ADP Warns of a Turning Point in the Labor Market

2022.12.01 07:02

[ad_1]

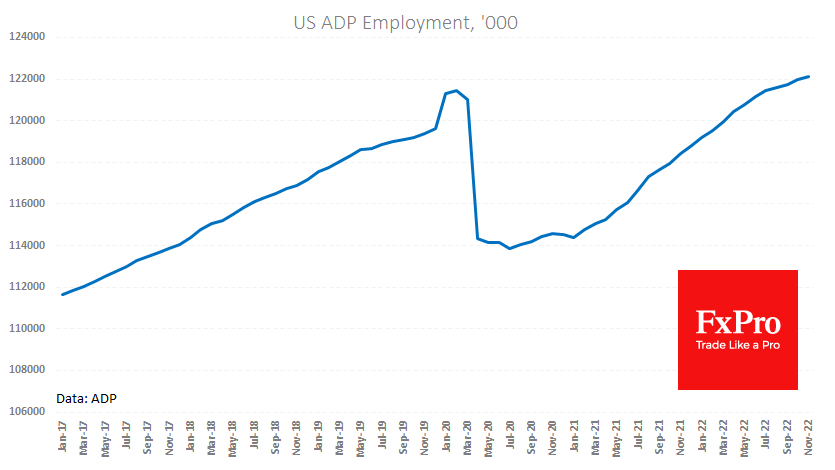

According to a new , the US private sector created 127K new jobs in November – the lowest since January 2021 and significantly below expectations (196K) and past data (239K).

The accompanying commentary says that the labor market and pay have already begun to be affected by the Fed’s policy tightening, and fewer people are quitting. These are probably signs that people see fewer lucrative job openings.

US private sector created 127K new jobs in November

US private sector created 127K new jobs in November

Although the ADP reports earlier this year methodically turned out to be sharply weaker than the official data and were later revised upwards, this time, they complement the picture that the weekly jobless claims paint. There has been an increase in and for many weeks, as is often the case before economic cycles turn around.

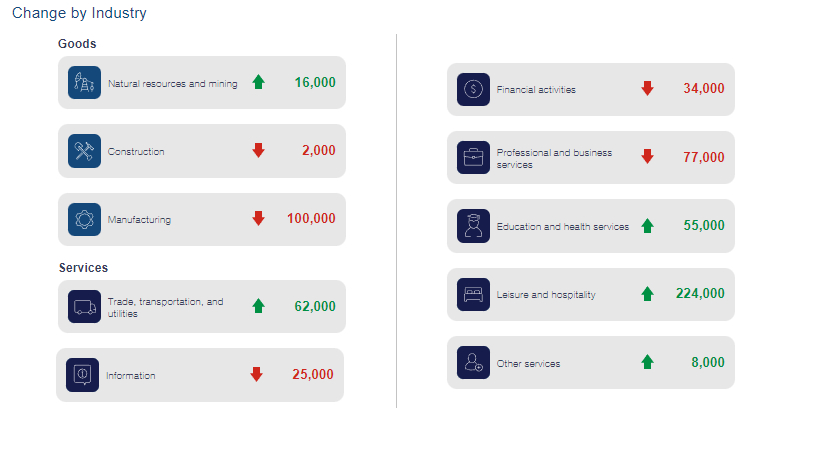

By sector, manufacturing has fallen by a staggering 100K, while the number of employees in professional services has dropped by 77K. Strong increases have been recorded in leisure/hospitality (224K) and trade (62K).

Change in employment on November

Change in employment on November

Today’s labor market data from the ADP should be regarded as a warning signal before the official data release on Friday. According to the market logic of recent weeks, weakness in the data should cause the to weaken, suggesting that the Fed will hike less aggressively and stop at a lower level. However, given the FOMC’s determination to fight inflation expectations, even such data may be needed.

It would probably make sense for investors and traders to take note of the figures but refrain from taking any active steps, at least until the Fed’s position, which may be announced later today by Powell or the Beige Book, has been clarified. But also, there could be a lack of strong market moves up to Friday’s .

[ad_2]

Source link