprised of many challenged business models that may need significant turnarounds and restructurings (if they are to stay in business).

Highlights this quarter:

1. Revenue growth slowdown. There is a significant difference in valuation multiples between companies growing 30%+ and companies growing in the high teens. Many tech companies that were growing 20%-30% are now guiding to 10-20%, which is a problem. Investors are now confused as traditional methods like revenue multiples don’t apply as easily if you are not growing.

As an example, Atlassian (NASDAQ:) guided to revenue growth of 21-24% for the upcoming quarter vs. 30%+ previously. This sent the stock from trading ~15x to

This is an area of opportunity. Many companies are not growing because of tough comps, others because of recession fears and some are facing secular challenges. Tough comps could turn into easy comps, but secular challenges are not easy to solve.

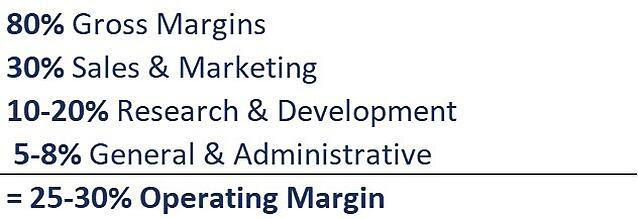

2. Profitability question marks. Now that companies are not growing at astronomic rates, the focus has shifted to profitability. For the first time investors are scrutinizing the different expense line items trying to understand a path to profitability. Again, commonly used principles such as “the Rule of 40” (Revenue growth % + FCF margins % of a successful business should exceed 40%) are not helpful, if a company is growing at mediocre rates and has negative margins.

As an example, Twilio (NYSE:), guided revenue down significantly, but in addition the company has relatively low gross margins and consequently -30% operating margins and negative FCF. High teens growth and significantly negative margins do not sound particularly appealing at any valuation.

SaaS companies require significant sales and marketing (S&M) and these areas are not easy to cut without sacrificing growth. Consequently, companies with high S&M hoping to generate cash flow need to be starting with very high gross margins.

Here is a general framework that we use:

General Framework Used

- S&M is hard to cut without sacrificing revenues. Ideally you want to find businesses where products sell themselves (i.e., upgrades), they do not require big deployments, have large installed bases of “fremium” customers that can become paying customers. Consequently, as revenue scales, S&M will become a smaller % of total revenue.

- While R&D is an area you don’t want to be cutting, there are many instances where it can be run more efficiently. Low R&D can also be a red flag.

- Most tech companies run relatively high G&A. There is significant opportunity to cut this from the high teens to 5-8%. Think cuts to free lunches, tap kombucha, organic pheasants, ping pong tables, etc.

The profitability framework is inherent in the business model so unless there is a clear path to profitability or turnaround, we generally would stay away from non-profitable business.

3. Balance sheets and liquidity concerns. Many companies that had several billions on their balance sheets are now seeing that balance deteriorate after several quarters of cash burn. Once investors realize there is less than ~1year of cash on the balance sheets at the current burn rate, stocks go into free-fall. An example is Carvana (NYSE:), once considered a low risk gem, is now scrambling to find sources of liquidity.

Moreover, there are many companies that take asset risk that may be overlooked by investors traditionally focused on evaluating companies on topline growth metrics. These businesses could face major write downs.

We believe that many of these companies will need significant balance sheet restructurings and are therefore avoiding them at this point in the cycle.

Where are the opportunities?

Amidst this carnage there were several decent earnings reports. Here are a few examples:

- Datadog (NASDAQ:) grew 61% yoy in 3Q (vs. 74% last quarter), with 17% operating margin and 15%+ FCF margin. Guided to 4Q growth of ~40% on a tough 84% comp.

- Hubspot (NYSE:) grew ~31% yoy (+38% in CC), with 9% operating margin and 8%+ FCF margin; Guided to 4Q growth of 20.5% (despite 9% FX headwind).

- Cloudflare (NYSE:) grew 47% yoy, GMs 78.1%, operating margin 5.8% and ~flat FCF (-$4.6mm). Guided to 4Q growth of ~40%. Investors were initially disappointed by a “less than usual” beat, but not so bad in hindsight.

