Accounting For 79% Of All Inflows In July, Short Bitcoin ETF Slumps

2022.08.23 14:18

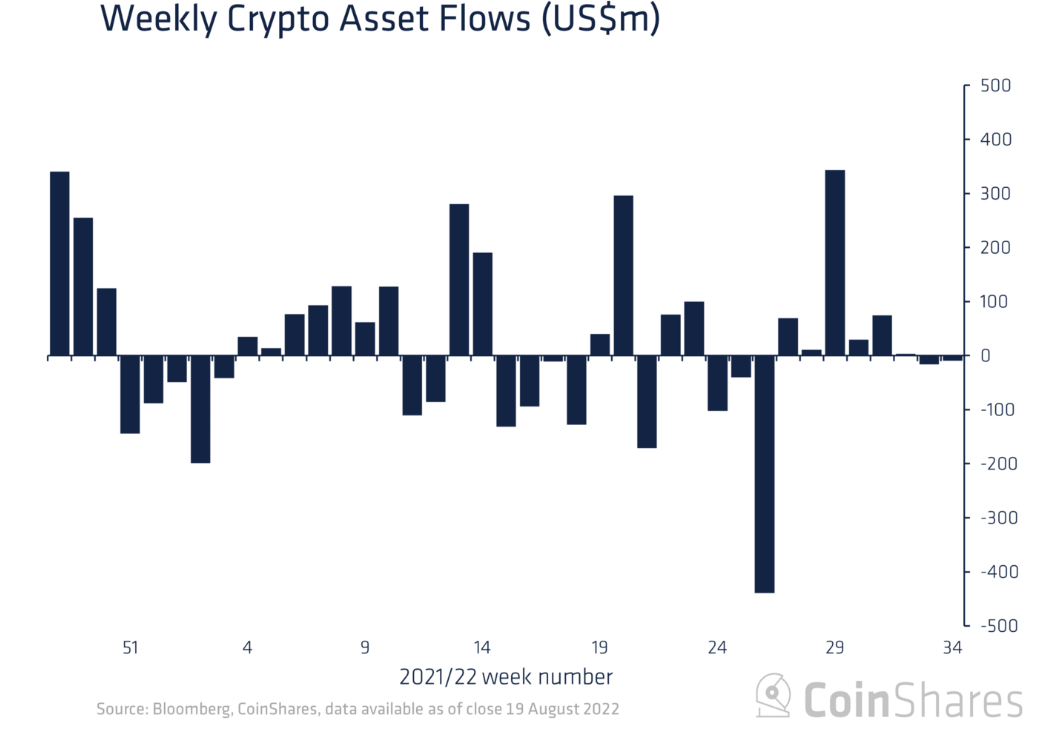

Digital asset investment products record the second lowest weekly volume for the year, signaling low investor participation in the market.

As per a recent Coinshares report, digital asset investment products recorded minor outflows last week. The report revealed that bitcoin saw a third consecutive week of outflows totaling $15 million. Interestingly, short Bitcoin exchange-traded funds (ETFs) witnessed minor inflows of $200,000 in the same period after weeks of record inflows.

Low Participation Causes Drop Off In Investment Volumes

Weekly Crypto Asset Flows

Weekly Crypto Asset Flows

The report indicates that this summer’s poor performance for digital asset investment products continued last week. The investment products saw minor outflows totaling $9 million while the volumes stood at $1 billion. The documented volume represents a 55% fall off from the yearly average and the second lowest weekly value for the year, indicating meager investor participation in the market.

While investor participation has dwindled, Bitcoin Short ETFs, accounting for 79% of digital asset fund inflows last month, have also seen interest level slump. The $200,000 in inflows recorded indicates that investors are refusing to bet against the price of Bitcoin plummeting further. Proshares launched the first short Bitcoin ETF earlier this year.

The demand for a short Bitcoin ETF peaked early in the summer, as $35 million was traded the day after its launch. This demand coincided with the general malaise in the market, which saw Bitcoin’s value fall over 70% year to date (YTD). Its strong performance persisted into July, recording $88 million in inflows in its first month. However, its strong performance halted in the final week of July after recording its first week of outflows.

Ethereum Funds Continue 9 Weeks of Inflows, Totaling $162M

Ethereum, which had recorded outflows totaling $459 million in mid-June, saw a flip in investor sentiment, enjoying weekly inflows totaling $3 million. Its solid weekly performance, like its future open interest surge, may be closely linked with the merger expected on Sept. 15. With the latest round of inflows, Ethereum funds have now recorded nine consecutive weeks of inflows to the tune of $162 million.

Meanwhile, other altcoins posted unremarkable inflows, with Cardano recording inflows worth $500,000. On the other hand, Solana experienced outflows for a second consecutive week totaling $1.4 million. Similarly, blockchain equities also saw outflows of $1.6 million in total.

Regionally, the US, Germany, and Sweden received the bulk of the outflows, totaling $10 million, $2.4 million, and $2.1 million, respectively. Meanwhile, little inflows of US$2.5 million and US$1.9 million were observed in Brazil and Switzerland, respectively.

Bearish Market Conditions Continue

Bitcoin One-Month Chart

Bitcoin One-Month Chart

Yesterday, major coins continued to experience persistent price declines, continuing the dismal trend that the cryptocurrency market suffered last week. According to Coinmarketcap, Bitcoin lost 10% of its value over the past seven days while losing 1.64% over the previous 24 hours. As seen in the chart above, Bitcoin fell below the $21,000 mark before rebounding to $21,231 as of press time.

Ethereum One-Month Chart

Ethereum One-Month Chart

Also, Ethereum, which recently rose above $2,000 several days ago, dipped towards the $1,500 price mark. According to Coinmarketcap, the second largest digital asset by market cap has plummeted 16.21% over the past seven days and 1.76% in the last 24 hours. At press time, it was trading at $1,596.