After A 74% Plunge, Now Is The Perfect Time To Buy DraftKings Stock

2022.09.16 07:34

[ad_1]

- DraftKings has sold off this year

- DKNG shares are down 30% year-to-date and 74.2% below their record high

- Stock offers a compelling opportunity at an attractive price point

DraftKings (NASDAQ:), which is widely considered the leader in online sports gambling, has seen its stock plummet due to a potent combination of rising , accelerating , and slowing economic growth which triggered a selloff in non-profitable tech companies.

Even as DKNG stock remains down 30% year-to-date, shares have staged an impressive recovery since falling to a record low of $9.77 on May 12.

At current valuations, the Boston-based digital sports entertainment and gaming company has a market cap of $8.6 billion.

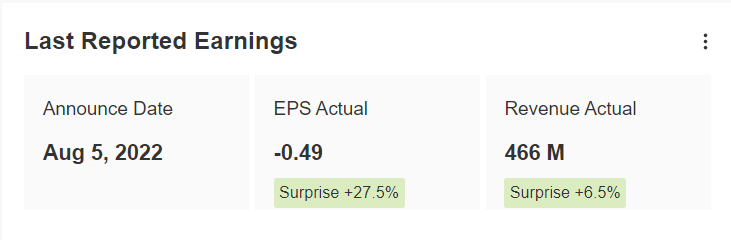

DraftKings stock has enjoyed a turnaround since the company delivered that eased investor concern over its long-term prospects.

Not only did it beat estimates on several key metrics it increased its full-year forecast.

“Customer engagement remains strong, and we continue to see no perceivable impact from broader macroeconomic pressures,” said CEO Jason Robins.

DraftKings’ average monthly unique paying customers increased by 30% over the past year to 1.5 million. Average revenue per paying user jumped to $103, also a 30% increase from the same period last year.

Multiple positives

- NFL Betting Season Kicks Off

The start of the National Football League (NFL) tends to be the best time of year for DraftKings. The 2022 NFL season is forecast to see a record number of Americans placing wagers on football games, according to the American Gaming Association.

Sports betting is currently legal in 36 states and Washington, D.C., the association said. 18 of the 22 states that have NFL teams have legalized sports betting.

- DraftKings And Amazon Team Up For ‘TNF’ Football

DraftKings will be the exclusive pregame and in-game betting odds provider for Amazon’s (NASDAQ:) stream-only NFL ‘Thursday Night Football’ (TNF) telecasts on Prime Video this season.

The sportsbook operator announced on Tuesday that it signed a multi-year deal with Amazon that also includes same-game parlays that will be available on the DraftKings app. As part of the agreement, content from DraftKings, including additional sports betting insights, will be featured in all 15 TNF games.

That should bode well for the mindshare of the online gambling specialist, which directly correlates to the development of positive consumer awareness and popularity.

“We look forward to working with Amazon to bring millions of viewers a premium and enhanced experience during TNF on Prime Video all season long and for years to come,” said Stephanie Sherman, Chief Marketing Officer of DraftKings.

Amazon paid the NFL $13 billion for the rights to exclusively stream TNF games through 2033.

There has long been speculation about whether Amazon could potentially enter the online sports betting space via an acquisition and this tie-up increases those odds.