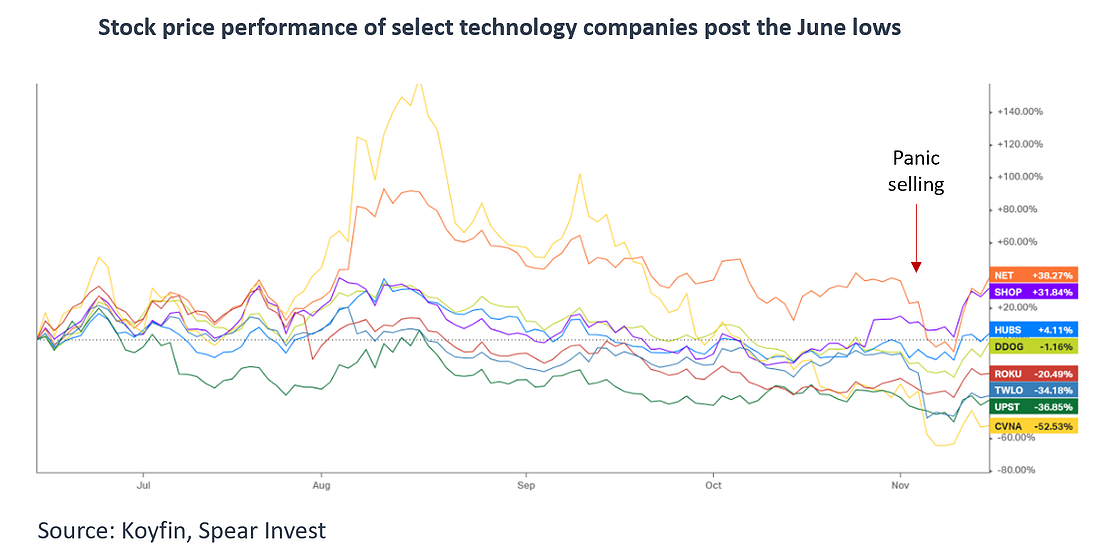

Overall, while panic selling results in high correlations i.e., babies get thrown with the bathwater, we have seen quite significant divergence post these sell-offs with good companies significantly outperforming the challenged business models.

Stock Price Performance Of Select Tech Companies

Stock Price Performance Of Select Tech Companies

Macro Backdrop

- End of inflation? Not really

- The mystery behind strong employment despite massive tech layoffs

The earnings driven technology implosion was followed by panic buying over the past several days, after both inflation indices ( and ) came in slightly lower than expected.

Is inflation over?

We don’t think so. There are several categories such as wages, that have significant lags, and will continue to put upward pressure on inflation. This is why the Fed is so focused on the employment numbers which may take some time to ease. We don’t foresee the economy getting to the 2% target any time soon.

That said, there is no question that economic activity is slowing and inflation numbers could continue to slightly surprise to the downside, giving the Fed ammunition to slow the rate of hikes. This is a major positive for technology stocks and could create a very favorable set up into next year.

We believe that the relationship between interest rates and technology valuations is not well understood by investors, potentially creating one of the best buying opportunities in decades.

How is employment data surprising to the upside despite massive tech layoffs

Tech layoffs have been well publicized. The most significant were Meta’s 11,000, Amazon’s (NASDAQ:) 10,000, Twitter’s 3,700, Stripe’s 1,000, Salesforce’s (NYSE:) 1,000 and several smaller ones.