- Cathie Wood Continues To Load Up

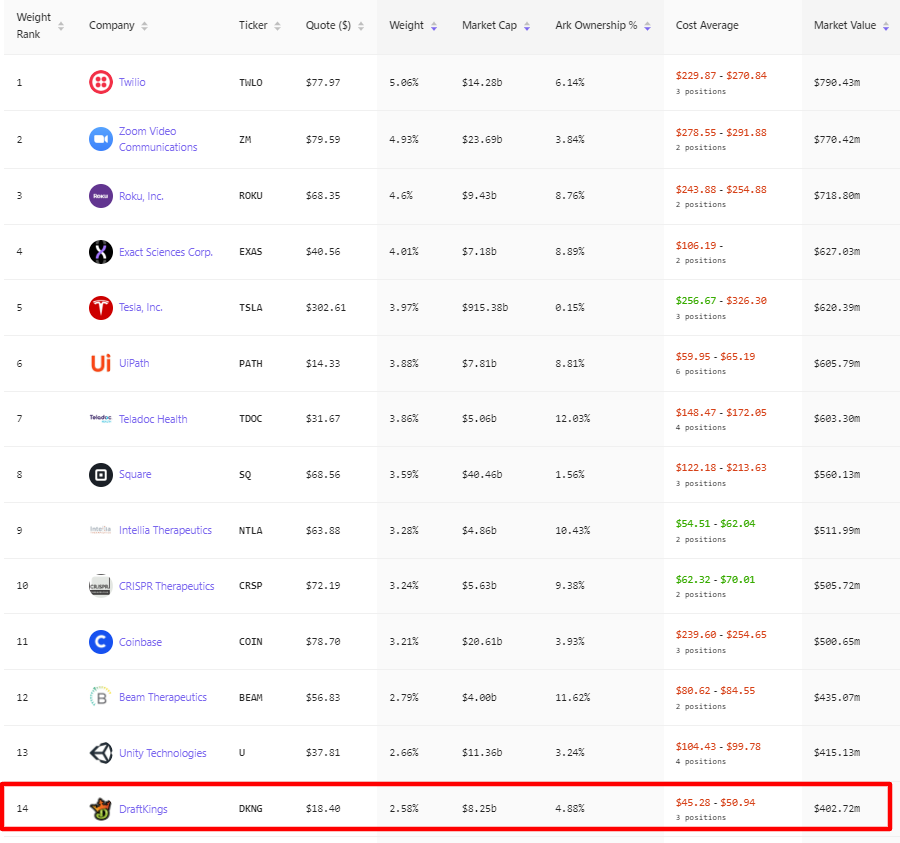

Cathie Wood, the founder, CEO and CIO of Ark Invest, is betting big on DraftKings. Wood, who made a name for herself as a growth-investing legend in 2020, has significantly added to her position in the online gambling and fantasy sports specialist since the start of September. She has made 13 purchases of the stock this month, adding 582,122 shares to Ark’s suite of exchange-traded funds (ETFs).

Her flagship ARK Innovation ETF (NYSE:) and ARK Next Generation Internet ETF (NYSE:) reported the largest purchases of the month so far.

DKNG stock currently accounts for 2.58% of the ARK ETFs’ total assets and it is currently the fund’s 14th largest holding, leap-frogging Shopify (NYSE:), Roblox (NYSE:), and Robinhood (NASDAQ:) in recent weeks.

Overall, Wood currently owns 22.4 million DKNG shares, bringing her stake to 4.88%. I expect the sports-betting company to move further up the list in the months ahead, considering the size and persistence of Wood’s purchasing activity.

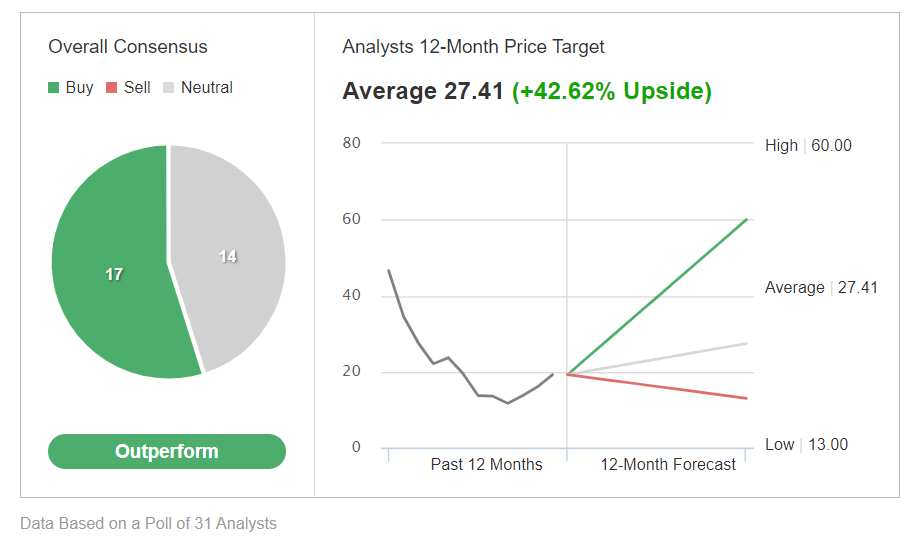

Wall Street has a long-term bullish view on the stock, with all 31 analysts surveyed by Investing.com rating it as either ‘buy’ or ‘hold’ with a potential upside of roughly 43%.

Draftkings Consensus Outlook

Draftkings Consensus Outlook

Roth Capital Partners upgraded its rating to ‘buy’ last month and increased the 12-month price target to $25 from $18. Analyst Edward Engel highlighting DraftKings’ app growth as a path to profitability. Citi’s Jason Bazinet also boosted his price target to $24 from $20 and reiterated a ‘buy’ rating. “We continue to view DKNG as a leading operator in the fast-growing U.S. betting market,” he wrote in a research note. And Morgan Stanley’s Ed Young maintained his ‘buy’ rating saying that the company was making progress on narrowing its losses as more states legalize sports betting.

Bottom Line

The dramatic selloff in the stock earlier this year combined with the start of the NFL football season earlier this month and the NBA basketball season starting soon means now is the ideal time to own DraftKings.

Disclosure: At the time of writing, Jesse has no position in any stock mentioned. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

[ad_2]

Source link