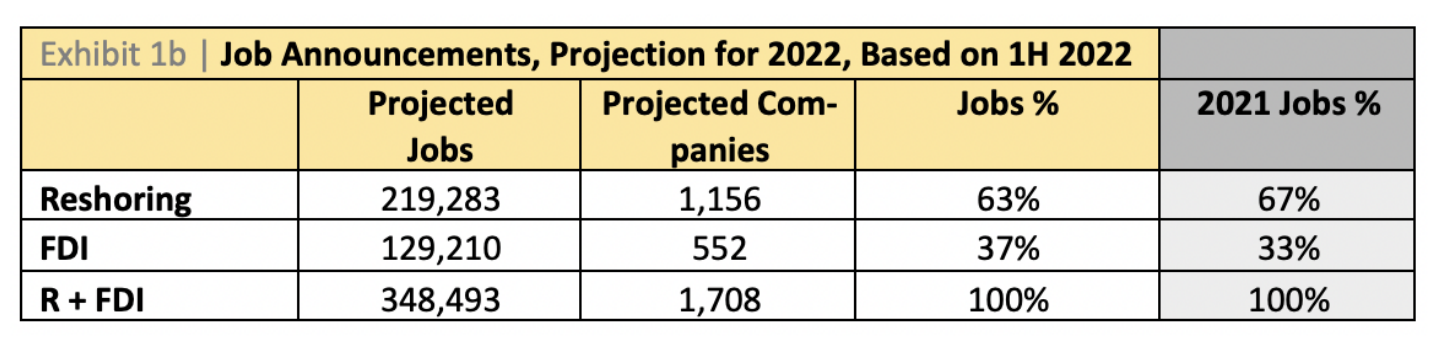

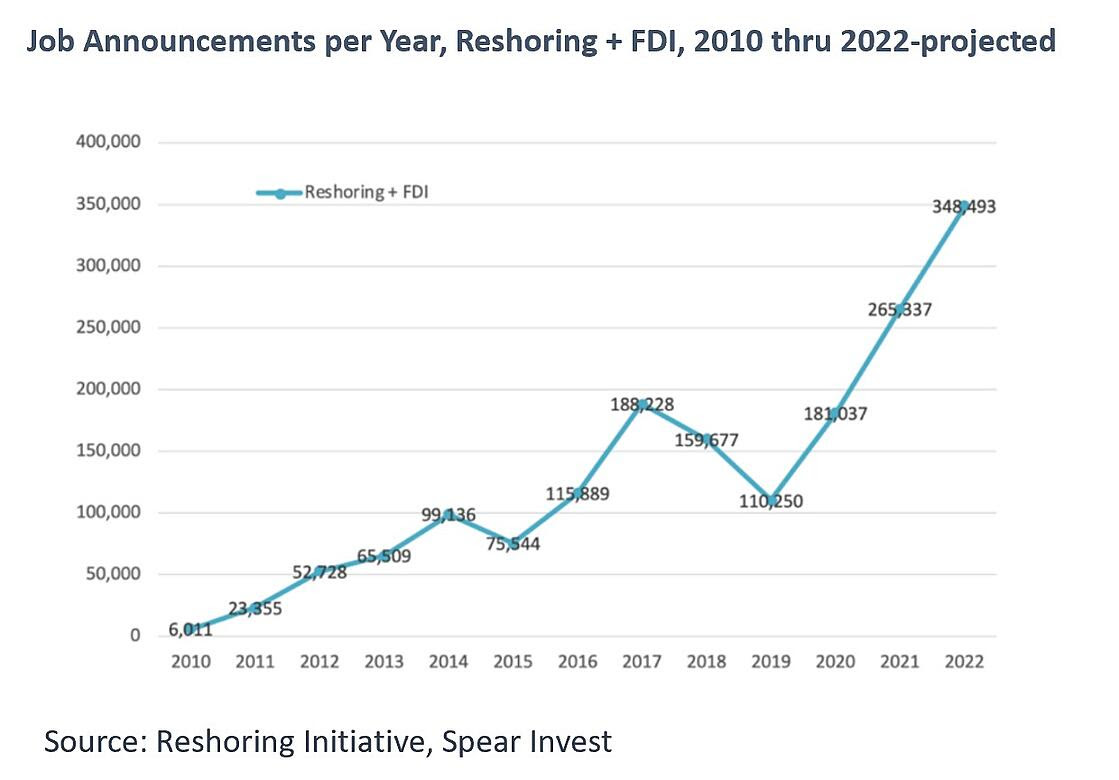

According to the Reshoring Initiative, re-shoring and foreign direct investment is projected to add 349,000 jobs in 2022. These jobs are mostly related to capex investments in semiconductor capacity (Chips Act), electric vehicle (EV) battery plants, other EV related infrastructure (Inflation Reduction Act) etc. Consequently, despite significant Fed tightening through interest rates, there is still significant “stimulus” in the system creating support.

Job Announcement, Projection For 2022

Job Announcement, Projection For 2022

Job Announcements Per Year

Job Announcements Per Year

We believe that productivity improvement through automation and AI will be the only way to sustainably address the labor shortage and wage inflation. We expect that industrial technology companies will be significant beneficiaries of this trend.

[ad_2]

Source link